This is calculated once the voucher has been matched, posted, and extracted. This is the difference between the amount on the voucher (in terms of the voucher exchange rate to the base currency) less the amount from the PO receipt (in terms of the PO exchange rate). For standard-cost items, two variances can be calculated, purchase price variance (PPV) and exchange rate variance. To calculate variance, start by calculating the mean, or average, of your sample. Then, subtract the mean from each data point, and square the differences.

This is usually done by the Purchasing manager or Purchasing agent. The first step in recording Purchase Price variance is when the material is received. Usually the material is received either at the same time or before the invoice is received. However, the invoice is usually entered by the Accounts payable officer after some time.

In this lesson, learn the differences between population and sample variance. For example, if a group of numbers ranges from 1 to 10, it will have a mean of 5.5. If you square and average the difference between each number and the mean, the result is 82.5.

What is the formula for sales price variance?

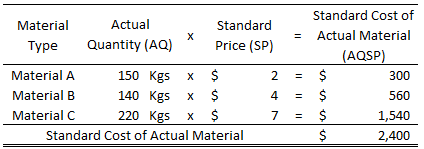

Calculating the Variance To calculate material price variance, subtract the actual price per unit of material from the budgeted price per unit of material and multiply by the actual quantity of direct material used. For example, say that a dress company used 1,000 yards of fabric during the month.

Sales volume variance

It is calculated as the average squared deviation of each number from the mean of a data set. For example, for the numbers 1, 2, and 3 the mean is 2 and the variance is 0.667.

The purchase price variance is the difference between the standard costs for the material and landed cost elements and the corresponding actual costs from the matched, posted, and extracted vouchers. Based on the timing of the voucher processing and the Landed Cost Extract process, the PPV could be computed and posted in one or two parts. If the voucher is not available when you run the Transaction Costing process, then the system calculates the difference between the standard cost and the PO price. We know that variance is a measure of how spread out a data set is.

To figure out the variance, subtract 82.5 from the mean, which is 5.5 and then divide by N, which is the value of numbers, (in this case 10) minus 1. Standard deviation is the square root of the variance so that the standard deviation would be about 3.03. For periodic weighted average items, no variances are computed for material costs, landed costs or exchange rate variances. The exchange rate variance is the change between the exchange rate for material and landed costs on the PO and the exchange rate for material and landed costs on the voucher.

Finally, divide the sum by n minus 1, where n equals the total number of data points in your sample. If all values of a data set are the same, the standard deviation is zero (because each value is equal to the mean). Standard deviation is only used to measure spread or dispersion around the mean of a data set. Generally, the more widely spread the values are, the larger the standard deviation is. For example, imagine that we have to separate two different sets of exam results from a class of 30 students the first exam has marks ranging from 31% to 98%, the other ranges from 82% to 93%.

When cost variances are low, you know you have controlled your risks well. You also know you have retrieved and analyzed data related to operations sufficiently. Ideally, your actual costs should match what you budgeted and your cost variance should be zero, but in practice this is fairly difficult to achieve. Regardless of whether the variance is positive or negative, it means one of two things. The first is that, due to insufficient or inappropriate data or human error, you overestimated or underestimated expenses.

If you took another random sample and made the same calculation, you would get a different result. As it turns out, dividing by n – 1 instead of n gives you a better estimate of variance of the larger population, which is what you’re really interested in. This correction is so common that it is now the accepted definition of a sample’s variance. A standard cost variance can be unusable if the standard baseline is not valid.

If the company bought a smaller quantity of raw materials, they may not have qualified for favorable bulk pricing rates. On a net basis, the purchase price variance is really the difference between standard cost of the material and the actual invoice price of the material.

Following each step, I got the mean of the data set, which is 11. I subtracted each number from 11 and then squared the result.

This is why, in most situations, it is useful to assess the size of the standard deviation relative to the mean of the data set. Standard deviation is also useful when comparing the spread of two separate data sets that have approximately the same mean. The data set with the smaller standard deviation has a narrower spread of measurements around the mean and therefore usually has comparatively fewer high or low values. An item selected at random from a data set whose standard deviation is low has a better chance of being close to the mean than an item from a data set whose standard deviation is higher. Unlike range and quartiles, the variance combines all the values in a data set to produce a measure of spread.

