The stockholders’ equity subtotal is located in the bottom half of the balance sheet. Book value measures the value of one share of common stock based on amounts used in financial reporting.

An investor could conclude that TechCo’s management is above average at using the company’s assets to create profits. Relatively high or low ROE ratios will vary significantly from one industry group or sector to another.

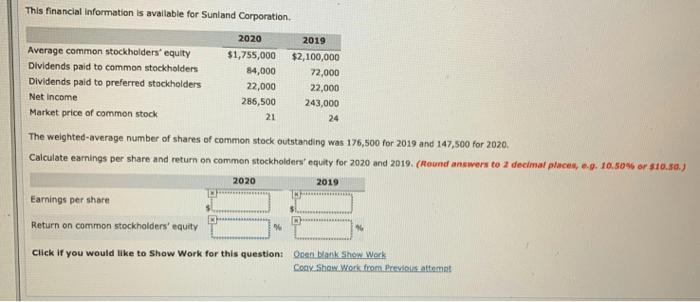

It equals net income minus preferred dividends divided by average common stockholders’ equity. Assume net income of $50,000, preferred dividends of $10,000, and average common stockholders’ equity of $200,000. When the balance sheet is not available, the shareholder’s equity can be calculated by summarizing the total amount of all assets and subtract the total amount of all liabilities. The shareholders’ equity is the remaining amount of assets available to shareholders after the debts and other liabilities have been paid.

A common scenario is when a company borrows large amounts of debt to buy back its own stock. This can inflate earnings per share (EPS), but it does not affect actual performance or growth rates. Continuing with our example from above, the dividend growth rate can be estimated by multiplying ROE by the payout ratio. The payout ratio is the percentage of net income that is returned to common shareholders through dividends. This formula gives us a sustainable dividend growth rate, which favors company A.

Share capital is capital invested in the business by shareholders who bought either common or preferred shares, while retained earnings are the business’s accumulated profits that were reinvested in its operations. Share buybacks are, as their names suggest, shares that were bought back by the corporation. One of the most important profitability metrics for investors is a company’s return on equity (ROE).

Using average shareholder equity makes particular sense if a company’s shareholder equity changed from one period to another. That number can change because of retained earnings, new capital issues, share buybacks, or even dividends.

BUSINESS IDEAS

Shareholders’ equity represents the net worth of a company, which is the dollar amount that would be returned to shareholders if a company’s total assets were liquidated, and all of its debts were repaid. Typically listed on a company’s balance sheet, this financialmetricis commonly used by analysts to determine a company’s overall fiscal health. Shareholders’ equity is also used to determine the value of ratios, such as the debt-to-equity ratio (D/E), return on equity (ROE), and thebook value of equity per share (BVPS). Shareholders’ equity is the residual value of a company’s assets if the company were to pay off its debts, and represents its shareholders’ total stake in the company.

To determine the approximate level of shareholders’ equity the company held throughout an accounting period, you must calculate its average shareholders’ equity between two periods. A higher average shareholders’ equity is typically better for shareholders. Return on equity (ROE) is a measure of financial performance calculated by dividing net income by shareholders’ equity. Because shareholders’ equity is equal to a company’s assets minus its debt, ROE is considered the return on net assets.

All that is required is to restate all prior calculations of EPS using the increased number of shares. For example, assume a company reported EPS for the year as $1.20 (or $120,000/100,000 shares) and earned $120,000 of net income during the year. The only change in common stock was a two-for-one stock split on December 1, which doubled the shares outstanding to 200,000. To compute the weighted-average number of common shares outstanding, we weight the change in the number of common shares by the portion of the year that those shares were outstanding.

ROE is considered a measure of how effectively management is using a company’s assets to create profits. Preferred stock, common stock, additional paid‐in‐capital, retained earnings, and treasury stock are all reported on the balance sheet in the stockholders’ equity section. Information regarding the par value, authorized shares, issued shares, and outstanding shares must be disclosed for each type of stock. If a company has preferred stock, it is listed first in the stockholders’ equity section due to its preference in dividends and during liquidation. Net income over the last full fiscal year, or trailing 12 months, is found on the income statement—a sum of financial activity over that period.

A company reports shareholders’ equity on its balance sheet, which is one of its financial statements. The balance sheet shows a company’s financial position only at a single point in time at the end an accounting period.

BUSINESS OPERATIONS

- Shareholders’ equity represents the net worth of a company, which is the dollar amount that would be returned to shareholders if a company’s total assets were liquidated, and all of its debts were repaid.

