I will talk about IRR (internal rate of return) in a future blog post. The Rule of 72 is a simple way to determine how long an investment will take to double given a fixed annual rate of interest.

Present Value of $1 Table Creator

You then add the discounted cash flows together and subtract the cost of the initial investment from that sum. The PV function returns the value in today’s dollars of a series of future payments, assuming periodic, constant payments and a constant interest rate.

A stream of cash flows that includes the same amount of cash outflow (or inflow) each period is called an annuity. When each period’s interest rate is the same, an annuity can be valued using the PV function. The presumed rate of return for the reinvestment of intermediate cash flows is the firm’s cost of capital when NPV is used, while it is the internal rate of return under the IRR method. A positive net present value means you may get a return on your investment. It shows you that while you are losing money up front (for the initial investment), the asset is going to generate cash flows in the future that in total are worth more than the initial cost.

Now when we sum the present value of all those cash flows, we get minus $334.59, which tells us that the project destroys value. If we know the initial investment and the stream of money coming in from the project in the future, we can measure the NPV as the difference between the two; its the net between those two streams. We need the ability to calculate whether that stream of future cash flows is worth more than the money we need to invest to buy it or build it. The effective annual interest rate is the real return on an investment, accounting for the effect of compounding over a given period of time. Both present values vs future value are very much important to the investors for taking crucial decisions regarding investment decisions.

Join PRO or PRO Plus and Get Lifetime Access to Our Premium Materials

The Rule of 72 is defined as a shortcut or rule of thumb used to estimate the number of years required to double your money at a given annual rate of return, and vice versa. Because money is worth more today than it is tomorrow, you need to find out how much future projected cash flows are worth in today’s time—or present value. The present value is the part of the net present value formula where projected cash flows for each year are discounted by a certain rate. The i is the discount rate that will be used to find the present value of the future cash flows.

The present value of an annuity is the current value of future payments from that annuity, given a specified rate of return or discount rate. The discount rate is the investment rate of return that is applied to the present value calculation. In other words, the discount rate would be the forgone rate of return if an investor chose to accept an amount in the future versus the same amount today.

Present value (PV) is the current value of a future sum of money or stream of cash flows given a specified rate of return. Present value takes the future value and applies a discount rate or the interest rate that could be earned if invested. Future cash flows are discounted at the discount rate, and the higher the discount rate, the lower the present value of the future cash flows. Determining the appropriate discount rate is the key to properly valuing future cash flows, whether they be earnings or obligations.

One simple approach is to exclude the initial investment from the values argument and instead subtract the amount outside the NPV function. Internal Rate of Return IRR is another financial analysis and decision making tool that compliments NPV. We need to adjust the cash flows for the time value of money by discounting them to the present value. We take that $1,500 and discount it one period at 15% and we get $1,304.35. Then we take the $1,800 and discount it two periods at 15% and we get $1,361.06.

The PMT function can be used to figure out the future payments for a loan, assuming constant payments and a constant interest rate. The Excel IRR function is a financial function that returns the internal rate of return (IRR) for a series of cash flows that occur at regular intervals. The decision rule is whether NPV is bigger than 0 or less than 0. We can construct the formula for NPV by following along very closely with what we did in the prior blog post discounting cash flows. NPV is the gold standard but using it along with IRR makes for even better analysis and decision making.

You can use the NPER function to figure out payments for a loan, given the loan amount, number of periods, and interest rate. The Excel NPV function is a financial function that calculates the net present value (NPV) of an investment using a discount rate and a series of future cash flows. In this formula, the C represents the cash flow for the given time period. The r represents the discount rate, or your desired rate of return. In this formula, you’re discounting each projected cash flow to find the present value.

- You can use the PV function to get the value in today’s dollars of a series of future payments, assuming periodic, constant payments and a constant interest rate.

- The Excel PV function is a financial function that returns the present value of an investment.

How the Time Value of Money Works

Because the PV of 1 table had the factors rounded to three decimal places, the answer ($85.70) differs slightly from the amount calculated using the PV formula ($85.73). The Excel PPMT function can be used to calculate the principal portion of a given loan payment. For example, you can use PPMT to get the principal amount of a payment for the first period, the last period, or any period in between.

The NPV method requires the use of a discount rate, which can be difficult to derive, since management might want to adjust it based on perceived risk levels. The IRR method does not have this difficulty, since the rate of return is simply derived from the underlying cash flows.

Present Value of an Ordinary Annuity Outline

What is the present value of 1?