- The purchase price variance is the difference between the standard costs for the material and landed cost elements and the corresponding actual costs from the matched, posted, and extracted vouchers.

To calculate material price variance, subtract the actual price per unit of material from the budgeted price per unit of material and multiply by the actual quantity of direct material used. You will learn the definition or meaning of purchase price variance. You will also learn what is standard costing and the two steps involved in recording purchase price variance journal entries in the system. However, in order for the system to work properly, standard cost for the material purchased needs to be maintained in the system.

The standard deviation is a statistic that measures the dispersion of a dataset relative to its mean and is calculated as the square root of the variance. It is calculated as the square root of variance by determining the variation between each data point relative to the mean. Standard deviation is calculated as the square root of variance by figuring out the variation between each data point relative to the mean. If the points are further from the mean, there is a higher deviation within the date; if they are closer to the mean, there is a lower deviation.

How do you calculate price variance?

Price variance is the difference between the actual price paid by a company to purchase an item and its standard price, multiplied by the number of units purchased.

Given these ranges, the standard deviation would be larger for the results of the first exam. This description is for computing population standard deviation. If sample standard deviation is needed, divide by n – 1 instead of n. Since standard deviation is the square root of the variance, we must first compute the variance.

At the time of recording goods receipt (GR), the purchase price variance is calculated by comparing the standard cost of material with the price entered in the Purchase Order. At the time the invoice is entered in the system, the system has the actual invoice price. So at this time another purchase price variance is recorded by comparing the price in the Purchase Order and the price entered from the vendor invoice. Standard deviation might be difficult to interpret in terms of how big it has to be in order to consider the data widely spread.

Analyzing the Variance

This example illustrates the accounting entries for purchase price variance and exchange rate variance for an average cost item. The inventory business unit’s currency in this example is USD. A long time ago, statisticians just divided by n when calculating the variance of the sample. This gives you the average value of the squared deviation, which is a perfect match for the variance of that sample. But remember, a sample is just an estimate of a larger population.

The variance (symbolized by S2) and standard deviation (the square root of the variance, symbolized by S) are the most commonly used measures of spread. Ruby will need to know how to find the population and sample variance of her data. This is very different from finding the average, or the mean, of a set of numbers. Population and sample variance can help you describe and analyze data beyond the mean of the data set.

What is price variance in cost accounting?

For example, a purchasing manager may negotiate a high standard cost for a key component, which is easy to match. Or, an engineering team assumes too high a production volume when calculating direct labor costs, so that the actual labor cost is much higher than the standard cost. Thus, it is essential to understand how standard costs are derived before relying upon the variances that are calculated from them. Cost variance allows you to monitor the financial progression of whatever it is you are doing in your business.

For step five, I took the total number of numbers from the data set and subtracted one. This compensates for the fact that we don’t have all of the information. Standard deviation is a statistic that looks at how far from the mean a group of numbers is, by using the square root of the variance. The calculation of variance uses squares because it weighs outliers more heavily than data closer to the mean. This calculation also prevents differences above the mean from canceling out those below, which can sometimes result in a variance of zero.

So the more spread out the group of numbers are, the higher the standard deviation. The material price variance calculation tells managers how much money was spent or saved, but it doesn’t tell them why the variance happened. One common reason for unfavorable price variances is a price change from the vendor. Companies typically try to lock in a standard price per unit for raw materials, but sometimes suppliers raise prices due to inflation, a shortage or increasing business costs. If there wasn’t enough supply available of the necessary raw materials, the company purchasing agent may have been forced to buy a more expensive alternative.

Understanding How Options Are Priced

The size of the mean value of the data set depends on the size of the standard deviation. When you are measuring something that is in the millions, having measures that are “close” to the mean value does not have the same meaning as when you are measuring the weight of two individuals.

‘ Remember that a sample is only part of the population and isn’t actually the whole picture. Because of that, statisticians found a way to compensate, by subtracting one from the total number of numbers in the data set. Also, variance will never be a negative number, so if you get one, make sure to double check your work. Variance can only be zero if all of the numbers in the data set are the same.