Without it, it’s nearly impossible to produce an accurate record of financial activities that affect everything, from profit to equity to payroll, and more. When it comes to bookkeeping tasks, there’s a great deal to learn. If you have mistakes to fix or transactions to track down, don’t stress.

Businesses can collect payment online from customers through Xero’s integration with Stripe and GoCardless. There are many resources to help you manage bookkeeping for your small business. What was once the domain of specialized professionals can now be carried out by entrepreneurs of all experience levels in any industry. Make sure to tackle your books when your mind is fresh and engaged—say, at the start of the day before you open your doors rather than late at night, after you’ve closed up shop. You want to be at your best when you’re looking at figures that explain your business’s profitability and help you chart a course for progress.

If you decide to hire and manage a bookkeeper you’ll also have to decide whether the position is part-time or requires full time. If you decide to outsource, there are a few ways to go including local bookkeeping services, local CPA firms that offer bookkeeping services and specialized, national outsourced bookkeeping firms. Let’s look into three different options your company could consider to fill this need… Most accounting software offers a range of features that are suited for almost any type of small business. Wave is an ideal accounting software platform for a service-based small business that sends simple invoices and doesn’t need to run payroll.

Staying on top of your bookkeeping is important so that you don’t have unexpected realizations about account balances and expenses. We’ve put together this guide to help you understand the basics of small business bookkeeping. If your business is moving into a growth stage, you need to consider graduating to full accrual based accounting, with financial and management reports that help you scale. Typically you will need this level of financial management not only for yourself but for your key stake holders including banks, investors and advisors.

You no longer need to worry about entering the double-entry data into two accounts. The costs a small business or nonprofit incurs for bookkeeping will depend upon many variables. In addition to these basic bookkeeping activities, your costs will be impacted by how your accounting systems, policies and procedures, and reporting needs are set up and administered. As businesses grow, it becomes easier to let small activities slip. Since good record keeping relies on accurate expense tracking, it’s important to monitor all transactions, keep receipts, and watch business credit card activity.

That means you can start out with basic bookkeeping at a modest cost and ladder up to more advanced services as your business grows. Professional bookkeepers also provide other services, like helping with financial reports (profit-and-loss, balance sheet, cash flow report), and measuring business performance. You should also hold onto the proof of purchase if you plan to claim that expense as a tax deduction.

Of course, it’s always possible to handle bookkeeping internally. If your business chooses to keep this task in-house, it’s best to stick to a predictable expense tracking schedule. Developing a bookkeeping routine prevents you from accidentally forgetting important steps in the accounting process.

Why bookkeeping for small businesses is important

This limited plan may be suitable for a micro-business with high-ticket transactions but only a few per month, such as a consulting or small service provider. The Advanced subscription adds many features including expense management, exclusive premium apps, a dedicated account team, and on-demand training. All plans allow integration with third-party apps such as Stripe or PayPal.

For businesses looking for a payroll solution, QuickBooks Payroll fully integrates with QuickBooks Online. Intuit’s QuickBooks Online has been one of the most common accounting software programs used by small businesses and their bookkeeping and tax professionals. The cloud-based software can be accessed through a web browser or a mobile app. From payroll taxes to managing invoices, efficient bookkeeping smooths out the process of all your business’s financial tasks and keeps you from wasting time tracking down every dollar. Single-entry accounting records all of your transactions once, either as an expense or an income.

Below, we’ll break bookkeeping down to its most basic principles. Along with reading this page to get a quick bookkeeping overview, we always recommend meeting with a CPA (certified public accountant) or bookkeeper before you open your doors. A financial expert can give advice specific to your unique business and give you a more in-depth look at basic bookkeeping principles. Alternatively, in-house or outsourced bookkeepers can update your books for you, typically for a monthly fee. But whether you plan to do bookkeeping yourself or outsource it to an accountant, it pays to understand the basics of bookkeeping.

Bookkeeping 101: Bookkeeping Basics for Small Businesses

Here are our top five picks for the best accounting software for small businesses. Thanks to the ubiquity of apps and services, entrepreneurs are most likely aware of the importance of bookkeeping for their businesses and have several tools already at their fingertips. If two sides of the equations don’t match, you’ll need to go back through the ledger and journal entries to find errors. Post corrected entries in the journal and ledger, then follow the process again until the accounts are balanced. Then you’re ready to close the books and prepare financial reports. Reconciliation involves regularly cross-referencing your business books against your bank statements to check that the transactions and balances match – and identifying the reasons if they don’t.