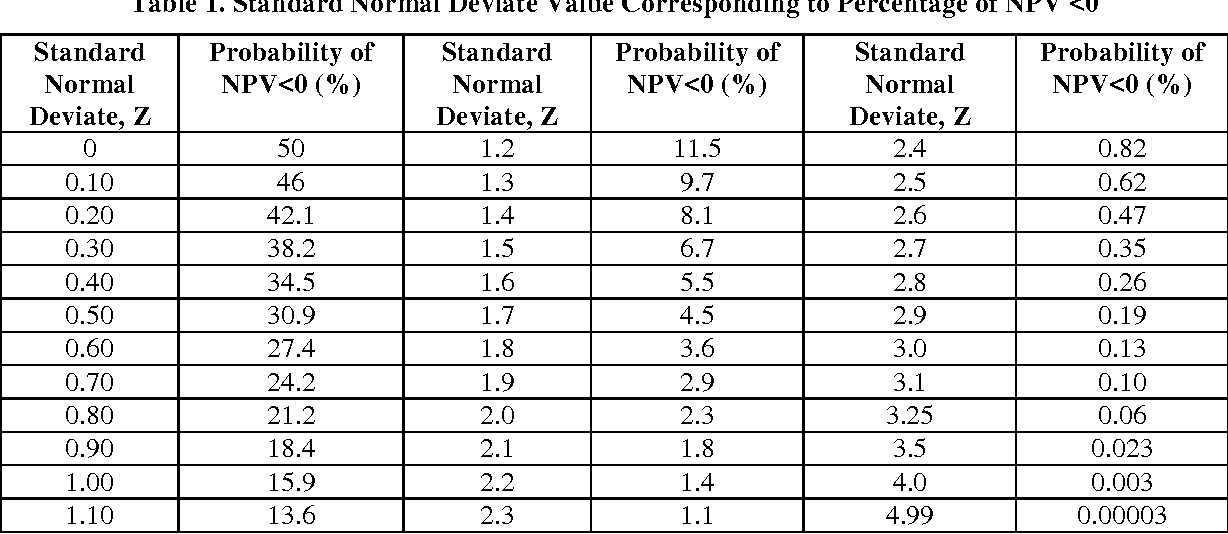

Present value of 1 table. A present value of 1 table states the present value discount rates that are used for various combinations of interest rates and time periods. A discount rate selected from this table is then multiplied by a cash sum to be received at a future date, to arrive at its present value.

The Excel PV function is a financial function that returns the present value of an investment. You can use the PV function to get the value in today’s dollars of a series of future payments, assuming periodic, constant payments and a constant interest rate. NPV calculates the net present value (NPV) of an investment using a discount rate and a series of future cash flows. The discount rate is the rate for one period, assumed to be annual. NPV in Excel is a bit tricky, because of how the function is implemented.

It’s important to remember that there are limitations with the net present value calculation. Since it’s based off of assumptions of projected cash flow, the calculation is only as good as the data you put into it. The present value of annuity formula determines the value of a series of future periodic payments at a given time.

The discount rate can also be thought of as the desired rate of return you could get on your investment. Net present value method is a tool for analyzing profitability of a particular project. The cash flows in the future will be of lesser value than the cash flows of today. This is a very important aspect and is rightly considered under the NPV method. After discounting the cash flows over different periods, the initial investment is deducted from it.

The present value of annuity formula relies on the concept of time value of money, in that one dollar present day is worth more than that same dollar at a future date. Simple interest is usually applied to short-term loans, where a sum of money, called the principal amount, is borrowed. At the end of the loan period, interest is applied to the principal amount, and the loan is paid off by paying back the principal amount borrowed, in addition to the interest incurred.

The discount rate that is chosen for the present value calculation is highly subjective because it’s the expected rate of return you’d receive if you had invested today’s dollars for a period of time. Money not spent today could be expected to lose value in the future by some implied annual rate, which could be inflation or the rate of return if the money was invested. The present value formula discounts the future value to today’s dollars by factoring in the implied annual rate from either inflation or the rate of return that could be achieved if a sum was invested.

By dividing 72 by the annual rate of return, investors obtain a rough estimate of how many years it will take for the initial investment to duplicate itself. In this example, the equipment is expected to generate an additional $17,000 over the next five years. After discounting the projected cash flow, that money is worth about $15,162.76 in present time. This is $9.837.24 less than the $25,000 initial investment—represented by a negative net present value. Because of this, the equipment may not provide a positive return on your investment and you may instead experience a loss.

If the result is a positive NPV then the project is accepted. And if NPV is zero then the organization will stay indifferent.

Although NPV carries the idea of “net”, as in present value of future cash flows less initial cost, NPV is really just present value of uneven cash flows. The Excel FV function is a financial function that returns the future value of an investment. You can use the FV function to get the future value of an investment assuming periodic, constant payments with a constant interest rate. The Excel PMT function is a financial function that returns the periodic payment for a loan.