As a result of its activities, any enterprise carries out some kind of business operations, makes certain decisions. Each such action is reflected in the accounting records. In accounting, reporting is its final stage, at which the accumulated bookkeeping information is generalized and presented in a form convenient for interested parties. Every business is obliged to draw up financial statements based on data from its bookkeeping records.

Reports are used for the management of the activities of organizations, its data is necessary for the analysis of production and financial activities. With its help, the reasons for deviations from the specified parameters are revealed, so appropriate actions can be taken to avoid losses and maximize profits. Statistical bodies widely use the annual reports of many enterprises for various statistics and analysis.

Overview

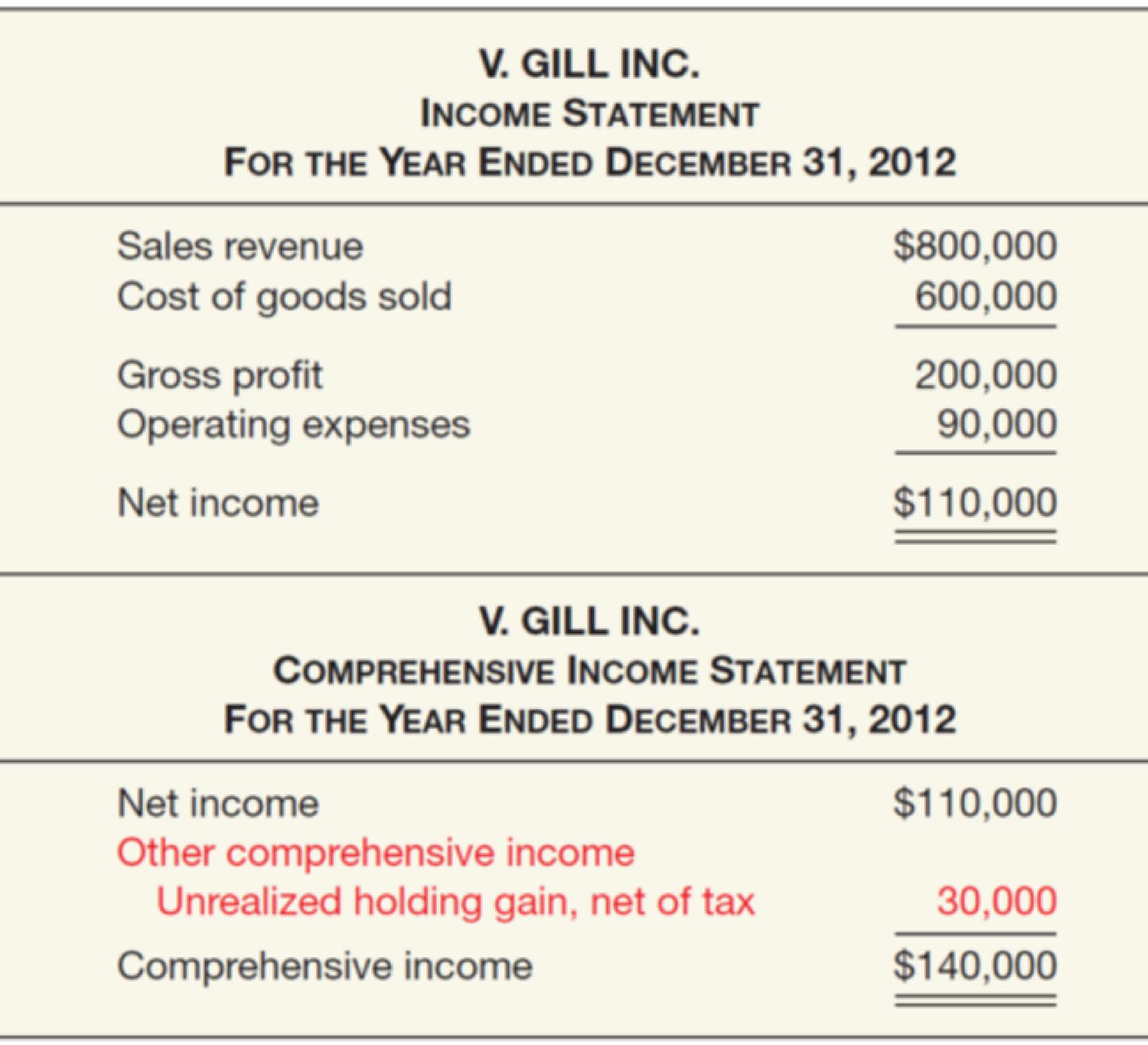

The purpose of financial statements is to summarize accounting data for a certain time and present them in a visual form to interested users. Statement of Comprehensive Income offers a whole picture of the company’s income that the Statement of Operations fails to capture. It reflects the adjustments that have been made to the equity during the reporting period. The exceptions are investments by owners, distributions to owners, and adjustments that are made to the accumulated income due to new accounting policy as well as errors.

In addition to net income or loss, this report presents the other comprehensive income, which is made up of four items:

- Unrecognized gains/losses on pension and post-retirement benefit plans

- Unrealized gains/losses on debt securities

- Adjustments arising due to transactions using foreign currency

- Deferred gains/losses from derivates.

Preparation methods

There are two ways to prepare this report: a single combined statement approach and a two statement approach. With the single statement approach, the company will prepare just one document called the Statement of Income and Comprehensive Income.

What this means is that you will present comprehensive income within the Profit and loss report. First, you will see all the items presented as if you would prepare an Income statement. After the Net income line, you will see the comprehensive income section, which will include all the items, if applicable, mention above. These items are added or subtracted to arrive at the Comprehensive income.

With a second approach, the company presents two financial reports. The company will prepare a usual Statement of operations. However, rather than presenting the information on comprehensive income within the Income statement, a company can create a second report – the Statement of Comprehensive Income. It is prepared by taking the Net Income value from the Income Statement and adding/subtracting items of other comprehensive income. The result of these computations will give the company’s total comprehensive income.