Additionally, choose companies with a debt to asset ratio of 1 in 10 or less, which means that they have more assets than they have debt. This is a sign of a strong company and a good stock, so take note of it and consider buying. Also, look for stocks with a Standard and Poor’s Quality Rating of at least B+.

Numerous academics have published studies investigating the effects of buying value stocks. These studies have consistently found that value stocks outperform growth stocks and the market as a whole.

Valuation From P/E

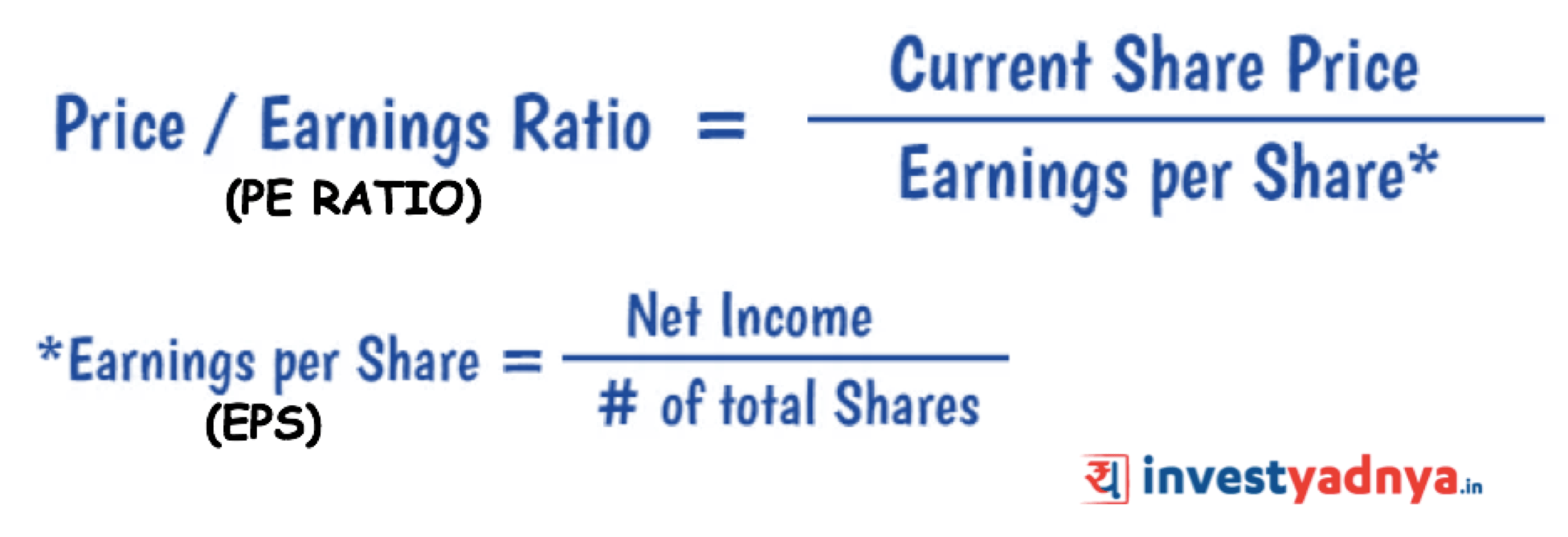

What does price to earnings mean?

The price to earnings ratio (PE Ratio) is the measure of the share price relative to the annual net income earned by the firm per share. PE ratio shows current investor demand for a company share. A high PE ratio generally indicates increased demand because investors anticipate earnings growth in the future.

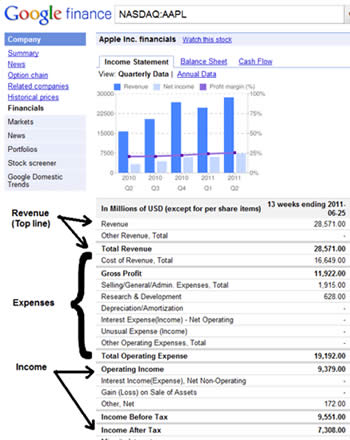

Martin Whitman focuses on acquiring common shares of companies with extremely strong financial position at a price reflecting meaningful discount to the estimated NAV of the company concerned. Value investing was established by Benjamin Graham and David Dodd, both professors at Columbia Business School and teachers of many famous investors. In terms of picking or screening stocks, he recommended purchasing firms which have steady profits, are trading at low prices to book value, have low price-to-earnings (P/E) ratios, and which have relatively low debt. Looking at these things can help you get a better sense of how strong the company’s financial position is and how sustainable the business model is. A company that’s seeing steady positive earnings over a multi-year period with minimal debt, for example, could be a good candidate as an undervalued stock if those indicators aren’t reflected by an increasing share price.

