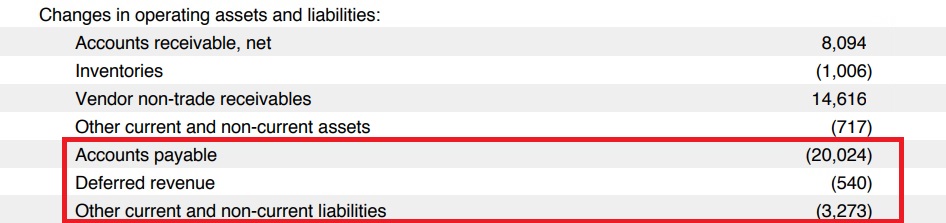

Companies looking to increase profits want to increase their receivables by selling their goods or services. Typically, companies practice accrual-based accounting, wherein they add the balance of accounts receivable to total revenue when building the balance sheet, even if the cash hasn’t been collected yet. As a result, accounts receivable are assets since eventually, they will be converted to cash when the customer pays the company in exchange for the goods or services provided. Accounts payable is a liability since it’s money owed to creditors and is listed under current liabilities on the balance sheet.

There are many accounting software options that are great for managing everything from your sales invoices to maintaining income statements and balance sheets. This software allows you to keep and edit notes on specific clients, which is accessible to every member of the collection team as well as other concerned departments. Therefore, everyone will evidently know the current stance of the client regarding their payment. Under the allowance method only do we estimate bad debts expense to prepare an adjusting entry at the end of each accounting period.

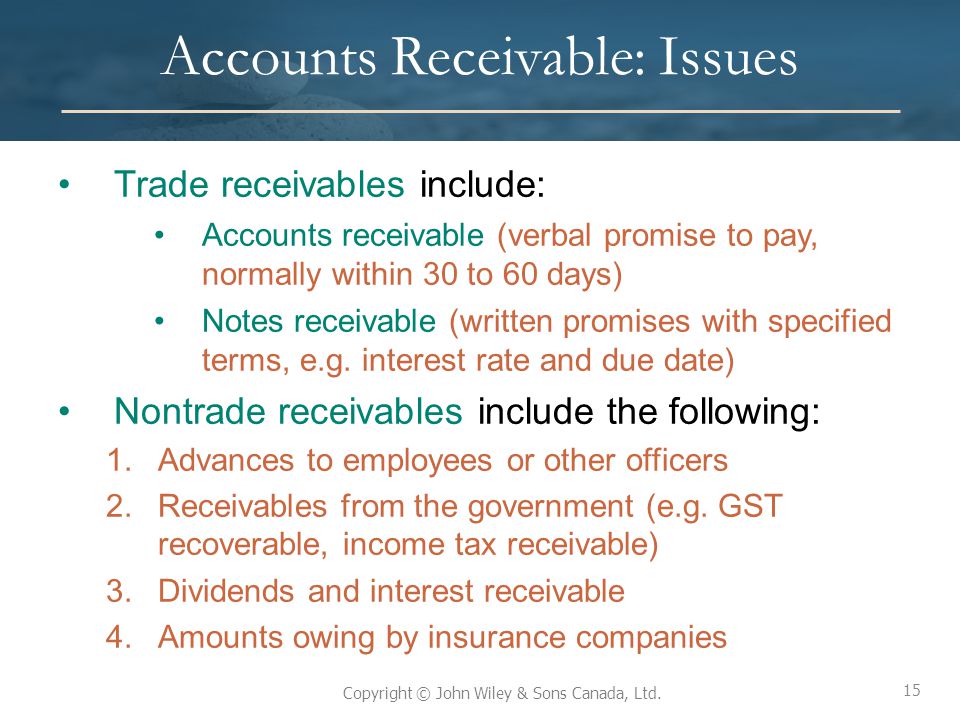

One is based on the income statement relation between bad debts expense and sales. The second is based on the balance sheet relation between accounts receivable and the allowance for doubtful accounts. Accounts receivable is the money owed to that company by entities outside of the company. Other receivables can be divided according to whether they are expected to be received within the current accounting period or 12 months (current receivables), or received greater than 12 months (non-current receivables).

