The amount of interest you earn on the notes receivable in an accounting period, but have yet to be paid, is called interest receivable. The amount of interest you earn regardless of when you receive payment is called interest revenue.

An interest expense is the cost incurred by an entity for borrowed funds. Interest expense is a non-operating expense shown on the income statement. It represents interest payable on any borrowings – bonds, loans, convertible debt or lines of credit. It is essentially calculated as the interest rate times the outstanding principal amount of the debt. Interest expense on the income statement represents interest accrued during the period covered by the financial statements, and not the amount of interest paid over that period.

Determine the number of months in an accounting period for which you held your notes receivable, regardless of whether or not you received interest payments. Determine the number of those months for which you have yet to receive payment. In this example, assume you held your notes receivable for three months during the period.

It is not the same as a dividend, which is paid to the holders of a company’s common stock or preferred stock, and which represents a distribution of the issuing company’s retained earnings. For public companies, there’s a much easier way to find the end result instead of doing all the math yourself. Save yourself the time and effort and just review the company’s statement of cash flows, included with its financial statements. Let’s say the supplier starts the first year with $50,000 in cash and accounts receivable of $100,000 (remember, this is money to be collected, not to be paid).

Interest receivable is a balance sheet account that reflects the interest income a business has earned but for which a customer or debtor has yet to pay. This type of account is commonly used by businesses that charge interest on loans and credit lines offered to customers. For example, suppose on June 1 a customer purchases $1,000 worth of equipment on credit and agrees to pay a monthly 1 percent interest charge on the unpaid balance.

Deferred interest loans postpone interest payments for a period of time and can either be extremely costly if not paid off or a way to save money. Interest income is the amount of interest that has been earned during a specific time period.

During this period the ownership of the bonds can be freely transferred between investors. A problem then arises over the issue of the ownership of interest payments. Only the owner of record can receive the coupon payment, but the investor who sold the bond must be compensated for the period of time for which he or she owned the bond. In other words, the previous owner must be paid the interest that accrued before the sale. In accrual rate accounting, your business recognizes revenue as soon as it earns that revenue, and it recognizes expenses at the time it incurs those expenses.

Interest Receivable Definition

While interest expense is tax-deductible for companies, in an individual’s case, it depends on his or her jurisdiction and also on the loan’s purpose. A note receivable is an amount of money a customer or other party owes your company. Your company earns interest on the note receivable to compensate you for extending credit.

So investor B will have to pay investor A the value of the bond in the market, plus $12.33 of accrued interest. The interest on bank loans is usually an expense of the accounting period in which the interest is incurred. Therefore, the interest appears on the income statement and reduces a company’s net income.

If the supplier allows its customer to pay in 60 days instead of 30, that means the customer gets a free month while the supplier has to wait an extra 30 days to collect that cash. In the subsequent year, that means the supplier’s cash flow would have only 11 monthly payments instead of 12.

A bond is a fixed income investment in which an investor loans money to an entity (corporate or governmental) that borrows the funds for a defined period of time at a fixed interest rate. Suppose investor A purchases a bond in the primary market with a face value of $1,000 and a coupon of 5% paid semi-annually. The amount investor B has to pay is the current price of the bond plus accrued interest, which is simply the regular payment adjusted for the time investor A held the bond. In this case, the bond would be $50 over the entire year ($1,000 x 5%), and investor A held the bond for 90 days which is almost a quarter of the year, or 24.66% to be exact (calculated by 90/365).

This is in contrast to cash-basis accounting, in which you record revenue and expenses only when cash changes hands. The distinction is especially important for interest because while you may only pay interest periodically, interest is continually being charged. That’s why knowing how to define accrued interest and understanding the accrual rate can help you plan your financial allocations throughout the fiscal year. Many companies have interest-bearing assets, such as loans and investments, that generate a stream of income for the company. That interest can be categorized as either “interest receivable” or “interest revenue.” These accounting terms have slightly different meanings.

- An interest expense is the cost incurred by an entity for borrowed funds.

Interest is realizable if you fully expect to receive payment in the future. The suppliers in our scenario have their own cash flow considerations in setting how long they’re willing to wait to receive payment. For the supplier, letting a customer wait for a little while before paying is called an account receivable. These short-term credits are recorded as current assets on the balance sheet, and they have an inverse impact on cash flow as accounts payable. Under the accrual method of accounting, interest expense is reported on a company’s income statement in the period in which it is incurred.

This amount can be compared to the investments balance to estimate the return on investment that a business is generating. The amount of interest may have been paid in cash, or it may have been accrued as having been earned but not yet paid. In the latter case, interest income should only be recorded if receipt of the cash is probable, and you can ascertain the amount of the payment to be received.

Is interest receivable a revenue?

Interest receivable is the amount of interest that has been earned, but which has not yet been received in cash. The usual journal entry used to record this transaction is a debit to the interest receivable account and a credit to the interest income account.

You can calculate these amounts at the end of your accounting period and report the amounts on your financial statements. A bond represents a debt obligation whereby the owner (the lender) receives compensation in the form of interest payments. These interest payments, known as coupons, are typically paid every six months.

That extra month would, at the end of the year, reduce the supplier’s cash flow by $100,000. A convertible bond has an embedded option which gives a bondholder the right to convert his or her bond into the equity of the issuing company or a subsidiary. An interest-paying convertible bond will makecoupon paymentsto bondholders for the duration of time the bond is held. After the bond has been converted to shares of the issuer, the bondholder stops receiving interest payments. At the time an investor converts a convertible bond, there will usually be one last partial payment made to the bondholder to cover the amount that has accrued since the last payment date of record.

AccountingTools

The interest paid on a bond is compensation for the money lent to the borrower, or issuer, this borrowed money is referred to as the principal. Similar to the case of the coupon, or interest payment, whoever is the rightful owner of the bond at the time of maturity will receive the principal amount. If the bond is sold before maturity in the market the seller will receive the bond’s market value. The “accrued interest” is the amount of interest the bond has earned but has not yet been paid since the last coupon payment.

However, the interest paid also causes a change in the company’s balance sheet and statement of cash flows. Under GAAP, revenue is recorded on a company’s books when it’s earned and realizable. In other words, interest revenue is reported once your business has fulfilled all obligations of a transaction, such as delivering goods to a customer who purchases them on credit.

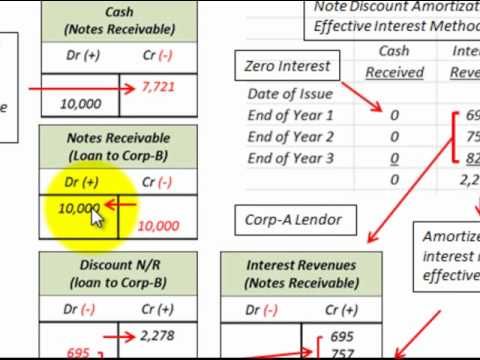

How to Calculate Interest Receivable & Interest Revenue for Notes Receivable

Hence, interest expense is one of the subtractions from a company’s revenues in calculating a company’s net income. When buying bonds in the secondary market, the buyer will have to payaccrued interestto the seller as part of the total purchase price. However, since the buyer did not earn all of the interest accrued over this period, s/he must pay the bond seller the portion of the interest that the seller earned before selling the bond.

Definition of Interest on Bank Loans

If the balance remains unpaid on July 1, you’ve earned $10 of interest. Until the interest is paid, or written off as uncollectible, the $10 is included in the interest receivable account. Interest income is earned from investments that pay interest, such as in a savings account or certificate of deposit.