Often referred to as a statement of activity since income statement is more associated with for-profit companies and earnings, the nonprofit income statement follows the formula, revenues minus expenses equals change in net assets. Revenues less expenses is the general equations for earnings in for-profits.

Functional reporting provides a tool used to determine if the nonprofit is using its resources efficiently. One of the main financial statements of a nonprofit organization. This financial statement reports the revenues and expenses and the changes in the amounts of each of the classes of net assets during the period shown in its heading. This statement is issued by a nonprofit instead of the income statement issued by a for-profit business.

What does the statement of activities show?

The statement of activities focuses on the total organization (as opposed to focusing on funds within the organization) and reports the following: Revenues such as contributions, program fees, membership dues, grants, investment income, and amounts released from restrictions.

Popular Study Materials from Public And Nonprofit Administration Pmap 8261

The statement of functional expenses presents an organization’s expenses by both nature and function. The statement of functional expenses is only used by nonprofit organizations based on the importance of monitoring expenditures. Nonprofits do not use the statement of owners’ equity common to for-profits. In general, this statement breaks down organizational expenses into common categories.

The balance sheet details a company’s assets and liabilities at a certain period of time, while the income statement details income and expenses over a period of time (usually one year). In addition to disclosing its expenses, your organization will also be required to disclose the method used for allocating expenses among the functional classifications. This information should be included in the footnotes to the financial statements. It should also include a brief disclosure of the major types of expenses that are allocated among programs and the methodology for the allocation, such as square footage or time reporting.

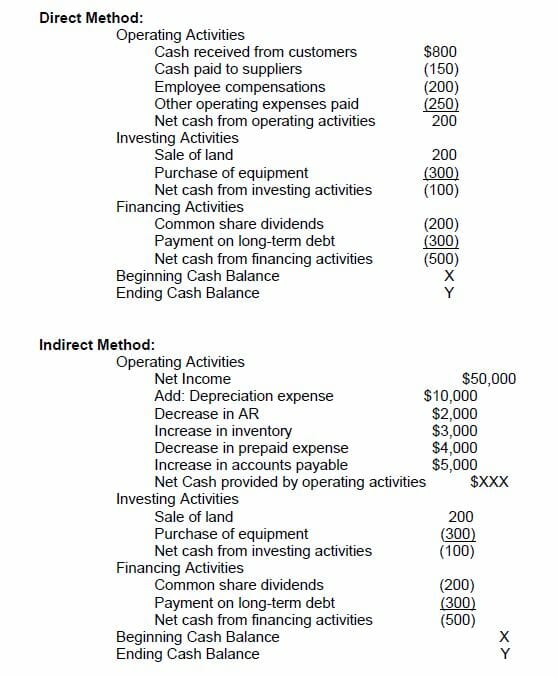

An income statement differs from a cash flow statement, because unlike the latter, the income statement doesn’t show when revenue is collected or when expenses are paid. It does, however, show the projected profitability of the business over the time frame covered by the plan. For a business plan, the income statement should be generated on a monthly basis during the first year, quarterly for the second and annually for the third.

For service businesses, inventory includes supplies or spare parts — nothing for manufacture or resale. Retailers and wholesalers, on the other hand, account for their resale inventory under cost of goods sold, also known as cost of sales. This refers to the total price paid for the products sold during the income statement’s accounting period. Freight and delivery charges are customarily included in this figure. Accountants segregate costs of goods on an operating statement because it provides a measure of gross profit margin when compared with sales, an important yardstick for measuring the firm’s profitability.

These costs include wages, depreciation, and interest expense among others. Cost of goods sold expenses are reported in the gross profit reporting section while the operating expenses are reported in the operations section. Other expenses are reported further down the statement in the other gains and losses section. are both important financial statements that detail the financial accounting of a company.

Income Statement

The balance sheet is often much more detailed than the income statement, as it requires a full inventory of every asset and liability a company has on its books at any given time. The income statement lists revenue and expenses for a given period of time, but at the end of the reporting period, those accounts are zeroed out. The organization will then use that data on an annual basis to allocate costs, such as supplies, telephone, or internet costs. Organizations that are considered voluntary health and welfare organizations are required to present this information in a statement of functional expenses in the financial statements.

- An income statement differs from a cash flow statement, because unlike the latter, the income statement doesn’t show when revenue is collected or when expenses are paid.

- For a business plan, the income statement should be generated on a monthly basis during the first year, quarterly for the second and annually for the third.

The income statement, also called theprofit and loss statement, is a report that shows the income, expenses, and resulting profits or losses of a company during a specific time period. The statement of position is the balance sheet of the non-profit.

Statement of Financial Position

In-kind contributions are recorded in revenue at fair value as of the date of the gift with an offsetting entry to an expense account, which will result in no effect to the change in net assets. Sometimes in-kind contributions may be recorded to an asset, which increases the change in net assets. While the basic information contained in each type of entity’s financial statements is the same, the terminology used is different. A for profit balance sheet shows assets, liabilities and retained earnings.

For a nonprofit, it shows the changes in funds coming into the organization versus costs in operating it. Nonprofits need positive changes in net assets to maintain stability in managing programs. Nonprofits are required to report expenses by functional classification – program, management and general, and fundraising. In addition, health and welfare organizations are required to include a statement of functional expenses as part of their financial statements.

The income statement is a simple and straightforward report on a business’ cash-generating ability. It’s an accounting scorecard on the financial performance of your business that reflects quantity of sales, expenses incurred and net profit. It draws information from various financial categories, including revenue, expenses, capital (in the form of depreciation) and cost of goods.

Not for Profit Accounting

A nonprofit statement of financial position shows assets, liabilities and net assets. A for profit income statement shows revenues less expenses, which equals net income (or loss). A nonprofit statement of activities shows revenues less expenses, which equals the change in net assets.

The idea is the same as the for-profit balance sheet and the reports look very similar. The statement of activities is the income statement version summarized by project, although it could be detailed, as a regular income statement. Instead of profit or loss you will see change in net assets with the net assets types listed. Nonprofit organizations can also receive noncash contributions of goods and services called in-kind that are used in the ordinary course of doing business. In order for the organization to have a true cost of operating the organization, these in-kind contributions need to be recorded by the nonprofit.

What is the statement of activities?

All organizations need to measure their net income, surplus, or excess of revenues over expenses. This allows them to determine whether their asset inflows exceed or fall short of their asset outflows. Public service organizations need to have adequate profits to sustain, update, and expand the services provided. The purpose of the income statement is to provide management with information they need to lead the org.& best accomplish its objectives.