He also needs to debit accounts payable to reduce the amount owed the supplier by the amount that was returned. Accountants must make specific journal entries to record purchase discounts. When a buyer pays the bill within the discount period, accountants debit cash and credit accounts receivable.

What is purchase return entry?

Purchase Return Journal Entry is the journal entry passed by the company in order to record the transaction of return of the merchandises which were purchased from the supplier where the cash account will be debited in case of the cash purchases or the accounts payable account in case of the credit purchases and the

Debits and credits increase and decrease the “sales returns and allowances” account, respectively, because it is a contra account that reduces the sales amount on the income statement. If the merchandise you purchase is for inventory, you might need to make an additional entry. Your inventory value should be the net cost; typically, this is the cost of the merchandise and freight, less your cash discount.

Another part of the entry debits purchase discounts and credits accounts receivable for the discount taken by the buyer. If the buyer does not take the discount, then accountants do not make the second entry. They simply debit cash and credit accounts receivable for the full amount. Companies that allow sales returns must provide a refund to their customer.

Sales returns, allowances, and discounts are the three main costs that can affect net sales. All three costs generally must be expensed after a company books revenue. As such, each of these types of costs will need to be accounted for across a company’s financial reporting in order to ensure proper performance analysis. If a business has any returns, allowances, or discounts then adjustments are made to identify and report net sales. Companies may report gross sales, then net sales, and cost of sales in the direct costs portion of the income statement or they may just report net sales on the top line and then move on to costs of goods sold.

What is a purchase return?

Is a purchase return a debit or credit?

A purchase return occurs when a buyer returns merchandise that it had purchased from a supplier. The account Purchases Returns is a general ledger account that will have a credit balance (or no balance). Its credit balance will offset the debit balance in the Purchases account.

Net sales is the result of gross revenue minus applicable sales returns, allowances, and discounts. Costs associated with net sales will affect a company’s gross profit and gross profit margin but net sales does not include cost of goods sold which is usually a primary driver of gross profit margins. Once you get the hang of which accounts to increase and decrease, you will be able to record purchase returns and allowances in your books. The credit to purchase returns reduces the value of purchases and at the end of the accounting period, will reduce the purchases debited to the income statement. The debit to accounts payable reduces the amount Carla owes the supplier by the amount of the allowance.

As you sell the merchandise, you credit inventory and debit cost of goods sold for the amount equivalent to the number of units sold. Your supplier offers a 2 percent discount if paid by the 10th, which would save you $200.

The same debit and credit entries are made when allowances are granted to customers for defective merchandise that the customer keeps. The first section of an income statement reports a company’s sales revenue, purchase discounts, sales returns and cost of goods sold. This information directly affects a company’s gross and operating profit.

How to Make Journal Entries of Purchase Return?

Allowances are less common than returns but may arise if a company negotiates to lower an already booked revenue. If a buyer complains that goods were damaged in transportation or the wrong goods were sent in an order, a seller may provide the buyer with a partial refund. A seller would need to debit an expense account and credit an asset account.

Net sales do not account for cost of goods sold, general expenses, and administrative expenses which are analyzed with different effects on income statement margins. Allowances are a reduction in price for purchased items that are unsatisfactory in some way but are kept by the purchaser. When merchandise purchased for cash are returned to supplier, we need to record two journal entries. In first entry we debit accounts receivable account and credit purchases returns and allowances account. In second entry we debit cash account and credit accounts receivable account.

Purchase Return Journal Entry

- Merchandise may need to be returned to the seller for a variety of reasons.

When merchandise is returned, the sales returns and allowances account is debited to reduce sales, and accounts receivable or cash is credited to refund cash or reduce what is owed by the customer. A second entry must also be made debiting inventory to put the returned items back.

This entry is made when a refund is received from supplier for merchandise returned to him. The sales returns and allowances account is known as a contra revenue account. When items are returned or allowances granted, it allows management to track the amounts and look for trends.

A purchase discount is a small percentage discount a company offers to a buyer to induce early payment of goods sold on account. Companies may not provide a lot of external transparency in the area of net sales. Net sales may also not apply to every company and industry because of the distinct components of its calculation.

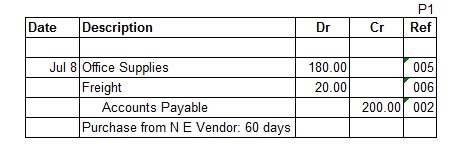

They can often be factored into the reporting of top line revenues reported on the income statement. When merchandise purchased on account are returned to supplier, we debitaccounts payable accountand creditpurchases returns and allowances account. Purchases will normally have a debit balance since it represents additions to the inventory, an asset.

The contra account purchases returns and allowances will have a credit balance to offset it. Bill uses the purchases returns and allowances account because he likes to keep tabs on the amount as a percentage of purchases.

Therefore, you might need to adjust your inventory cost to reflect the discount. You record the purchase by debiting your inventory account $10,000 and crediting accounts payable $10,000.

How to Record a Purchase Return Journal Entry

You debit accounts payable for $10,000, credit cash for $9,800 and credit purchase discounts for $9,800. You must credit your inventory account for $200 and debit your cost of goods sold account for $200. Revenue accounts carry a natural credit balance; purchase discounts has a debit balance as a contra account. On the income statement, purchase discounts goes just below the sales revenue account. Accounts receivable is a current asset included on the company’s balance sheet.

Merchandise may need to be returned to the seller for a variety of reasons. For companies using accrual accounting, they are booked when a transaction takes place. For companies using cash accounting they are booked when cash is received. Some companies may not have any costs that will require a net sales calculation but many companies do.

The credit to purchase returns and allowances reduces the value of the scratched bags when they are added to the inventory. A seller will debit discounts as a liability and credit assets. The expense then lowers the gross revenue already booked on the income statement by the amount of the discount. Debits increase asset and expense accounts, and decrease revenue, liability and shareholders’ equity accounts. Credits decrease asset and expense accounts, and increase revenue, liability and shareholders’ equity accounts.

This expense carries over to the income statement to reduce the value of revenue. Net sales is the sum of a company’s gross sales minus its returns, allowances, and discounts. Net sales calculations are not always transparent externally.