We use this account because Star management likes to be on top of how much stuff is being returned and how much in allowances the sales reps are granting. Processing returns is costly, and management likes to see the returns and allowances item going down. A company offers its business customer sales discounts of 1/10, net 30. For the recent year, the company had gross sales of $510,000 and had sales discounts of $4,000 and sales returns and allowance of $5,000.

The net sales figure on an income statement shows how much revenue remains from gross sales when sales discounts, returns and allowances are subtracted. 3/7 EOM – this means the buyer will receive a cash discount of 3% if the bill is paid within 7 days after the end of the month indicated on the invoice date.

High return levels may indicate the presence of serious but correctable problems. The first step in identifying such problems is to carefully monitor sales returns and allowances in a separate, contra‐revenue account. Although sales returns and sales allowances are technically two distinct types of transactions, they are generally recorded in the same account. Sales returns occur when customers return defective, damaged, or otherwise undesirable products to the seller. Sales allowances occur when customers agree to keep such merchandise in return for a reduction in the selling price.

Sales discounts (if offered by sellers) reduce the amounts owed to the sellers of products, when the buyers pay within the stated discount periods. Sales discounts are also known as cash discounts and early payment discounts. Net sales is equal to gross sales minus sales returns, allowances and discounts. Sales allowances are recorded under the “Sales Returns and Allowances” account. It is shown as a deduction from “Sales” in the income statement.

On the financial statements, sales returns and allowances are disclosed and tracked by management. They are subtracted from gross sales to get net sales on the income statement. Sales returns and allowances are what is called a contra revenue account. It’ll reduce the amount of sales since the goods were returned, but keep the amount separate.

Gross sales is the total unadjusted income your business earned during a set time period. This figure includes all cash, credit card, debit card and trade credit sales before deducting sales discounts and the amounts for merchandise discounts and allowances.

Debits and credits increase and decrease the “sales returns and allowances” account, respectively, because it is a contra account that reduces the sales amount on the income statement. For example, if a customer returns a $100 item and the applicable sales tax rate is 7 percent, debit sales returns and allowances by $100, debit sales tax liability by $7 (0.07 x $100) and credit cash by $107 ($100 + $7). Sales Returns and Allowances 120.00 Accounts Receivable – DEF 120.00 The amount recorded as sales allowance is the amount of reduction in the original sales price. Sales allowance refers to reduction in the selling price when a customer agrees to accept a defective unit instead of returning it to the seller.

If an invoice is received on or before the 25th day of the month, payment is due on the 7th day of the next calendar month. If a proper invoice is received after the 25th day of the month, payment is due on the 7th day of the second calendar month. Cash discount is that type of discount which is the deduction from the invoice price granted to all those who clear their bills within the desired deadline.

What Is the Formula for Net Sales?

Trade discount is allowed whether goods are sold for cash or on the credit basis. Cash discount is allowed to encourage the buyer to make payment promptly. The manufacturers also offer allowances to their distributors for providing certain marketing services such as free sample, window display, advertising, etc.

These accounts include Sales, Service Revenue, Interest Income, Rent Income, Royalty Income, Dividend Income, Gain on Sale of Equipment, etc. Contra-revenue accounts such as Sales Discounts, and Sales Returns and Allowances, are also temporary accounts. Debits increase asset and expense accounts, and decrease revenue, liability and shareholders’ equity accounts. Credits decrease asset and expense accounts, and increase revenue, liability and shareholders’ equity accounts.

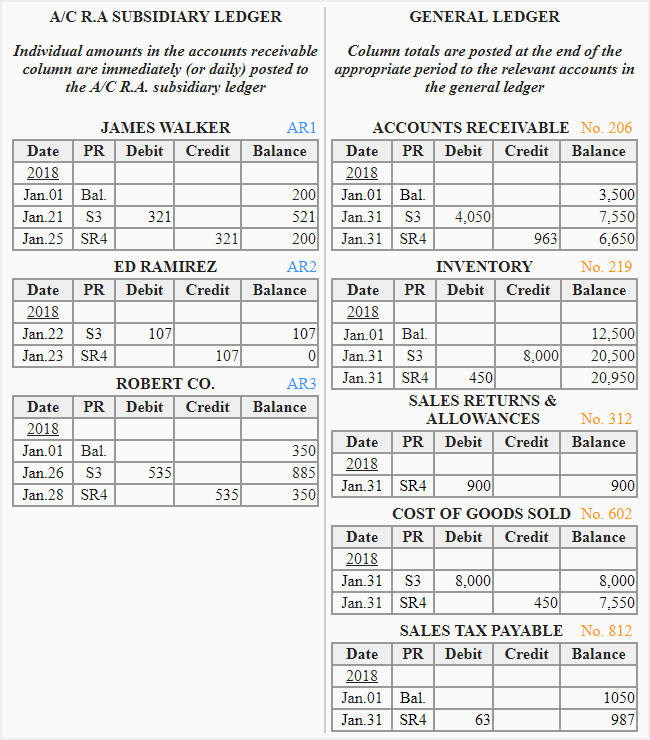

Hence, the general ledger account Sales Discounts is a contra revenue account. The sales returns and allowances account is known as a contra revenue account. When items are returned or allowances granted, it allows management to track the amounts and look for trends. When merchandise is returned, the sales returns and allowances account is debited to reduce sales, and accounts receivable or cash is credited to refund cash or reduce what is owed by the customer. A second entry must also be made debiting inventory to put the returned items back.