However, calculating a single company’s return on equity rarely tells you much about the comparative value of the stock, since the average ROE fluctuates significantly between industries. Stockholders’ equity can be calculated by subtracting the total liabilities of a business from total assets or as the sum of share capital and retained earnings minus treasury shares. The return on common stockholders’ equity ratio is also a useful way to measure the historical financial performance of an individual business, over a period of time. Average shareholder equity is a common baseline for measuring a company’s returns over time.

The return on stockholders’ equity, or return on equity, is a corporation’s net income after income taxes divided byaverage amount of stockholders’ equity during the period of the net income. ratio indicating the earnings on the common stockholders’ investment.

To do this calculation, you will need a company’s financial statements for at least two periods, like two consecutive quarterly or annual reports. You will find shareholder equity listed on the balance sheet in the “Liabilities and Equity” section of the financial statements. Net income minus preferred dividends, divided by average common stockholders’ equity. Shareholder equity is equal to total assets minus total liabilities. Shareholder equity is a product of accounting that represents the assets created by the retained earnings of the business and the paid-in capital of the owners.

If the business can use borrowed funds to generate income in excess of the net after-tax cost of the interest on such funds, a lower percentage of stockholders’ equity may be desirable. By following the formula, the return XYZ’s management earned on shareholder equity was 10.47%.

Return on equity reveals how much after-tax income a company earned in comparison to the total amount of shareholder equity found on the balance sheet. In terms of assessing management’s use of equity capital, analysts and investors should exercise caution in using the ROCE ratio. It is important to note that, just like ROE, ROCE can easily be overstated. Suppose that a company chooses to pursue an NPV-positive opportunity and funds the project with debt capital. The project pays off and the company sees its net income figure rise.

Shareholders’ equity may be calculated by subtracting itstotal liabilities from its total assets–both of which are itemized on a company’s balance sheet. Shareholders’ equity may be calculated by subtracting its total liabilities from its total assets, both of which are itemized on a company’s balance sheet. Such shares do not increase the capital invested in the business and, therefore, do not affect income.

When used to evaluate one company to another similar company, the comparison will be more meaningful. A common shortcut for investors is to consider a return on equity near the long-term average of the S&P 500 (14%) as an acceptable ratio and anything less than 10% as poor.

Shares are outstanding only during those periods that the related capital investment is available to produce income. We should point out, however, that too low a percentage of stockholders’ equity (too much debt) has its dangers. Financial leverage magnifies losses per share as well as Earnings Per Share (EPS) since there are fewer shares of stock over which to spread the losses.

In this scenario, ROCE would increase by a fair margin since the amount of outstanding common equity has not changed, but net income has increased. However, the rise in net income was not due to management’s effective use of equity capital. Return on Equity (ROE) is a measure of a company’s profitability that takes a company’s annual return (net income) divided by the value of its total shareholders’ equity (i.e. 12%).

The Average Common Stockholders Equity

To calculate book value, divide total common stockholders’ equity by the average number of common shares outstanding. The return on average equity is a financial ratio that measures the profitability of a company in relation to the average shareholders’ equity. This financial metric is expressed in the form of a percentage which is equal to net income after tax divided by the average shareholders’ equity for a specific period of time. If you were to calculate their return on equity for the period using just the second quarter’s $1.5 million number, ROE would appear lower than the company’s actual performance. If a company has been borrowing aggressively, it can increase ROE because equity is equal to assets minus debt.

ROE combines the income statement and the balance sheet as the net income or profit is compared to the shareholders’ equity. Share capital is the amount of funds poured into business by various shareholders, including preferred and common shares. Retained income is the accumulated profits of the company that it reinvested in carrying forward its business. A good rule of thumb is to target an ROE that is equal to or just above the average for the peer group. For example, assume a company, TechCo, has maintained a steady ROE of 18% over the last few years compared to the average of its peers, which was 15%.

MANAGE YOUR BUSINESS

Shareholders’ equity comes from the balance sheet—a running balance of a company’s entire history of changes in assets and liabilities. Shareholders’ equity is equal to assets minus liabilities or share capital plus retained earnings minus share buybacks.

As a result, the company may be forced into liquidation, and the stockholders could lose their entire investments. From a creditor’s point of view, a high proportion of stockholders’ equity is desirable. A high equity ratio indicates the existence of a large protective buffer for creditors in the event a company suffers a loss. However, from an owner’s point of view, a high proportion of stockholders’ equity may or may not be desirable.