ROE is also a factor in stock valuation, in association with other financial ratios. Companies that are heavily capital intensive may have higher debt to equity ratios while service firms will have lower ratios. The primary differentiator between ROE and ROA is financialleverage or debt.

ROE reveals how much profit a company earned in comparison to the total amount of shareholder equity found on the balance sheet. Shareholder equity is equal to total assets minus total liabilities. Shareholder equity is a creation of accounting that represents the assets created by the retained earnings of the business and the paid-in capital of the owners. Because shareholders’ equity is equal to a company’s assets minus its debt, ROE could be thought of as the return on net assets. If a company has been borrowing aggressively, it can increase ROE because equity is equal to assets minus debt.

A common scenario is when a company borrows large amounts of debt to buy back its own stock. This can inflate earnings per share (EPS), but it does not affect actual performance or growth rates. As with any ratio, the debt-to-equity ratio offers more meaning and insight when compared to the same calculation for different historical financial periods. If a company’s debt to equity ratio has risen dramatically over time, the company may have an aggressive growth strategy being funded by debt. Debt and equity compose a company’s capital structure or how it finances its operations.

ROE is especially used for comparing the performance of companies in the same industry. As with return on capital, a ROE is a measure of management’s ability to generate income from the equity available to it.

Return on Equity is an important measure for a company because it compares it against its peers. With return on equity, it measures performance and generally the higher the better. Some industries have a high ROE as they require little or no assets while others require large infrastructure builds before they generate profit.

ROE is considered a measure of how effectively management is using a company’s assets to create profits. The return on equity (ROE) metric reveals how effectively a corporation is generating profit from the money that investors have put into the business.

Splitting return on equity into three parts makes it easier to understand changes in ROE over time. For example, if the net margin increases, every sale brings in more money, resulting in a higher overall ROE. Similarly, if the asset turnover increases, the firm generates more sales for every unit of assets owned, again resulting in a higher overall ROE. Finally, increasing financial leverage means that the firm uses more debt financing relative to equity financing.

Example of How to Use ROE

For this reason ROE is best used to compare companies in the same industry. Performance ratios like ROE, concentrate on past performance to get a gauge on future expectation. The second half of the equation is called financial leverage, which is also known as the equity multiplier. A higher proportion of assets compared to shareholder equity demonstrates the extent to which debt (leverage) is used in a company’s capital structure. But if that company takes on financial leverage, its ROE would rise above its ROA.

What is a good return on shareholders equity?

ROE is especially used for comparing the performance of companies in the same industry. As with return on capital, a ROE is a measure of management’s ability to generate income from the equity available to it. ROEs of 15-20% are generally considered good.

Although ROE and ROA are different measures of management effectiveness, the DuPont Identity formula shows how closely related they are. The DuPont formula, also known as the strategic profit model, is a common way to decompose ROE into three important components. Essentially, ROE will equal the net profit margin multiplied by asset turnover multiplied by financial leverage.

Increased debt will make a positive contribution to a firm’s ROE only if the matching return on assets (ROA) of that debt exceeds the interest rate on the debt. Return on equity (ROE) is a measure of financial performance calculated by dividing net income by shareholders’ equity. Because shareholders’ equity is equal to a company’s assets minus its debt, ROE is considered the return on net assets.

- ROE is also a factor in stock valuation, in association with other financial ratios.

- As with return on capital, a ROE is a measure of management’s ability to generate income from the equity available to it.

- ROE is especially used for comparing the performance of companies in the same industry.

The average for return on equity (ROE) for companies in the banking industry in the fourth quarter of 2019 was 11.39%, according to the Federal Reserve Bank of St. Louis. ROE is a key profitability ratio that investors use to measure the amount of a company’s income that is returned as shareholders’ equity. One of the most important profitability metrics is Return on Equity, or ROE for short.

What Does ROE Tell You?

Interest payments to creditors are tax-deductible, but dividend payments to shareholders are not. Thus, a higher proportion of debt in the firm’s capital structure leads to higher ROE. Financial leverage benefits diminish as the risk of defaulting on interest payments increases. If the firm takes on too much debt, the cost of debt rises as creditors demand a higher risk premium, and ROE decreases.

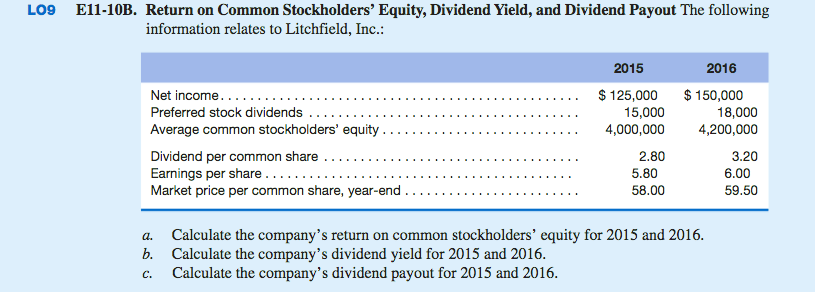

How do you calculate return on stockholders equity?

It is calculated by dividing a company’s earnings after taxes (EAT) by the total shareholders’ equity, and multiplying the result by 100%. The higher the percentage, the more money is being returned to investors. This ratio helps business owners and financing professionals determine a company’s financial health.

What Is Return on Equity (ROE)?

ROE is calculated by dividing net income by total shareholders’ equity. ROE is a very effective metric for evaluating and comparing similar companies, providing a solid indication of earnings performance.

By taking on debt, a company increases its assets thanks to the cash that comes in. But since shareholder equity equals assets minus total debt, a company decreases its equity by increasing debt.

A common shortcut for investors is to consider a return on equity near the long-term average of the S&P 500 (14%) as an acceptable ratio and anything less than 10% as poor. While most corporations focus on earnings per share (EPS) growth, banks emphasize ROE.

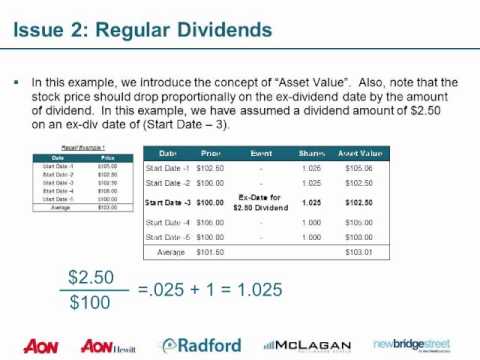

Estimating the Dividend Growth Rate

The debt to equity ratio can be used as a measure of the risk that a business cannot repay its financial obligations. Return on equity measures how efficiently a firm can use the money from shareholders to generate profits and grow the company. Unlike other return on investment ratios, ROE is a profitability ratio from the investor’s point of view—not the company. In other words, this ratio calculates how much money is made based on the investors’ investment in the company, not the company’s investment in assets or something else.

A good rule of thumb is to target an ROE that is equal to or just above the average for the peer group. For example, assume a company, TechCo, has maintained a steady ROE of 18% over the last few years compared to the average of its peers, which was 15%. An investor could conclude that TechCo’s management is above average at using the company’s assets to create profits. Relatively high or low ROE ratios will vary significantly from one industry group or sector to another. When used to evaluate one company to another similar company, the comparison will be more meaningful.