Accounts receivables are listed on the balance sheet as a current asset. AR is any amount of money owed by customers for purchases made on credit. Gem’s Bad Debts Expense will report credit losses of $2,000 on its June income statement.

At the end of the first year, $20,000 of credit sales remained uncollected. Based on the experience of similar businesses, TechCom estimated that $1,500 of its accounts receivable would be uncollectible and made the following adjusting entry.

Financial Accounting

Promissory notes strengthen a company’s legal claim against those who fail to pay as promised. The maturity date of a note determines whether it is placed with current assets or long-term assets on the balance sheet. Notes that are due in one year or less are considered current assets, while notes that are due in more than one year are considered long-term assets.

These billings are typically documented on formal invoices, which are summarized in an accounts receivable aging report. This report is commonly used by the collections staff to collect overdue payments from customers. Accounts receivable are similar to accounts payable in that they both offer terms which might be 30, 60, or 90 days. However, with receivables, the company will be paid by their customers, whereas accounts payables represent money owed by the company to its creditors or suppliers. Accounts receivable (AR) is the balance of money due to a firm for goods or services delivered or used but not yet paid for by customers.

The receivables owed by the company’s customers are called trade receivables. Account receivables are classified as current assets, assuming that they are due within one calendar year or fiscal year. Recognizing the bad debt requires a journal entry that increases a bad debts expense account and decreases accounts receivable. Smith fails to pay a $100 balance, for example, the company records the write-off by debiting bad debts expense and crediting accounts receivable from J.

The total dollar amount of all receivables is multiplied by this percent to get the estimated dollar amount of uncollectible accounts—reported in the balance sheet as the Allowance for Doubtful Accounts. The debit in this entry charges the uncollectible amount directly to the current period’s Bad Debts Expense account. The credit removes its balance from the Accounts Receivable account in the general ledger (and its subsidiary ledger). When a company directly grants credit to its customers, it expects that some customers will not pay what they promised.

Companies record accounts receivable as assets on their balance sheets since there is a legal obligation for the customer to pay the debt. Furthermore, accounts receivable are current assets, meaning the account balance is due from the debtor in one year or less. If a company has receivables, this means it has made a sale on credit but has yet to collect the money from the purchaser.

Non-current Note Receivables

- There are many accounting software options that are great for managing everything from your sales invoices to maintaining income statements and balance sheets.

- Having an automated software to manage your bookkeeping needs does wonders for your business.

- Two methods are available to calculate the amount of bad debt expense and allowance of doubtful accounts at the end of an accounting period — percentage of accounts receivable or percentage of sales.

As we stated above, the account Allowance for Doubtful Accounts is a contra asset account containing the estimated amount of the accounts receivable that will not be collected. For example, let’s assume that Gem Merchandise Co.’s Accounts Receivable has a debit balance of $100,000 at June 30. Gem anticipates that approximately $2,000 of this is not likely to turn to cash, and as a result, Gem reports a credit balance of $2,000 in Allowance for Doubtful Accounts. The accounting entry to adjust the balance in the allowance account will involve the income statement account Bad Debts Expense. Accounts receivable and notes receivable that result from company sales are called trade receivables, but there are other types of receivables as well.

The accounts of these customers are uncollectible accounts, commonly called bad debts. The total amount of uncollectible accounts is an expense of selling on credit. Why do companies sell on credit if they expect some accounts to be uncollectible? The answer is that companies believe that granting credit will increase total sales and net income enough to offset bad debts. Many companies allow their credit customers to make periodic payments over several months.

