The right side lists liabilities such as accounts payable to vendors and balances due on loans. The sides of the balance sheet are meant to balance, so you also plug in a number called “owners equity” on the liability side representing the sum of your assets minus the sum of your liabilities. To calculate the labor burden, add each employee’s wages, payroll taxes, and benefits to an employer’s annual overhead costs (building costs, property taxes, utilities, equipment, insurance, and benefits). Then divide that total by the employer’s number of employees.

The cost of labor is the sum of each employee’s gross wages, in addition to all other expenses paid per employee. Other expenses include payroll taxes, benefits, insurance, paid time off, meals, and equipment or supplies. Once the total overhead is added together, divide it by the number of employees, and add that figure to the employee’s annual labor cost.

Bonus: Employee Billable Cost per Hour

The company presents its expense accounts on the income statement and its liability accounts on the balance sheet. The debits and credits must add up to the same amount for accurate payroll accounting entries. This will help determine how much an employee costs their employer per hour.

AccountingTools

It is important to have a consistent employee timesheetsoftware or app for long term labor cost success. Salary payable is the amount of liability of the company towards its employees against the services provided by them but not yet paid. Salary payable is a current liability account that contains all the balance or unpaid amount of wages. If the company earns an additional $500 of revenue but allows the customer to pay in 30 days, the company will increase its asset account Accounts Receivable with a debit of $500.

Average, Annual Employee Hours Worked

The credit entry in Service Revenues also means that owner’s equity will be increasing. As noted earlier, expenses are almost always debited, so we debit Wages Expense, increasing its account balance.

Since your company did not yet pay its employees, the Cash account is not credited, instead, the credit is recorded in the liability account Wages Payable. A credit to a liability account increases its credit balance. Overhead represents the average cost of benefits per employee.

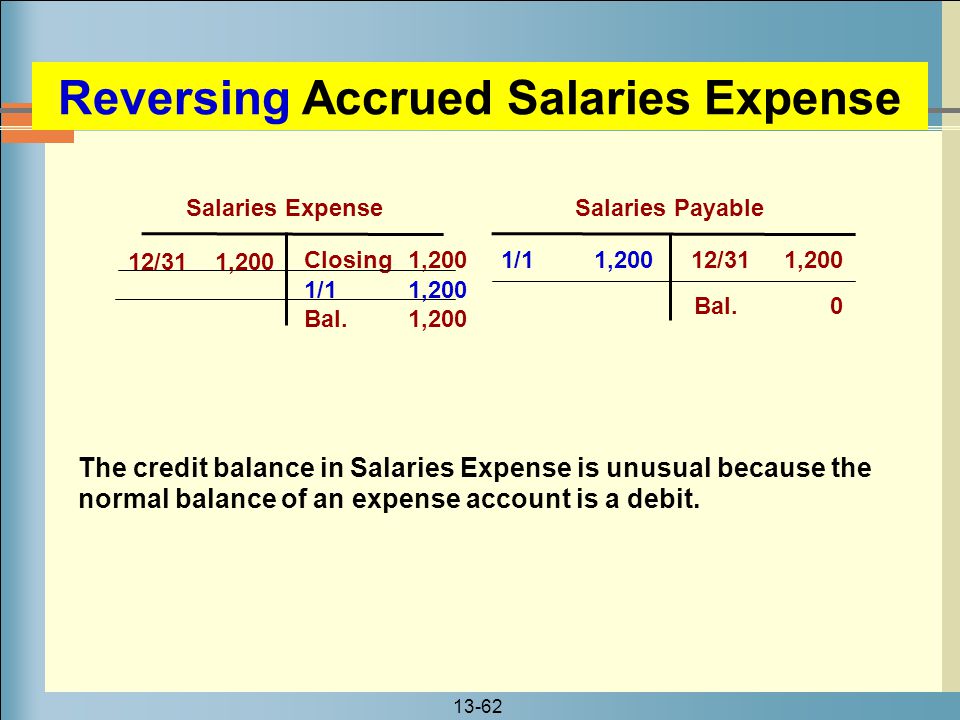

Companies that use the accrual method of accounting record wages expense as the cost is incurred, which is not necessarily when the company pays the employee. A debit to this account, under the accrual basis, requires a credit to the wages payable account for any amounts not paid. We now offer eight Certificates of Achievement for Introductory Accounting and Bookkeeping.

