EXPLAINER: When to require Sales Invoice and Official Receipt as proof of payment?

Also, benefits are typically lower for part-time employees. Pro-rata salaries are calculated according to what percentage of a full-time job your hours make up if you work part time [ie less than full-time hours]. For example, if you work two days a week and a full-time person in your position gets £18,000. Term-time workers should receive at least the statutory minimum entitlement of 5.6 weeks paid annual leave a year. Suppose that an employee is expected to work 20 hours each week and is paid a salary.

Is rata a word?

A RATA or Relative Accuracy Test Audit compares data from a facility Continuous Emissions Monitor (CEM) system to independent Reference Method data.

In this situation, you must calculate an hourly rate in the event the employee occasionally works overtime. Pro rata salaries are paid to salaried workers who work less than 40 hours a week or who work only part of the year. For example, a retailer may need some additional salaried workers and also may need hourly workers to meet seasonal demand during the holidays.

Calculation of return premium of a cancelled insurance policy is often done using a cancellation method called pro rata. First a return premium factor is calculated by taking the number of days remaining in the policy period divided by the number of total days of the policy. This factor is then multiplied by the policy premium to arrive at the return premium.

Based on nationwide figures, this reward would have been better than what most top-performing employees would receive. Holiday pay is included in your daily rate of pay calculated as annual salary over 195 working days. For term-time workers with irregular hours, you can still pay holiday pay in instalments over the year (for example, monthly or at the end of each term) ensuring that it amounts to at least 5.6 weeks’ pay. In this situation, the most accurate approach is to calculate the average weekly working time over an appropriate period of weeks. If an employee works days of varying lengths, holiday entitlement should be calculated in hours, otherwise an employee might take all their holiday on days when they work longer hours.

Accrued interest is the total interest that has accumulated on a bond since its last coupon payment. When the bondholder sells the bond before the next coupon date, he or she is still entitled to the interest that accrues up until the time the bond is sold.

If an employee has not yet worked at a company long enough for a year of pay data to be available, the reference period will be the number of weeks that they have worked for the company so far. In this scenario, we’ll need to work out how much an employee earned over the previous 12 week period in order to work out an average rate of pay. If your full-time employees are entitled to more than the statutory minimum, you must ensure that your part-time employees receive a pro-rata equivalent of that amount.

What is a rata?

1 : a tree of the genus Metrosideros especially : either of two New Zealand timber trees (M. robusta and M. lucida) 2 : the hard dark red wood of a rata tree used by the Maoris for paddles and war clubs.

To get the hourly equivalent rate for the job, divide $40,000 by 2,080 hours (2,080 equals 40 hours per week times 52 weeks in a year). Take a woman with an annual salary of $80,000 and a modest 1% salary increase. That means her base pay only inched up $800—not enough to keep up with inflation. But if that employee also took home a bonus of $4,000, her total compensation would jump 6% (1% base-pay increase plus 5% bonus).

To calculate the pro rata salary, first find the amount of the annual salary used as a basis. Suppose the annual full time salary is $39,000 per year. Divide the hours to be worked of 20 by the standard 40 hours of a full time worker to find the percentage of full time the employee works. When it comes to bonds, payment on accrued interest is calculated on a pro rata basis.

How to Calculate a Pro Rata Share

For salaried employees working fixed hours, calculating holiday pay is fairly straight forward. They simply receive their usual pay each month, regardless of whether they’ve taken some days off that month as holiday. Pro-rata holiday entitlement is an amount of holiday that’s in proportion to the holiday entitlement of a full-time employee. During a pay period, Alex takes 15 unpaid hours off from work for personal reasons.

A renter of a rental property may pay his/her pro rata share of a monthly rate if the rental ends before the month expires. A worker’s part-time work, overtime pay, and vacation time are typically calculated on a pro rata basis. If you offer paid time off (PTO) to employees, do not prorate their salary when they use their time off. But, there are a number of reasons to calculate a prorated paycheck. Hiring salaried employees can eliminate some of the guesswork out of wage calculations.

Typically, an employee earning a salary receives the same amount each pay period. But, what happens when an employee uses an unpaid day of work? In these situations, you must know how to prorate salary. To do this, divide the pro rata salary by 52 for a weekly amount of $375. Divide by the 20 hours the employee is expected to work for an hourly rate of $18.75.

- Some salaried employees are exempt from the provisions of the Fair Labor Standards Act, whereas others are not.

- A salaried employee is someone who is paid based on an annual amount, rather than by an hourly rate.

