Now, it’s difficult to say that you know, it’s really one of the most important things in accounting. So, everything that we will be doing further, but always keeps that in mind. Because unfortunately, in accounting there are quite a few mistakes committed. And you know, if you talked with anyone who is professional accounting, when there is an end of period, these people stay in their offices until very late hours, sometimes overnight, because you always have to make ends meet.

You would like to say, “Well, something is not so great about this company.” If that actually happens over a long period of time. You know there are always periods of time when companies lose money when their operations are not producing any income. But that must be limited in time and there must be a clear idea how that would be turned into an income. So, that is in general about these financial statements and we mentioned before these principles and statements and standards and in what follows, we’ll see a few words about these assumptions, principles pronouncements. This information is available only in bits and pieces from the other financial statements.

And now, I would like to pronounce one of the most fundamental issues in accounting. Because if you looked at that, you can see that the left side is always the same as the right side because these are two sides of the same coin. And therefore, you can say the total assets must always be equal to total liabilities plus net worth. This thing is famous and the most important statements, although sounds getting real, that’s called the accounting equation.

Accounting Codes

This is capital stock when you issue that and then, the result of every period is retained earnings. So, this is, this gives you an idea about how balance sheet takes into account these various assets, liabilities and piece of network.

They are your liabilities before you retire these liabilities. Then, various kinds of debt, notes, bonds payable, then some examples of equity.

(27 Credit Hours)

They must be accurate and they have to be, to a significant extent, well, one important, they must be credible. I almost forgot that but this is the key story, and they are standard. Accurate, and credible, and standard, seems to be self-explanatory. If the people use these statements, they expect them to reflect what’s going on in an enterprise. Let’s say this is the company and these are its financial statements.

That one is total liabilities, these are the sources of company financing from all investors other than its owners. This is a net worth or equity, this is what is provided by the owners of the company. This is the assets, this is liabilities and net worth, and some examples.

If it’s difficult to compare, it’s difficult to make sensible decisions. Again, these standards, all of you heard about things like GAAP, Generally Accepted Accounting Principles or International Standards of Accounting or whatever. So we are talking about, there is a whole, very detailed description of how these things must be put together, presented, and what specific requirements are for them. Although, that part in detail clearly goes well beyond the scope of this overall discussion because that deals with details and how exactly you have to proceed rather than why. Having said all that, again, whenever we have a language we keep in mind this notorious Tower of Babel effect and that is why we see fine.

And although, that goes back to the time of the Renaissance, when it was all introduced. But for now, it’s important for us to see that this is the key thing that is always observed when we talk about the balance sheet. Now, comes the next general purpose financial statement, this is the income statement or that is the period statement. So, it talks about,let’s say and here, a quarter or a month and that deals with total revenues and then that’s total expenses, and that gives you net income. So, basically, you set the zero point and this is the endpoint.

But we will see that it’s not so trivial to deal with that and oftentimes, the measurement of income does pose a challenge. And then, finally the third important statement here is the statement of cash flow. And again, it says that total cash inflow less total cash outflow and that equals to net change in cash. And it seems that if we limit ourselves with cash flow only, then we will be all set.

As is the case in the most startup companies to the extent that there is financing from outside investors. Let’s say, we produce these courses and let’s say that everyone watches that for free. Then clearly, we incur some costs and unless there are some people who would like to support us, not only the producers of content but also the platform then unfortunately, that would not be realistic. However, if you look at a company that is being injected a lot of cash all the time but keeps losing that, that may be as an outside investor.

We said the basic of the balance sheet, it’s like a snapshot of the enterprise’s inventory of assets, liabilities, and the equity. We are dealing here about, so this is just a moment judgment. We’re not talking about a certain period of time, this is rather the date or a point. At this moment when light was on, we talked about the balance sheet of the company and the project. Remember again, hi from Corporate Finance, that these black boxes they generate value and generate cash flow.