To account for wages expense, the bookkeeper or accountant debits the account for the amount of labor costs during the relevant period. When you have a debit, there must be a corresponding credit, or credits, to make the accounting equation balance.

The owner’s equity and liabilities will normally have credit balances. Since expenses reduce owner’s equity, Advertising Expense must be debited for $500. Therefore, double entry requires that another account must be credited for $500. This is logical since this asset’s normal debit balance must be reduced. At a manufacturing company, the salaries and wages of employees in the manufacturing operations are assigned to the products manufactured.

The company then credits several payable accounts for taxes it owes to FICA, the state and federal governments, the health insurance provider, the 401(k) custodial company and wages payable. At the end of the year, the company will present this account on its balance sheet as a liability. Wages expense is the account that the bookkeeper or accountant uses to record the labor costs of the company.

How to determine the true cost of an hourly employee

- To account for wages expense, the bookkeeper or accountant debits the account for the amount of labor costs during the relevant period.

- The company then credits several payable accounts for taxes it owes to FICA, the state and federal governments, the health insurance provider, the 401(k) custodial company and wages payable.

- When you have a debit, there must be a corresponding credit, or credits, to make the accounting equation balance.

The increase in the company’s assets will be recorded with a debit of $900 to Cash. Since every entry must have debits equal to credits, a credit of $900 will be recorded in the account Service Revenues.

The certificates include Debits and Credits, Adjusting Entries, Financial Statements, Balance Sheet, Income Statement, Cash Flow Statement, Working Capital and Liquidity, and Payroll Accounting. Revenues, gains, expenses, and losses are income statement accounts. If a company performs a service and increases its assets, owner’s equity will increase when the Service Revenues account is closed to owner’s equity at the end of the accounting year. To illustrate why revenues are credited, let’s assume that a company receives $900 at the time that it provides a service and therefore is earning the $900.

You may also refer to it as salary expense or payroll expense, depending on the organization’s preference. Those businesses that use the cash basis of accounting record this expense as it is paid to the employees.

It must also record a credit of $500 in Service Revenues because the revenue was earned. The credit entry in Service Revenues also means that the owner’s equity will be increasing. AccountDebitCreditGross Wages800FICA Tax Payable (Employee)61.20Federal Income Tax Payable60State Income Tax Payable20Wages Payable658.80The next journal entry you make happens when you give the employee their paycheck. When you pay the employee, you no longer owe wages, so your liabilities decrease.

These sales typically translate into assets that improve your company’s net worth. Your balance sheet shows your financial position as of the date it reflects. The left side lists assets such as cash in the bank, inventory and equipment owned.

Are salaries expenses or liabilities?

Salaries expense is the fixed pay earned by employees. The expense represents the cost of non-hourly labor for a business.

Debit the wages, salaries, and company payroll taxes you paid. If your business is healthy and successful, the amounts you spend on salaries, wages and operating expenses add value to your bottom line. Direct labor included in cost of goods sold should go into creating products that you can sell for more than the cost of the materials and payroll that went into them.

These include all the expenses you pay outside of labor costs — things like building costs, property taxes, and utilities — and they can be calculated either monthly or annually, depending on the needs of your business. To figure it out, just divide your total annual overhead costs by the number of employees at your business. Salary payable can be attributed to the type of payroll journal entry that shall be used to record in the books of account the compensation which shall be paid to the employees. It is usually included in the current liabilities on the balance sheet as it is expected to be paid within one year. The primary difference between wages expense and wages payable lies in the type of accounts that they are.

What is a salary expense?

salaries expense definition. Under the accrual method of accounting, the account Salaries Expense reports the salaries that employees have earned during the period indicated in the heading of the income statement, whether or not the company has yet paid the employees.

Wages expense is an expense account, whereas wages payable is a current liability account. A current liability is one that the company must pay within one year.

AccountDebitCreditGross WagesXFICA Tax Payable (Employee)XFederal Income Tax PayableXState Income Tax PayableXPayroll Payable (Net Wages)XThe expenses include gross wages, which are debited. The liabilities include FICA tax payable, federal income tax payable, state income tax payable, and payroll payable. Because they are paid amounts, you increase the expense account.