For example, let’s assume Company A purchases raw material, utilities, and services from its vendors on credit to manufacture a product. This means that the company can use the resources from its vendor and keep its cash for 30 days.

In other words, the ratio measures the speed at which a company pays its suppliers. Accounts payable is listed on the balance sheet undercurrent liabilities. The ratio is calculated on a quarterly or on an annual basis, and it indicates how well the company’s cash outflows are being managed.

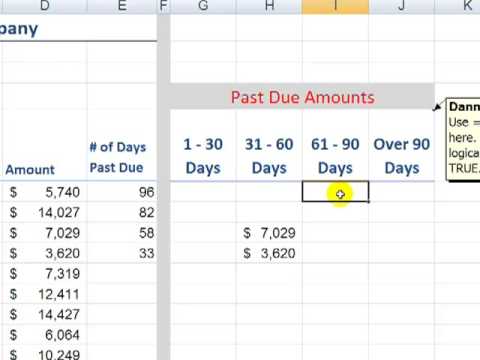

A high number may be due to suppliers demanding quick payments, or it may indicate that the company is seeking to take advantage of early payment discounts or actively working to improve its credit rating. , the accounts payable turnover ratio (or turnover days) is an important assumption for driving the balance sheet forecast. As you can see in the example below, the accounts payable balance is driven by the assumption that cost of goods sold (COGS) takes approximately 30 days to be paid (on average). Therefore, COGS in each period is multiplied by 30 and divided by the number of days in the period to get the AP balance.

How to Calculate DPO

The ratio is a measure of short-term liquidity, with a higher payable turnover ratio being more favorable. Companies with strong bargaining power are given longer credit terms and hence, will have a lower accounts payable turnover ratio. This may be due to favorable credit terms, or it may signal cash flow problems and hence, a worsening financial condition. While a decreasing ratio could indicate a company in financial distress, that may not necessarily be the case.

Generally, a company acquires inventory, utilities, and other necessary services on credit. It results inaccounts payable (AP), a key accounting entry that represents a company’s obligation to pay off the short-term liabilities to its creditors or suppliers.

Accounts payable are short-term debt that a company owes to its suppliers and creditors. The accounts payable turnover ratio shows how efficient a company is at paying its suppliers and short-term debts.

As the average payment period increases, cash should increase as well, but working capital remains the same. Most companies try to decrease the average payment period to keep their larger suppliers happy and possibly take advantage of trade discounts. The accounts payable turnover ratio shows investors how many times per period a company pays its accounts payable.

How do you calculate days payable?

Analysis and Interpretation A higher DPO means that the company is taking longer to pay its vendors and suppliers than a company with a smaller DPO. Companies with high DPOs have advantages because they are more liquid than companies with smaller DPOs and can use their cash for short-term investments.

It might be that the company has successfully managed to negotiate better payment terms which allow it to make payments less frequently, without any penalty. Accounts Receivable (AR) represents the credit sales of a business, which are not yet fully paid by its customers, a current asset on the balance sheet. Companies allow their clients to pay at a reasonable, extended period of time, provided that the terms are agreed upon.

The accounts payable turnover ratio is a liquidity ratio that measures how many times a company is able to pay its creditors over a span of time. The accounts payable turnover in days shows the average number of days that a payable remains unpaid. To calculate the accounts payable turnover in days, simply divide 365 days by the payable turnover ratio.

Days Payable Outstanding – DPO Definition

- Generally, a company acquires inventory, utilities, and other necessary services on credit.

- Beyond the actual dollar amount to be paid, the timing of the payments – from the date of receiving the bill till the cash actually going out of the company’s account – also becomes an important aspect of business.

But a high accounts payable turnover ratio is not always in the best interest of a company. Many companies extend the period of credit turnover (i.e. lower accounts payable turnover ratios) getting extra liquidity.

Accounts payable turnover shows how many times a company pays off its accounts payable during a period. When the turnover ratio is increasing, the company is paying off suppliers at a faster rate than in previous periods. An increasing ratio means the company has plenty of cash available to pay off its short-term debt in a timely manner. As a result, an increasing accounts payable turnover ratio could be an indication that the company managing its debts and cash flow effectively.

Investors can use the accounts payable turnover ratio to determine if a company has enough cash or revenue to meet its short-term obligations. Creditors can use the ratio to measure whether to extend a line of credit to the company.

Related Terms

A high value of DPO can be beneficial if the company is running short of cash. A high DPO also helps if the company is better off in delaying the payments than making them on time and then loaning the money by paying interest to continue its business operations.

What is Days Payable Outstanding?

Accounts receivable turnover shows how quickly a company gets paid by its customers while the accounts payable turnover ratio shows how quickly the company pays its suppliers. The accounts payable turnover ratio is used to quantify the rate at which a company pays off its suppliers.

Payment requirements will usually vary from supplier to supplier, depending on its size and financial capabilities. A high ratio means there is a relatively short time between purchase of goods and services and payment for them. Conversely, a lower accounts payable turnover ratio usually signifies that a company is slow in paying its suppliers.

If you’re currently using a manual accounting system to manage accounts payable and other financial records, you can save time and energy by using an accounting software like QuickBooks. QuickBooks allows you to track all unpaid bills and make payments directly with a check or online bill payment so that your accounts payable balance is always up to date.

What does high Payable Days mean?

A high value of DPO can be beneficial if the company is running short of cash. A high DPO also helps if the company is better off in delaying the payments than making them on time and then loaning the money by paying interest to continue its business operations. Companies must strike a delicate balance with DPO.

This cash could be used for other operations or an emergency during the 30-day payment period. DPO takes the average of all payables owed at a point in time and compares them with the average number of days they will need to be paid. DefinitionThe average payment period (APP) is defined as the number of days a company takes to pay off credit purchases.

Beyond the actual dollar amount to be paid, the timing of the payments – from the date of receiving the bill till the cash actually going out of the company’s account – also becomes an important aspect of business. DPO attempts to measure this average time cycle for outward payments and is calculated by taking the standard accounting figures into consideration over a specified period of time. Like accounts payable turnover ratio, average payment period also indicates the creditworthiness of the company. But a very short payment period may be an indication that the company is not taking full advantage of the credit terms allowed by suppliers.

The accounts payable turnover ratio is a short-term liquidity measure used to quantify the rate at which a company pays off its suppliers. Accounts payables turnover trends can help a company assess its cash situation. Just as accounts receivable ratios can be used to judge a company’s incoming cash situation, this figure can demonstrate how a business handles its outgoing payments. Dividing 365 by the ratio results in the accounts payable turnover in days, which measures the number of days that it takes a company, on average, to pay creditors. that measures the average number of times a company pays its creditors over an accounting period.

Accounts payable turnover ratio is an accounting liquidity metric that evaluates how fast a company pays off its creditors (suppliers). The ratio shows how many times in a given period (typically 1 year) a company pays its average accounts payable. An accounts payable turnover ratio measures the number of times a company pays its suppliers during a specific accounting period. The accounts payable turnover ratio indicates to creditors the short-term liquidity and, to that extent, the creditworthiness of the company. A high ratio indicates prompt payment is being made to suppliers for purchases on credit.