Higher-income taxpayers are required to pay higher Medicare taxes. In 2013, an additional Medicare tax was implemented, imposing an extra 0.9% of taxes on earnings over $200,000. Employees at U.S. businesses are required to pay what are known as FICA taxes, often referred to as payroll taxes. Your FICA taxes impact your final net pay and are determined by the amount of your earnings.

- Basically, an employer withholds or automatically deducts a certain percentage of each paycheck to pay the withholding tax.

- Wage earners pay 6.2% on income of $160,200 ($168,600 in 2024) or less toward Social Security.

- Sometimes, employers end up withholding too little or too much in FICA taxes.

- If you earn a wage or a salary, you’re likely subject to Federal Insurance Contributions Act taxes.

- There’s no employer match for Additional Medicare Tax.

Confused or confounded about the money taken out of your paycheck every week? Wondering what Social Security and Medicare taxes have to do with you? If you don’t pay FICA taxes on time, you’ll incur a late fee and penalties along with other consequences.

What Are the FICA Tax Rates and Limits?

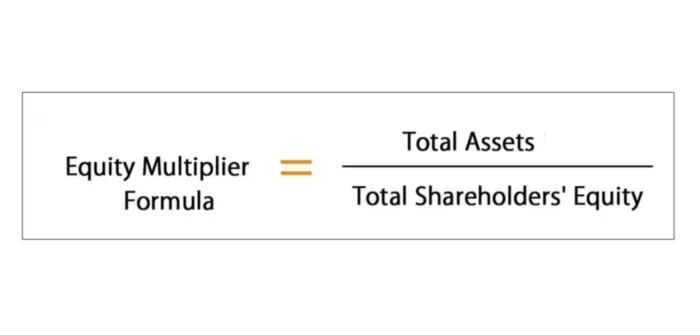

FICA, which stands for Federal Insurance Contributions Act, is a federal law that regulates the payment of social security and Medicare taxes. FICA taxes fund the nation’s program of social security and Medicare benefits. People typically receive these benefits when they reach retirement age, but you have to pay taxes to fund the programs while you’re still working. Employers withhold the required payments from their employees’ wages and also contribute their own share.

Remember, these taxes are not used to pay for your future benefits. Instead, those payroll taxes you’re paying are collected by the IRS and sent out to folks who are currently receiving Social Security benefits (aka beneficiaries). Paying FICA taxes is mandatory for most employees and employers under the Federal Insurance Contributions Act. The funds are used to pay for both Social Security and Medicare.

and 2020 FICA tax rates

While FICA taxes are automatically taken out of your paycheck as an employee, you’ll need to pay close attention if you change jobs or have more than one. You want to be sure you’re not paying more than you’re required to. And if you’re self-employed, you’ll need to use the IRS worksheets to ensure you’re paying the correct amounts. Remember, you’re required to pay Social Security taxes only on earnings up to $147,000.

Employees and employers each pay half of the FICA rate or 7.65%. You need to withhold an additional amount if your employee receives $200,000 or more per year. Ultimately, the Social Security portion of FICA payments goes to the Social Security Administration and the Medicare portion goes to the Department of Health and Human Services. Learn more about the FICA tax and other details below. Each pay period, you should withhold, pay the employer portion, and deposit your employee’s Federal Insurance Contributions Act (FICA) payments. We suggest consulting a tax professional or payroll provider who operates in your state to learn more about state-specific requirements.

What is withholding tax?

We’re breaking down the terms, forms and deadlines you need to know to responsibly file your taxes in 2023 – starting with FICA. Just about everyone pays FICA taxes, including noncitizens. It doesn’t matter whether you work part-time or full-time. Your employer is also responsible for paying half of the total FICA obligation. Looking for other ways to lower your taxable income?

- These numbers should look familiar because SECA taxes essentially just add up the employer and employee share of FICA taxes.

- For these individuals, there’s a 12.4% Social Security tax, plus a 2.9% Medicare tax.

- If employees expect to underpay the Medicare surtax, they can make estimated tax payments throughout the year or ask for additional withholding on Form W-4.

- The Federal Insurance Contributions Act, or FICA, requires that wage earners contribute a portion of their earnings to fund the Social Security and Medicare programs.

- This includes salary, bonuses, commissions, tips, overtime pay, sick pay and premiums on some types of insurance.

For 2023, the Social Security tax rate is 6.2% of an employee’s wages, and the Medicare tax rate is 1.45%. Additional Medicare Tax applies to an individual’s Medicare wages that exceed a threshold amount based on the taxpayer’s filing status. Employers are responsible for withholding the 0.9% Additional Medicare Tax on an individual’s wages paid in excess of $200,000 in a calendar year, without regard to filing status.

How to report FICA taxes

You also don’t have to pay any employer taxes on wages above that amount. Sometimes, employers end up withholding too little or too much in FICA taxes. This could be due to a withholding error or the way the tax system is structured.

For instance, employers are required to start withholding the Medicare surtax once the employee’s wages reach $200,000, without regard to the employee’s filing status or total household income. This can result in the employee underpaying or overpaying the Medicare surtax. After the passage of the Affordable Care Act in 2010, employees who make over a certain amount of money each year must pay an additional Medicare surtax. Once an employee’s wages reach $200,000, you must start withholding 0.9% on any wages exceeding that threshold. There is no employer matching in this case; only employees pay the Medicare surtax. Businesses have to report FICA taxes on a quarterly basis using IRS Form 941.

Your FICA taxes are deducted from your paychecks, and your employer pays a matching amount. FICA is a payroll tax, and it’s short for the Federal Insurance Contributions Act. The law requires employers to withhold a certain percentage of an employee’s wages to help fund Social Security and Medicare. The total bill is split between the employer and the employee.

FICA Tax: Wage Base Limits

But instead of paying FICA taxes, you’re required to pay “SECA” taxes under the Self-Employed Contributions Act. FICA stands for the Federal Income Contributions Act, which is the name for the U.S. payroll tax deduction used to fund Social Security and Medicare. Those familiar government programs provide financial and health care benefits for tens of millions of retirees, disabled Americans and children.