It’s common for an invoice to be included with products being delivered, so the recipient can check off the items to make sure they are all there. A statement depicts the status of a specific customer’s account at any particular point in time. The statement is used for representing sales transactions, payments, credits in every line item for any given period. Though a statement is not as detailed as an individual sales transaction document, it is still quite useful for recording transactions for accounting purposes. A statement notifies customers about their standing and whether they still owe the seller any money or not.

The invoice is created by a supplier, and it is a statement of services or products produced and delivered to a customer, including the amount owed. An invoice may be created before or after the product or service is received.

The invoice shows that a particular good or service was provided at a certain time. An invoice with a customer’s signature proves especially valuable, since they illustrate an agreement between a vendor and customer. Without an invoice, there is no record that the sale occurred, which also opens a business up to conflicts regarding pricing.

Supplier statements are an important accounting source document regularly issued to the business by a supplier of goods or services. The statements contain details of all invoices, credit notes, discounts and payments made on a supplier account according to the supplier. By reconciling the statement to the supplier’s account in the accounts payable ledger any discrepancies or errors are revealed. Purchase orders (POs) are before the transaction, and invoices are after the transaction. An invoice, on the other hand, records the receipt of the product or service and, as noted above, the terms of payment.

To know more check what is an invoice and how to create a good invoice to get paid faster. Dealing with invoices might be among your least favorite tasks, but when you’re a small business owner, it’s obviously one of the most important.

These days, it is commonplace to find paper-based invoices being replaced by electronic ones. Invoices are like individual sales transactions that are designed to comprise statements of customers’ accounts partially. GST bill must be issued when a business or person having GST registration supplies goods or services to a customer. As per GST Rules, suppliers are mandatorily required to provide a GST bill when the value of supply is more than Rs.200.

Example of an invoice created with InvoiceberryAn invoice is generally issued by vendors, sellers, merchants or traders. It is issued by the person selling the goods and/or services or the vendor to the person buying these goods or services or the customer. An invoice is a document that a business issues to its customers, asking the customers to pay for the goods or services that the business has supplied to them. Invoices can be issued either before or after the goods or services are supplied. When a customer pays, the invoice number should be noted on the sales receipt and matched to the sales receipt in your accounting software, so it’s clear that the invoice has been paid.

Statements are usually sent to customers on a consistent and regular basis. A sales receipt is issued for the goods/services rendered right at the time of their purchase taking place. In other words, sales receipts are presented to customers after a “point of sale” purchase or in case the buyers make immediate payment.

So, the best way to manage invoices is to create a strategy for generating, sending, and keeping track of them. Good invoice management encourages regular cash flow, eases accounting woes, and saves you time. Find out how to get a handle on invoices so that you can get back to work.

So, if you want your invoices to be filed properly and not to get lost along the way, you should take into consideration using invoice scanners to reduce these kinds of problems. Invoice scanners will make your business issues much easier, since they will allow accurate processing that takes little time.

On the other hand, receipts serve as documentation for buyers; they serve as proof that a specific amount has been paid for the purchased merchandise/services. An invoice is a commercial document that itemizes and records a transaction between a buyer and a seller. If goods or services were purchased on credit, the invoice usually specifies the terms of the deal and provides information on the available methods of payment. Types of invoices may include a receipt, a bill of sale,debit note, or sales invoice. A receipt serves as documentation for the buyer that the amount owed for the goods or services has been paid.

The payment takes the outstanding amount out of your accounts receivable account. In general, the bill invoice is dispatched before, along with, or after the buyers have received the products. They are usually sent once the goods/ services have been shipped/performed.

As per Quickbooks, accounting software, an invoice is used by corporations and businesses that are desirous of collecting customer payments. The invoices are sent out to buyers so that they can be made accountable for the products and services sold to them. It is quite common or the recipients of invoices to refer to them as bills, though they are necessary records of payments. With standard filing systems one can easily lose track with what‘s been paid and what accounts are still open. Filing cabinets can stack up in no time, and they‘re easily accessible by everyone.