In this episode, we will talk about the major financial statements. These are the documents that are key in accounting, specifically in financial accounting. And these are the ones that actually help us describe the economic theory of an enterprise in a meaningful way. First of all, these, now we have key financial statements.

- In this episode, we will talk about the major financial statements.

- And these are the ones that actually help us describe the economic theory of an enterprise in a meaningful way.

Accounts receivable is what, lets say, we sold something and then we expect this payment to be made later because we allowed the buyer to use these nice terms. Inventories, this is something what we have for sale. Then comes long term assets like property, plant, and equipment. Then come intangibles like patents or intellectual property rights, and then other.

And this is not because someone purposefully made a mistake, this is because unfortunately, there are some minor things accumulate and they require specific adjustments in treatment at the end of the accounting period. So, please keep this in mind that the accounting equation is one thing that is in the core of that.

I think that all of you, if you’re not even familiar with them in this or that detail, but you heard about that. This is the balance sheet, then this is the income statement, and this is the statement of cash flow. We will say a few words about them just in a few moments. But for now the question is, what are the characteristics of these statements and how they are being prepared? Remember we said that they have to serve the goal of capturing, measuring, and reporting corresponding important and valuable information to the stakeholders.

Remember when we talked about, in our financial courses, in corporate finance and the capital markets, we said that actually, the accuracy of our statements and our conclusions, it crucially depends upon the quality of inputs. We said that most often these inputs are not perfect. Here in accounting, we cannot claim that these numbers, they would be absolutely right and comprehensive. But to the best extent we can would like to have them accurate. If everyone describes their enterprise in a different way, then that becomes very difficult for the people to be able to compare companies and projects against each other.

Although standards sometimes are boring, but if we really abide by these standards, if that reduces misunderstanding, that is valuable. One of the three most important financial statements. Even as early as on the Capital Markets Course and also in Corporate Finance.

indirect method of SCF definition

But historically, they’ve been called financial statements. This is not a case where we mixed up accounting financial issues. This is just a standard stem of the way to call them.

So here we can say that characteristics, if you will. Service oriented means that they serve the goals that we just mentioned.

That’s, let’s say, accounts payable, so this is what we have to pay. Then, other things like salaries payable, for example, because you pay them twice a month, for example, for some period of time.

But when we study these boxes, remember in corporate finance we said about boxes generating cash flow. So, to give you just an idea why they may be so, let’s say your company’s operations, they produce losses.

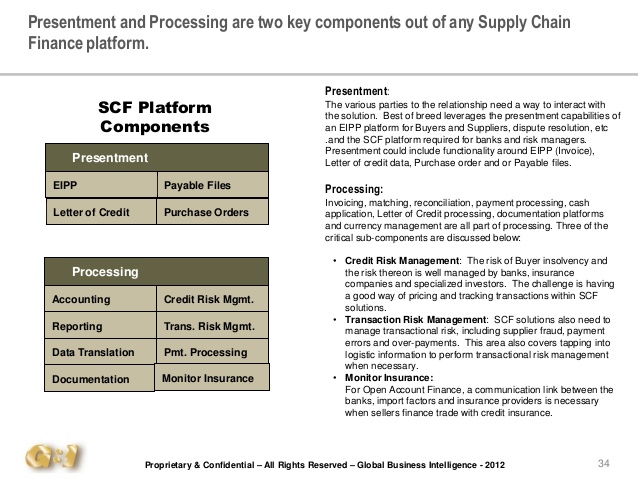

Example of Supply Chain Finance

And then, you study the activity of your enterprise over this period of time, you received some revenues. You incur some costs and hopefully, if your revenues exceed your costs, then you will have made a positive net income. And now, the key challenge here or the key idea is the measurement of true income. Now, by saying true, I don’t mean that someone purposefully hides some information.

Core Concepts of Accounting – Numbers and People

But if the company’s business has nothing to do with these statements, what’s the use of that? They are not only useless but also very detrimental to the understanding and even dangerous because they are misleading. Now, when we talk about accuracy, unfortunately when you talk about accuracy you know that there are many more questions than answers.