If a general ledger is like a book, a chart of accounts is like a book’s table of contents—it’s a list of all the accounts your business uses to record transactions. In this metaphor, each account is like a chapter of a book, and individual journal entries are kind of like the pages of each chapter. If you work with a certified public accountant, business lawyer or tax advisor, ask if they have recommendations for a bookkeeper or bookkeeping service. Small businesses also handle aspects of accounts receivable, which ensures your business is paid for its goods or services. This can include estimating the eventual value of a finished project, preparing and sending invoices and providing statements.

- With an accounting system, you need to decide when to record transactions.

- However, as a business grows, its accounting needs may become more complex, and a custom enterprise resource planning (ERP) system is often needed.

- Get the complete breakdown on QuickBooks Online pricing and plans.

- Sure, most accounting software platforms come with some form of support, but it’s generally technical support for troubleshooting software-specific programs.

- Alternatively, in-house or outsourced bookkeepers can update your books for you, typically for a monthly fee.

- As your company grows, you’ll probably want to move towards accrual accounting, but it’s not a necessity when starting a business.

And sometimes it can be produced to include comparisons against the prior year’s same period or the prior year’s year-to-period data. Once you’ve got a handle on how to begin bookkeeping for your small business, it’s time to set yourself up for success with an ongoing bookkeeping system. QuickBooks Online is the best small business accounting software due to its industry popularity and user resources. Beyond the immediate needs of paying vendors and employees or keeping track of expenses, installing and maintaining proper bookkeeping for a small business has innumerable benefits, both short and long-term. Doing your bookkeeping in Excel is a good option if you don’t want to spend extra money on software since you may already have the program installed on your work computers. Plus, there are tons of free Excel templates available, so you don’t have to reinvent the wheel with your business spreadsheets.

Choose your bookkeeping method

These will help you determine where to commit funds in the future and how to create your business plan. They tell you the story of what is really going on in your business. Also called “money out,” an expense is something you pay for, like supplies or rent. Whether you’re just starting a small business or you’ve had one a few years, these easy tips will help you stay organized. Here’s everything you need to produce a reliable financial forecast for your business.

The entry system you choose impacts how you manage your finances and how your bookkeeping processes will work. Small-business bookkeeping requires you to choose between single- or double-entry accounting. With the development of bookkeeping and accounting technology, bookkeeping tasks have become more automated. However, this doesn’t make it any less important to ensure you set everything up properly from the start. You might do bank reconciliation daily, weekly, monthly, or less often, depending on the number of transactions going through your business. However, you will probably be required to reconcile your books before submitting tax returns at the very least.

Outsource specific financial tasks to a tax professional who is experienced in handling business accounts. A separate bank account is the first step in distinguishing between business and personal finances. Bookkeeping becomes more difficult when business transactions are lumped together with personal activity.

With a cash account system, you’ll record transactions anytime cash changes hands. An accrual accounting system records transactions, like sales, immediately, even if money isn’t exchanged until later. As your company grows, you’ll probably want to move towards accrual accounting, but it’s not a necessity when starting a business. Bookkeeping is the process of tracking income and expenses in your business. It lets you know how you’re doing with cash flow and how your business is doing overall.

Additionally, FreshBooks often offers discounts for your first months of membership. The four plans are Lite ($17/monthly or $183.60/yearly), Plus ($30/monthly or $324/yearly), Premium ($55/monthly or $594/yearly), and Select, which is a custom service with custom pricing. Not only do the majority of small business accounting professionals use QuickBooks Online, but there are also endless online training resources and forums to get support when needed. All accounting features can be conveniently accessed on one main dashboard, making bookkeeping more fluid and efficient.

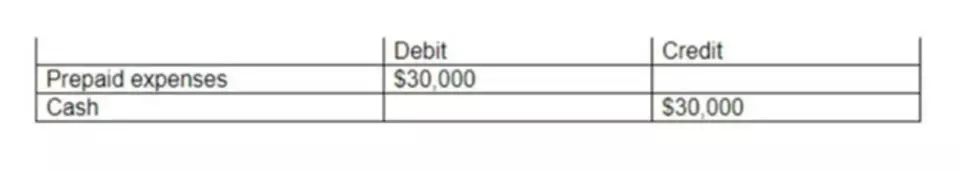

Remember that each transaction is assigned to a specific account that is later posted to the general ledger. Posting debits and credits to the correct accounts makes reporting more accurate. Take a look at the following four steps to manage your bookkeeping. Even with your carefully maintained balance sheet and cash flow reports, it’s hard to predict what will happen in the future.

The accounting method your business uses will have rules about when and how to document revenue and expenses in your own records and in reports to the IRS. It will affect how you track everything from your balance sheets to your cash flow statements. When you keep detailed, organized records of your business transactions, tax season suddenly won’t feel like such a daunting chore. By being proactive with your bookkeeping, you’ll save your small business time when it comes to taxes. Simply turn your financial statements over to your CPA or other tax filings expert, and let them handle the rest.