The minimum holiday entitlement for full-time workers is 28 days. This may or may not include bank holidays, but bank holidays do not have to be given as additional to the 28 days. A salaried employee is exempt from FSLA overtime rules if he is paid at least $23,600 per year and if his job meets certain requirements. Part-time salaries are typically based on full-time salaries divided by the number of hours worked. Some companies pay part-time employees a discounted rate, that is, less than the equivalent full-time salary.

A prorated salary is when you divide an employee’s wages proportionally to what they actually worked. Multiply 50 percent by $39,000 to find the pro rata annual salary, which is $19,500. This is less than the minimum for an exempt employee, so she is automatically nonexempt.

Pro rata definition

A salaried employee is someone who is paid based on an annual amount, rather than by an hourly rate. Their salaries are still based on an annual full-time salary, but the amount they receive is a proportion of the full-time pay, called a pro rata salary. Some salaried employees are exempt from the provisions of the Fair Labor Standards Act, whereas others are not. Their exempt or nonexempt status affects how you calculate pro rata pay. To calculate a pro rata salary, you must know the annual salary that it’s based on, that is, the hours per week the employee works and how many weeks per year the employee will work.

More specifically, the IRS defines a full-time employee as anyone who averages 30 hours per week, or 130 hours per month. This means they’ll be entitled to ¾ of the full-time annual holiday entitlement.

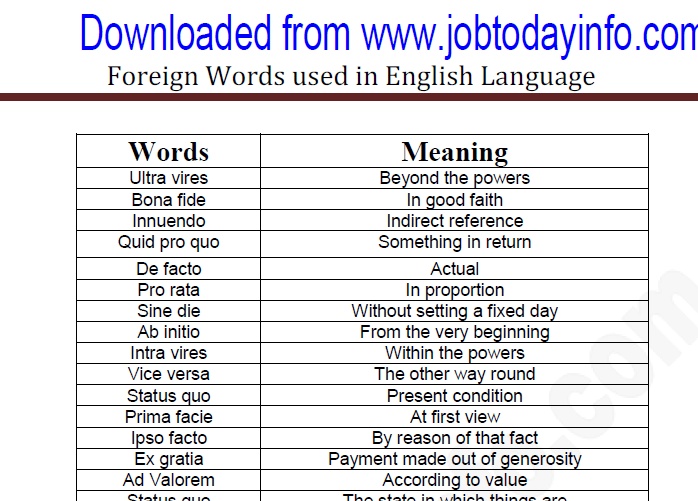

The bond buyer, not the issuer, is responsible for paying the bond seller the accrued interest, which is added to the market price. If you offer the statutory minimum paid holiday, another easy way to calculate how much paid holiday part-time workers are entitled to is to multiply the number of days worked per week by 5.6. Pro rata is a Latin term meaning “in proportion,” referring to a share to be received or an amount to be paid based on the fractional portion of value, such as ownership, responsibility or time used.

What Is Pro Rata?

A customer prepays for services not yet provided in the amount of $1,000, and then cancels service 10 days into the 30-day service period. The seller calculates the amount it has earned as 10 service days divided by the 30-day service period, or $300, and returns the remaining $700 to the customer. This is a pro rata distribution based on the passage of time. Your week’s pay will be the average number of hours you work at an average pay rate over a 12-week period.

Describing a distribution according to some proportion. For example, a salary may be stated as $120,000 per year pro rata. This means that if an employee only works for six months, his/her salary will be $60,000. Likewise, dividends are distributed pro rata, meaning that shareholders receive them according to the proportion of shares that they own.

Nonexempt employees are entitled to overtime pay for the hours worked in a week. This is unlikely to occur with a part-time employee, but it is a real possibility for seasonal salaried workers and must be factored in. A part-time worker will get a pro rata of a full-time worker’s holiday entitlement.

Understanding Bond Prices and Yields

Work out the average hourly rate by dividing the total amount you earned in 12-week period by the number of hours you worked. Full-time typically ranges between 32 and 40 hours per week, but is ultimately up to your employer. If you work within this range, you should be eligible for the company’s full-time benefits.

If the employee does work more than 40 hours in a week, she must be paid at an overtime rate of 1.5 times the regular hourly rate for all hours worked over 40. For instance, let’s assume a job pays a salary of $40,000 (based on a 40-hour workweek – all Salary.com salaries are based on a 40-hour workweek).

Prorating an employee’s salary only applies to salaried workers. Instead, hourly workers earn wages for the hours they work during a pay period, which can fluctuate. Because you pay hourly workers for the hours they work, you don’t need to do any additional calculations. When an employee doesn’t work their full hours, they earn less than their predetermined wages.

As this calculation will often result in a fraction of a shift, it may be easier to calculate the holiday entitlement in hours. Here, each shift is 12 hours, and so the annual holiday entitlement would be 235.2 hours (19.6 shifts x 12 hours).