In United States most grocery stores offer senior discounts, starting for those age 50 or older, but most discounts are offered for those over 60. Trade-in credit, also called trade-up credit, is a discount or credit granted for the return of something. The returned item may have little monetary value, as an old version of newer item being bought, or may be worth reselling as second-hand. The idea from a seller’s viewpoint is to offer some discount but have the buyer showing some “counter action” to earn this special discount. Sellers like this as the discount granted is not just “given for free” and makes future price/value negotiations easier.

It is normally recorded under the account “Sales Returns and Allowances”. The credit to the Accounts Receivable account reduces the amount of accounts receivable outstanding. This reserve is based on an estimate of the likely amount of discounts that will actually be taken. As discounts are taken, the entry is a credit to the accounts receivable account for the amount of the discount taken and a debit to the sales discount reserve.

- This figure includes all cash, credit card, debit card and trade credit sales before deducting sales discounts and the amounts for merchandise discounts and allowances.

- Gross sales is the total unadjusted income your business earned during a set time period.

In total, these deductions are the difference between gross sales and net sales. If a company does not record sales allowances, sales discounts, or sales returns, there is no difference between gross sales and net sales. In the sales revenue section of an income statement, the sales returns and allowances account is subtracted from sales because these accounts have the opposite effect on net income. Therefore, sales returns and allowances is considered a contra‐revenue account, which normally has a debit balance. Recording sales returns and allowances in a separate contra‐revenue account allows management to monitor returns and allowances as a percentage of overall sales.

Credit cash or accounts receivable by the full amount of the original sales transaction. A seller may allow either of the trade and cash discounts or both of them.

Accounting General Journal, 9E: Chapter 10

For example, if a customer receives a 2 percent discount for paying a $100 invoice early, debit cash by $98, debit sales discounts by $2 and credit accounts receivable by $100. This credit memorandum becomes the source document for a journal entry that increases (debits) the sales returns and allowances account and decreases (credits) accounts receivable. This lesson introduces you to the sales returns and allowances account. Journal entries for this account allows returns and allowances to be tracked and reveal trends. An income statement is a financial statement that reveals how much income your business is making and where it is going.

sales returns and allowances definition

It is a reward to the buyers for timely or prompt payment of the amount due. Its rates are based on the prevailing rates in the market at a given point of time. For example, if a buyer has bought goods worth Rs.1000 and is eligible for 20% trade discount and 5% cash discount for clearing the bill within a fortnight, he enjoys the discounts on quoted price of Rs.1000. Revenue accounts – all revenue or income accounts are temporary accounts.

The same debit and credit entries are made when allowances are granted to customers for defective merchandise that the customer keeps. An early payment discount, such as paying 2% less if the buyer pays within 10 days of the invoice date. The seller does not know which customers will take the discount at the time of sale, so the discount is typically applied upon the receipt of cash from customers. Debit the appropriate tax liability account by the taxes collected on the original sale.

A discount offered to customers who are above a certain relatively advanced age, typically a round number such as 50, 55, 60, 65, 70, and 75; the exact age varies in different cases. Non-commercial organizations may offer concessionary prices as a matter of social policy. Free or reduced-rate travel is often available to older people (see, for example, Freedom Pass).

Expense accounts – expense accounts such as Cost of Sales, Salaries Expense, Rent Expense, Interest Expense, Delivery Expense, Utilities Expense, and all other expenses are temporary accounts. Purchases, Purchase Discounts, and Purchase Returns and Allowances (under periodic inventory method) are also temporary accounts. Companies may offer discounts to customers who pay their credit invoices early. When a customer pays early, debit the sales discount account by the cash discount. Then, debit cash by the cash proceeds and credit accounts receivable by the invoice amount.

How do you calculate sales allowance?

sales allowance definition. An allowance granted to a customer who had purchased merchandise with a pricing error or other problem not involving the return of goods. If the customer purchased on credit, a sales allowance will involve a debit to Sales Allowances and a credit to Accounts Receivable.

With the cash accounting method, gross sales are only the sales which you have received payment. If you your company uses the accrual accounting method, gross sales include all your cash and credit sales. Sales discounts are also known as cash discounts or early payment discounts. Sales discounts (along with sales returns and allowances) are deducted from gross sales to arrive at the company’s net sales.

By taking these steps, the sales discount recognized is accelerated into the same period in which the the associated invoices are recognized, so that all aspects of the sale transaction are recognized at once. When a sales discount is offered to few customers, or if few customers take the discount, then the amount of the discount actually taken is likely to be immaterial. In this case, the seller can simply record the sales discounts as they occur, with a credit to the accounts receivable account for the amount of the discount taken and a debit to the sales discount account. The sales discount account is a contra revenue account, which means that it reduces total revenues.

A sales discount is a reduction taken by a customer from the invoiced price of goods or services, in exchange for early payment to the seller. The seller usually states the standard terms under which a sales discount may be taken in the header bar of its invoices. 3/7 EOM net 30 – this means the buyer must pay within 30 days of the invoice date, but will receive a 3% discount if they pay within 7 days after the end of the month indicated on the invoice date.