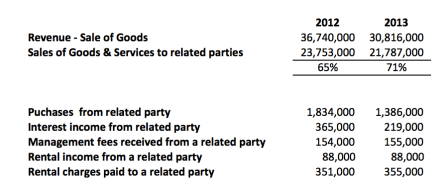

Trade receivables

The Allowance for Doubtful Accounts credit balance of $1,500 reduces accounts receivable to its realizable value, which is the amount expected to be received. Although credit customers owe $20,000 to TechCom, only $18,500 is expected in cash collections from these customers. (TechCom continues to bill its customers a total of $20,000.) In the balance sheet, the Allowance for Doubtful Accounts is subtracted from Accounts Receivable and is often reported as shown in Exhibit 7.6. Most businesses operate by enabling their clients to buy goods in credit. The cost of sales on credit is what is referred to as Accounts Receivable.

This expense is being reported even though none of the accounts receivables were due in June. (Recall the credit terms were net 30 days.) Gem is attempting to follow the matching principle by matching the bad debts expense as best it can to the accounting period in which the credit sales took place. On a company’s balance sheet, accounts receivable is the money owed to that company by entities outside of the company.

For example, interest revenue from notes or other interest-bearing assets is accrued at the end of each accounting period and placed in an account named interest receivable. Wage advances, formal loans to employees, or loans to other companies create other types of receivables. If significant, these nontrade receivables are usually listed in separate categories on the balance sheet because each type of nontrade receivable has distinct risk factors and liquidity characteristics. Revenue is only increased when receivables are converted into cash inflows through the collection. Revenue represents the total income of a company before deducting expenses.

Two methods are available to calculate the amount of bad debt expense and allowance of doubtful accounts at the end of an accounting period — percentage of accounts receivable or percentage of sales. Having an automated software to manage your bookkeeping needs does wonders for your business.

For example, Harley-Davidson reports more than $2 billion in installment receivables. The seller refers to such assets as installment accounts (or finance) receivable, which are amounts owed by customers from credit sales for which payment is required in periodic amounts over an extended time period.

Account receivables are classified as current assets assuming that they are due within one year. To record a journal entry for a sale on account, one must debit a receivable and credit a revenue account. When the customer pays off their accounts, one debits cash and credits the receivable in the journal entry.

The ending balance on the trial balance sheet for accounts receivable is always debit. Notes receivable are amounts owed to the company by customers or others who have signed formal promissory notes in acknowledgment of their debts.

Current liabilities are short-term liabilities of a company, typically less than 90 days. To guard against overstatement, a company will estimate how much of its accounts receivable will never be collected. This estimate is reported in a balance sheet contra asset account called Allowance for Doubtful Accounts. The percent of accounts receivable method assumes that a percent of a company’s receivables is uncollectible. This percent is based on past experience and is impacted by current conditions such as economic trends and customer difficulties.

What is the difference between trade receivable and non trade receivable?

Non trade receivables are amounts due for payment to an entity other than its normal customer invoices for merchandise shipped or services performed. In all of the examples, the non trade items are typically not billed using the company’s invoicing software; instead, they are recorded as journal entries.

Definition of Accounts Receivables

The estimated bad debts expense of $1,500 is reported on the income statement (as either a selling expense or an administrative expense). A contra account is used instead of reducing accounts receivable directly because at the time of the adjusting entry, the company does not know which customers will not pay. TechCom’s account balances (in T-account form) for Accounts Receivable and its Allowance for Doubtful Accounts are as shown in Exhibit 7.5. The allowance method estimates bad debts expense at the end of each accounting period and records it with an adjusting entry. TechCom, for instance, had credit sales of $300,000 during its first year of operations.

What is trade and other receivables?

Trade receivables can be accounts or notes receivable. A non-trade receivable would be when someone owes the company money not related to providing a service or selling a product. For example, the company loans an employee money for a travel advance or a company borrows money from another company.

Most of these receivables require interest payments, and they can be either current or noncurrent assets depending on the length of repayment. While AP is the debt a company owes to its suppliers or vendors, accounts receivable is the debt of the buyers to the company. Accounts Receivables are important assets to a firm, while Accounts Payable are liabilities that must be paid in the future by the company. Basically, firms choose to offer receivables to encourage customers to choose their products over the competitor’s products. Trade receivables are amounts billed by a business to its customers when it delivers goods or services to them in the ordinary course of business.