Items like rent, deferred taxes, payroll, and pension obligations can also be listed under long-term liabilities. Long-term liabilities are any debts and payables due at a future date that’s at least 12 months out. This is reflected in the balance sheet, and they are obligations, but they do not pose an immediate threat to the financial stability of a company’s working capital.

Because a bond typically covers many years, the majority of a bond payable is long term. The present value of a lease payment that extends past one year is a long-term liability. Deferred tax liabilities typically extend to future tax years, in which case they are considered a long-term liability. Mortgages, car payments, or other loans for machinery, equipment, or land are long term, except for the payments to be made in the coming 12 months. The portion due within one year is classified on the balance sheet as a current portion of long-term debt.

But without considering the debt, business leaders are ignoring key indicators to the financial solvency of the company. Understand the difference between current vs. long-term liabilities, so that you can properly define needed working capital and ratios. Current liability obligations play a different role than long-term liabilities. Current types of liabilities of a company consist of short-term financial obligations that are due typically within one year.

Here’s what you need to know about the different types of debt companies may take on.

Long-term liabilities include mortgage loans, debentures, long-term bonds issued to investors, pension obligations and any deferred tax liabilities for the company. Keep in mind that a portion of all long-term liabilities is counted in current liabilities, namely the next 12 months of payments.

Accounting Examples of Long-Term vs. Short-Term Debt

Current liabilities are those line items of the balance sheet which are liable for the company within a one-year time frame. The calculation for the current liabilities formula is fairly simple. The current liabilities of a company are notes payable, accounts payable, accrued expenses, unearned revenue, current portion of long term debt, and other short term debt. Commercial paper is also a short-term debt instrument issued by a company.

Understanding Short-Term Debt

Ideally, analysts want to see that a company can pay current liabilities, which are due within a year, with cash. Some examples of short-term liabilities include payroll expenses and accounts payable, which includes money owed to vendors, monthly utilities, and similar expenses. In contrast, analysts want to see that long-term liabilities can be paid with assets derived from future earnings or financing transactions.

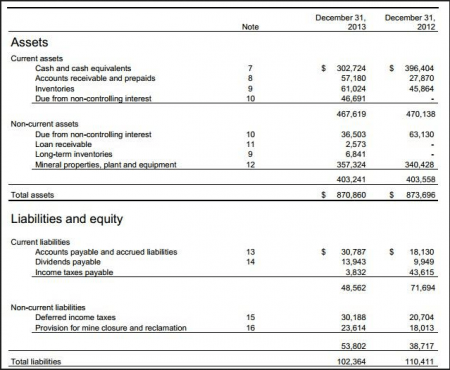

Reading the Balance Sheet

Current liabilities could also be based on a company’s operating cycle, which is the time it takes to buy inventory and convert it to cash from sales. Current liabilities are listed on the balance sheet under the liabilities section and are paid from the revenue generated from the operating activities of a company.

Because debenture bonds fall into this category, they are placed on the balance sheet in the long-term liabilities section. Long-term liabilities are financial obligations of a company that are due more than one year in the future. The current portion of long-term debt is listed separately to provide a more accurate view of a company’s current liquidity and the company’s ability to pay current liabilities as they become due. Long-term liabilities are also called long-term debt or noncurrent liabilities.

Current liabilities are debts and interest amounts owed and payable within the next 12 months. Any principal balances due beyond 12 months are recorded as long-term liabilities.

- Ideally, analysts want to see that a company can pay current liabilities, which are due within a year, with cash.

- Some examples of short-term liabilities include payroll expenses and accounts payable, which includes money owed to vendors, monthly utilities, and similar expenses.

In the context of personal finance and small business accounting, bills payable are liabilities such as utility bills. They are recorded as accounts payable and listed as current liabilities on a balance sheet.

The debt is unsecured and is typically used to finance short-term or current liabilities such as accounts payables or to buy inventory. Examples of current liabilities include accounts payables, short-term debt, accrued expenses, and dividends payable. Liabilities occur to assist in the financing of a company’s operations or expansion.

Liabilities are shown on the balance sheet as either current liabilities or long-term liabilities. Long-term liabilities are debts that are not required to be repaid within one year.

What is included in short term liabilities?

Key Takeaways. Short-term debt, also called current liabilities, is a firm’s financial obligations that are expected to be paid off within a year. Common types of short-term debt include short-term bank loans, accounts payable, wages, lease payments, and income taxes payable.

Current liabilities are defined over the course of a 12-month period, unless the company has elected a different financial cycle. Current liabilities are found with information on the balance sheet and income statement. These obligations include notes payable, accounts payable, and accrued expenses. Business leaders love to talk about revenues, net profits and assets. After all, those are all positive numbers on a balance sheet that can make a company look great.

Liabilities can either be the short term which is due and payable within the next 12 months or long term which is due and payable in excess of 12 months. Short term liabilities are items such as accounts payable, taxes payable, and wages payable which are not charged a stated interest.

Noncurrent liabilities, also called long-term liabilities or long-term debts, are long-term financial obligations listed on a company’s balance sheet. Short-term debts can include short-term bank loans used to boost the company’s capital. Overdraft credit lines for bank accounts and other short-term advances from a financial institution might be recorded as separate line items, but are short-term debts. The current portion of long-term debt due within the next year is also listed as a current liability.

The debt ratio compares a company’s total debt to total assets, to provide a general idea of how leveraged it is. The lower the percentage, the less leverage a company is using and the stronger its equity position. The higher the ratio, the more financial risk a company is taking on. Other variants are the long term debt to total assets ratio and the long-term debt to capitalization ratio, which divides noncurrent liabilities by the amount of capital available. The long-term portion of a bond payable is reported as a long-term liability.

The current portion of long-term debt is separated out because it needs to be covered by more liquid assets, such as cash. Long-term debt can be covered by various activities such as a company’s primary business net income, future investment income, or cash from new debt agreements.

Using long-term debt wisely can help grow a company to the next level, but the business must have the current assets to meet the new obligations added to current liabilities. Short-term debt, also called current liabilities, is a firm’s financial obligations that are expected to be paid off within a year. It is listed under the current liabilities portion of the total liabilities section of a company’s balance sheet. Debenture bonds are liabilities of the company because they represent debts that will have to be repaid in the future.

Long term liabilities and short term bank financing incur interest. All liabilities are paid through the use of cash or sale/reduction of other assets. Investors and creditors use numerous financial ratios to assess liquidity risk and leverage.

Together, current and long-term liability makes up the “total liabilities” section. Current accounts usually include credit accounts your business maintains for inventory and supplies. The long-term debt is most often tied to major purchases used over time to operate the business. Long-term liabilities are a useful tool for management analysis in the application of financial ratios.

When presenting liabilities on the balance sheet, they must be classified as either current liabilities or long-term liabilities. A liability is classified as a current liability if it is expected to be settled within one year. Accounts payable, accrued liabilities, and taxes payable are usually classified as current liabilities. If a portion of a long-term debt is payable within the next year, that portion is classified as a current liability. Business leaders should work with key financial advisors, such as bookkeepers and accountants to fully understand trends, and to establish strategies for success.