Accurate and unbiased presentations of P/E ratios rely on accurate inputs of the market value of shares and of accurate earnings per share estimates. The market determines the prices of shares through its continuous auction. The printed prices are available from a wide variety of reliable sources. If that trust is perceived to be broken the stock will be considered more risky and therefore less valuable. His approach is called safe-and-cheap, which was hitherto referred to as financial-integrity approach.

But the PER does not in itself indicate whether the share is a bargain. The PER depends on the market’s perception of the risk and future growth in earnings.

Price-to-Earnings Ratio – P/E Ratio

The market price of a given stock is needed to calculate its P/E ratio, but in many ways, the P/E ratio offers better insight into the stock’s growth potential. The price/earnings ratio (PER) is the most widely used method for determining whether shares are “correctly” valued in relation to one another.

A company with a low PER indicates that the market perceives it as higher risk or lower growth or both as compared to a company with a higher PER. The PER of a listed company’s share is the result of the collective perception of the market as to how risky the company is and what its earnings growth prospects are in relation to that of other companies.

The P/E ratio measures the relationship between a company’s stock price and its earnings per share of stock issued. The P/E ratio is calculated by dividing a company’s current stock price by its earnings per share (EPS). If you don’t know the EPS, you can calculate it by subtracting a company’s preferred dividends paid from its net income, and then dividing the result by the number of shares outstanding. Another important limitation of price-to-earnings ratios is one that lies within the formula for calculating P/E itself.

If a company can grow its earnings, it takes fewer years for the company to earn back the price you pay for the stock. As a shareholder, you want the company to earn back the price you pay as soon as possible.

- However, companies that grow faster than average typically have higher P/Es, such as technology companies.

- A higher P/E ratio shows that investors are willing to pay a higher share price today because of growth expectations in the future.

The average P/E for the S&P 500 has historically ranged from 13 to 15. For example, a company with a current P/E of 25, above the S&P average, trades at 25 times earnings. The high multiple indicates that investors expect higher growth from the company compared to the overall market. Any P/E ratio needs to be considered against the backdrop of the P/E for the company’s industry. While a company’s stock price reflects the value that investors are currently placing on that investment, a stock’s P/E ratio indicates how much investors are willing to pay for every dollar of earnings.

If a company is paying the bulk of its profits out in dividends, for example, that may leave it with less cash flow to pay off debts or invest in growth for the long-term. When it comes to finding stocks that are undervalued, the key thing to look for with dividend yield and cash flow is consistency.

However, companies that grow faster than average typically have higher P/Es, such as technology companies. A higher P/E ratio shows that investors are willing to pay a higher share price today because of growth expectations in the future.

Other P/E Considerations

In other words, the shares could prove to be a dark horse whose potential isn’t being realized by investors. Many dividend investors do not look to technology stocks due to their high volatility. Historically, tech stocks have not been known to be great dividend stocks, as many tech companies prefer to invest cash back into their businesses rather than pay a dividend.

In many cases, companies will have dividend yields that are similar to their peers, but that is not always the case. Check out the chart below to see how the stocks you own measure up with their sector averages. To determine undervalued stocks, start by looking up the stock on a trading website, like Morningstar or Yahoo Finance. Look for stocks with a low price to earnings ratio, which compares the current price of the stock with the earnings made from each share. If you see a low ratio, this indicates that the stock is cheaper.

P/E vs. PEG Ratio

If a company is continually paying out a steady dividend, despite a lower share price, that’s a sign that its underlying financials are strong. EPS is also used in several valuation metrics, particularly the price-to-earnings ratio, which is probably the most widely used way to compare stocks’ valuations.

Investors use the PER to compare their own perception of the risk and growth of a company against the market’s collective perception of the risk and growth as reflected in the current PER. If investors believe that their perception is superior to that of the market, they can make the decision to buy or sell accordingly. Value investing has proven to be a successful investment strategy. One way is to examine the performance of simple value strategies, such as buying low PE ratio stocks, low price-to-cash-flow ratio stocks, or low price-to-book ratio stocks.

This trend has changed in recent years, however, as many former high-growth tech companies have accepted a slower growth trajectory and started to focus more on rewarding shareholders with dividends and buybacks. For additional overview on tech stocks that pay dividends, take a look at 10 Big Tech Stocks That Pay A Dividend. For dividend investors, yield is one of the most important factors to consider when making an investment. Dividend yield can make or break the attractiveness of a dividend stock.