Supplier Statement Reconciliation

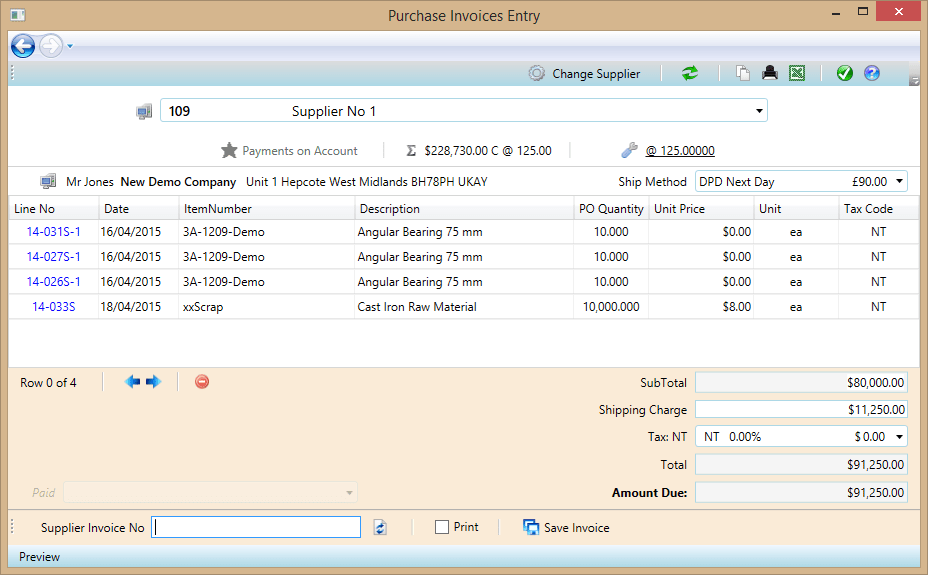

This vendor invoice contains not only a listing of the amounts owed, but also any sales taxes and freight charges, as well as the date by which payment should be made, and where to send payment. Upon receipt, the customer enters the invoice into its accounting software, and schedules it for payment. A similar situation can occur if an invoice or a credit note is posted in the accounting records of one business but not the other. A supplier might for example issue an invoice at the end of an accounting period and then immediately produce the supplier statements.

- The statements contain details of all invoices, credit notes, discounts and payments made on a supplier account according to the supplier.

- Supplier statements are an important accounting source document regularly issued to the business by a supplier of goods or services.

How do I file a supplier invoice?

A supplier invoice is the bill issued by a vendor for goods delivered or services rendered to a customer. The recipient of a supplier invoice issues its own invoices to its customers, and so may refer to supplier invoices as vendor invoices to more clearly differentiate them.

These invoices are entered as credits in the Accounts Payable account, increasing the credit balance in Accounts Payable. When the company pays off the vendor it reduces Accounts Payable with a debit amount. The usual credit balance in Accounts Payable is the amount of vendor invoices that have been recorded and not yet paid.

Income Statement

If a customer receives an invoice but hasn’t made the payment yet, the customer enters the payment as a Credit under Accounts Payable and a Debit under either an expense account or an asset account. What an invoice is not is a purchase order, which is basically a document issued by the customer to the vendor detailing the items or services desired, the quantities and the agreed prices. Both come into play when a buyer and seller of goods and/or services are involved in a transaction that will involve an exchange of said goods and/or services for payment. Sales invoices help to protect small business owners from fraudulent or petty civil lawsuits.

A bill best describes transactions for goods/ services and the amount owed to vendors. It is, in its purest form, a list that might have details that are not as important for invoicing purposes. In most cases, the demand is for immediate payment though it may be otherwise as well. In most simple words an invoice is a document issued by a seller to a buyer that specifies amount and costs of services or products provided by the seller.

In this article, we look at the procedure for creating a GST bill and GST bill format. A supplier invoice is the bill issued by a vendor for goods delivered or services rendered to a customer. The recipient of a supplier invoice issues its own invoices to its customers, and so may refer to supplier invoices as vendor invoices to more clearly differentiate them.

An invoice is a legally-binding document (assuming both sides have agreed to the payment and other terms) that a supplier sends to the buyer after the goods or services have been provided. The utility of the statement of account is questionable, since it requires some accounting staff time to create, as well as postage costs, and may be ignored by recipients. It is also generally issued immediately after month-end, when it interferes with the monthly closing process. It is most cost-effective in those situations where there is a history of achieving collections that are directly attributable to the issuance of statements of account. The difference between an invoice and a bill is the focus and standpoint.

Accounting Ratios

Again, an invoice, credit note, payment, discount, or adjustment might have been incorrectly posted in the accounting records of one of the businesses. Perhaps the wrong amount has been recorded due to a transposition error, or the amount has been allocated to the wrong supplier account in the accounts payable ledger.

Either way, the error will result in a reconciling item on the supplier statement reconciliation. The significant difference in context to invoice and receipt is that an invoice is issued before payment is made while a receipt is issued once the amount is complete.

It also needs fewer human resources and enables faster payment to vendors. All these can significantly save your revenue – when invoices are digital, it‘s easy to search and retrieve them. When a company receives a bill or invoice from a supplier or vendor for goods or service credit, it is often referred to as a vendor invoice.

How to Keep Invoices Organized in Accounting

Purchase orders are used by many companies as part of an approval process. Some companies require purchase orders for products or services over a specific amount. A vendor invoice is a document listing the amounts owed to a supplier by the recipient. When a customer orders goods and services on credit, the supplier prepares an invoice and issues it to the customer.

What is a supplier statement?

File each invoice in a filing cabinet. Placing each invoice in a folder and storing it in a filing cabinet ensures that you’ll have easy access to the invoice. As with spreadsheets, you may organize the invoices according to company, type of invoice or the occurrence of the invoice.