Logically, short-term investments are classified as current assets. Fiduciaries may comply with this requirement in any appropriate written document, including, but not limited to, any periodic statement or account. When you use the Worthy Bonds mobile app, you can automatically add funds to your investment account. Similar to many micro-savings apps, Worthy Bonds uses spending “round-ups” to move small amounts of money into your investment account as you spend. For example, if you pay $4.10 for a cup of coffee, the app will charge your account an even $5.

The company’s investment in commercial paper was worth $17.4 billion and mutual funds were $800 million. government securities of $8.2 billion and certificates/time deposits of $7.3 billion. Mortgage/asset-backed securities were at $20 billion and municipal securities at $973 million, rounded out its short-term investments. CDs, money market accounts, and Treasury bills are common types of low-risk short-term investments. Temporary investments are securities that can be sold in the near future, and for which there is an expectation of doing so.

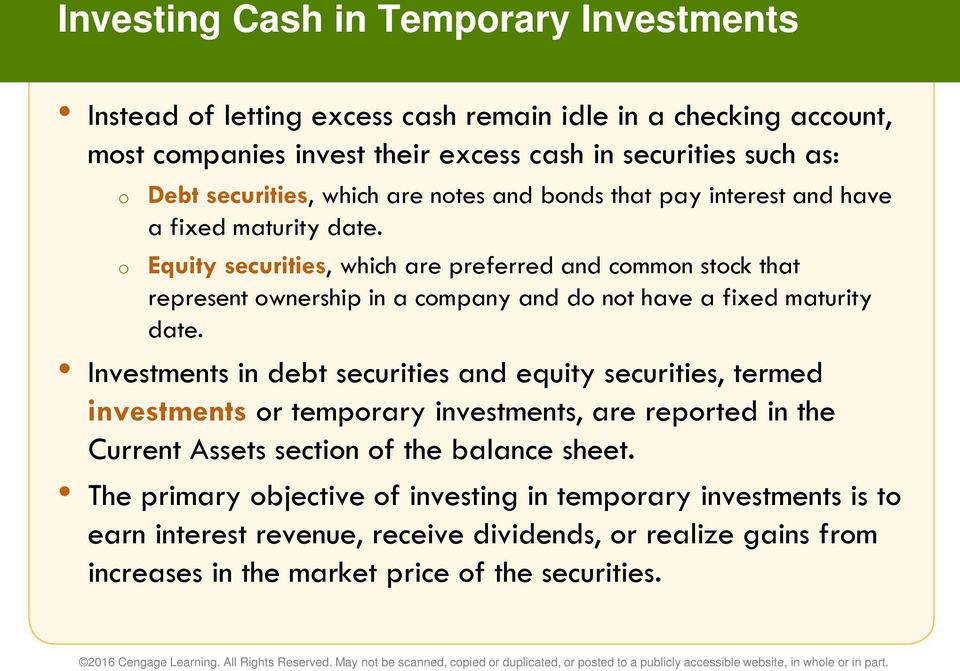

The price you pay for safety and liquidity is a lower rate of return than bonds and other longer-term investments. And while cash equivalent investments hardly offer breathtaking returns, you might as well earn as much as you can on them. In the course of normal business operations, companies require cash to pay for goods and services, including salaries of employees. Sound financial management techniques go beyond holding cash in bank accounts. Companies with significant financial flexibility, and a strong cash position, may purchase short-term investments as an alternative to placing money in a savings account at a financial institution such as a bank.

As a result, the company can afford to invest excess cash in stocks, bonds, or cash equivalents to earn higher interest than what would be earned from a normal savings account. strategy of using seasonal excess of cash to invest in marketable securities that the company intends to convert back into cash within one year.

For example, both a three-month US Treasury bill and a three-year Treasury note purchased three months from maturity qualify as cash equivalents. However, a Treasury note purchased three years ago does not become a cash equivalent when its remaining maturity is three months. Government obligations or (h) pooled investment funds or accounts that invest only in investments other than securities or instruments of the type described in clauses (a) through (d) of this definition. Short-term investments, also known as marketable securities or temporary investments, are those which can easily be converted to cash, typically within 5 years.

An investment in short-term, low-risk securities such as Treasury bills, money markets and so forth. A temporary investment aims to protect the funds invested in it while also providing a (low) return. Apple Inc. also held short-term investments, listed as marketable securities, of $254 billion as of March 31, 2018.

When investing long-term, you can be more aggressive because you have a longer time horizon, so you could opt to invest in anaggressive mutual fundto get the highest rate of return. Instead, look for high interest online savings accounts, such as the Savings Builder from CIT Bank, and money market accounts. Online banks have less physical overhead, so they offer much higher interest rates and have less fees. Check to see if there’s a promo code for CIT Bank right now if you decide to sign up. You likely won’t be able to earn as much in a short-term investment as you would in a long-term investment.

Cash includes currency on hand as well as demand deposits with banks or financial institutions. Generally, only investments with original maturities of three months or less qualify under that definition. Original maturity means original maturity to the entity holding the investment.

