Overview

Every business owner and investor place their money into the business to receive a return on their investment. If the money is used successfully, a company makes a profit. Net income is what is left from the profit after all the costs and taxes are paid. These funds remain at the disposal of the business owners. When the company receives a net income (loss), it is reflected in the corresponding line in the Statement of financial results as well as the Balance sheet.

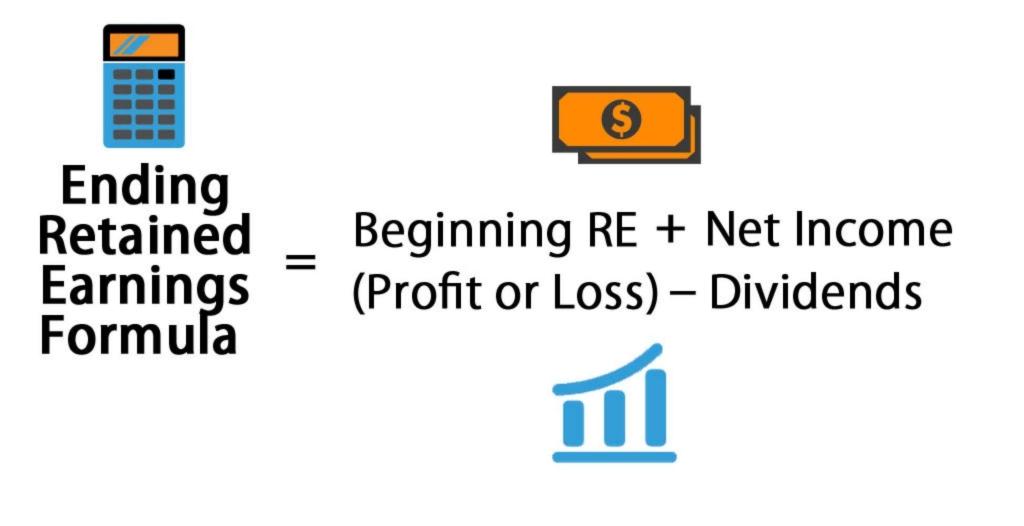

Retained earnings (RE) is a monetary indicator of income that remains with a firm (company, enterprise, organization) after all obligations, including tax liabilities to the government, have been paid and after the distribution of dividends among the shareholders. Retained profit (loss) consists of the retained earnings for the current and previous years, so it is often referred to as accumulated profits. Thus, the formula for Retained Earnings at the end of a given year can be represented as:

Only the owners of the company can dispose of this profit. This happens at the general meeting of shareholders, in accordance with the provisions stipulated in the constituent documents. Actions on the disposal of profits are recorded in the minutes of the general meeting and this serves as the basis for the accountant to form transactions for the use of profits.

If the company is closed (liquidated), then the amount of accumulated profit will be distributed among business owners (shareholders), therefore they are primarily interested in the positive value of this indicator. Unfortunately, Retained Earnings can reflect not only profit but also the Accumulated Deficit. This is when expenses exceed revenues. It is reflected on the Balance Sheet in parentheses.

Accounting for RE

When all the financial statements are prepared at the end of the period, a journal entry is made to move the amount on the RE account to the RE. Retained Earnings on the Balance Sheet are reflected in the Shareholder’s Equity section. It is shown on an accrual basis since the entity was first formed.

There are three main accounts that affect the RE account. When a company posts Net Income, this account is going to go up. When it posts Net Loss or declared dividends, it is going to go down.

How to Use the RE

The right to decide how to spend the Retained Earnings belongs exclusively to the owners (shareholders) of the enterprise. Only they can decide what to do with that income. They may also decide not to distribute profits.

- One of the options for using Retained Earnings may be the payment of dividends. But again, participants of the meeting decide what part of the profit to direct towards the payment of dividends, or to refuse such payment altogether.

- Another option could be to create a capital reserve. In this case, it should be kept in mind that the company can use the reserve capital only for coverage of losses of the enterprise, payment of dividends on preferred shares, and in other cases provided for by law. Reserve capital is like funds set aside for a rainy day and are not used in daily activities.

- The third option for using Retained Earnings is to direct it to increase the authorized capital of the enterprise.

- Retained earnings can also be used to pay off the company’s losses.

RE for external users

Accumulated profits play a key role not only to shareholders (owners) of the company but also to external users (investors, banks, regulatory authorities). Investors are interested in where this indicator is spent. As mentioned before, it can be spent:

- For the payment of dividends to shareholders;

- To pay off losses from past periods;

- For infusion into the development of the company (e.g. the acquisition of fixed assets, equipment, etc.);

- To increase the authorized capital;

- To create a reserve fund;

- For other purposes established by legislative acts.

If the business experienced a loss, then it can be repaid by the following sources:

- At the expense of shareholders’ own funds;

- At the expense of the profit received in the previous periods;

- Through the use (reduction) of the authorized capital;

- By using (decreasing) the reserve fund.

It is important for investors that more profits are spent not on the payment of dividends, but the investment activities of the company. It is also important for them that the profit received before distribution should increase every year, and not decrease.