$4.10 will go to pay the merchant, and $0.90 will go into your investment account. Once you accumulate an even $10 in round-ups, the funds can be used to purchase a bond. As the name implies, short-term investments are usually sold after holding them for three years or less. Examples of investment vehicles that lend themselves to a shorter investment period include stocks, mutual funds, and some bonds and bond mutual funds. Long-term investments are vehicles that you can expect to pay off after holding them for a period of several years.

The two major investments were corporate securities, which represented $138 billion, and U.S. Treasury/agency securities, which were $62.3 billion.

You may have heard of long-term investments and short-term investments, but are unsure of what they mean, what the difference is, or what investment strategy is best for you. A long-term investment usually offers ahigher probability of maximizing your return over a 10-year period, rather than bringing you a high return in just a few years. Examples of long-term investment vehicles include stocks and index funds. The financial accounting term short-term investments refers to securities the company has purchased that can, and will be, sold in less than twelve months.

While these investments are associated with a higher level of risk, the rewards can be greater too. A type of investment that is structured to only last for a short amount of time. Temporary investments are popular among investors that have assets that they do not want to commit to long-term investments. With this type of investment investors can quickly access and use money invested in these temporary options.

Real-Life Example of Short-Term Investments

A business may invest cash in stocks of other corporations. Or, a company may buy other types of corporate or government securities. If these investments are acquired for long-term purposes, or perhaps to establish some form of control over another entity, the investments are classified as noncurrent assets. The accounting rules for those types of investments are covered in subsequent chapters.

- Cash includes currency on hand as well as demand deposits with banks or financial institutions.

Money market fund accounts, treasury bills, and some short-term CDs are a few examples of temporary investments. Managed by professional financial advisers, bond funds are often a higher yield (although sometimes riskier) investment than money markets. So, if you’re looking for a high-yield short term investment, bonds may just be the right fit. Companies in a strong cash position will have a short-term investments account on their balance sheet.

If you invest for the short term, you’ll be limited to certain types of investments and shouldn’t buy riskier kinds such as stocks and stock funds. While some define short-term investments as those that cash out within three years (or sometimes even one year), the time span is typically around five years. With a shorter investment period, your goals will be different – for example, short-term investors may use the strategy to take advantage of rising interest rates over a short period. However, there are lots of options when it comes to a strategy with short-term investing.

These investments are commonly used when a business has a short-term excess of funds on which it wants to earn interest, but which will be needed to fund operations within the near future. These types of investments are usually very safe, but also have quite a low rate of return. Temporary investments are classified as current assets on the balance sheet. Short-term investments are readily marketable securities (stocks and bonds) that are intended to be sold within the time period of current assets.

Money market accounts are another kind of bank deposit, and they usually pay a higher interest rate than savings accounts, though they typically require a higher minimum investment, too. Because of their time frame, short term investments are often seen as safer than long term investments, especially on the stock market.

You can often invest, write checks off the account, transfer money and do other typical bank-like activities. Cash management accounts are typically offered by robo-advisers and online stock brokers.

Examples of Short-Term Investments

Usually, these investments are high-quality and highly liquid assets or investment vehicles. Ashort-term investmentis an investment you expect to hold for 3 years or less, then sell and/or convert to cash. Examples of short-term investments include money market funds, certificates of deposit, and short-term bonds.

The investments produce dividend and/or interest income as well as possible capital appreciation for the company. Temporary investments are considered short-term investments and are classified as current assets under the marketable security heading on the balance sheet.

Many short-term investments are sold or converted to cash after a period of only 3-12 months. Some common examples of short term investments include CDs, money market accounts, high-yield savings accounts, government bonds and Treasury bills.

AccountingTools

Also known as temporary investments, short-term investments typically include marketable equity and debt securities as well as short-term paper. Short term investments should have little risk and almost guaranteed returns. Safest options are high-yield savings, money market, and CDs. A cash management account allows you to put money in a variety of short-term investments, and it acts much like an omnibus account.

The 7 Best Places to Put Your Savings

A short term investment is an investment you plan to hold for 5 years or less. Examples of short-term investments are high-yield savings accounts, CDs, money market accounts, treasury bills, and government bonds. The investment should easily convert to cash when the time is right. If you’re going to need money in the near future, temporary investments are the most sensible place to put those dollars.

Join PRO or PRO Plus and Get Lifetime Access to Our Premium Materials

If they’re being held in a retirement account, taxes don’t matter (yet), so pick the temporary investment with the highest yield. The trick here is simply to do some ciphering to determine how much taxes would reduce the investment return, based on your tax bracket. Even though the stated interest rate on a particular cash equivalent investment may be lower, it’s how much you get to keep after taxes that counts. This information can be found easily by accessing any number of web sites that show average and top yielding interest rates. Also, the financial pages of most newspapers regularly show the interest being paid on most types of temporary investments, including rates offered by local banks.

While many people like to play the market or speculate with day trading, it’s a risky business and you should educate yourself and do plenty of research before you try short-term investing. For most people, it is easier and safer to plan on long-term investments.