Your company may issue dividend payments to shareholders when it earns profits. Whatever earnings your company distributes to shareholders is not part of retained earnings. Instead, the corporation likely used the cash to acquire additional assets in order to generate additional earnings for its stockholders.

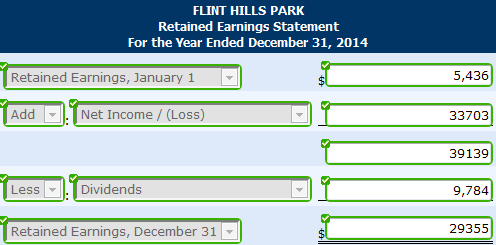

However, it can also be calculated by taking the beginning balance of retained earnings, adding thenet income(or loss) for the period followed by subtracting anydividendspaid to shareholders. Due to the nature of double-entry accrual accounting, retained earnings do not represent surplus cash available to a company. Rather, they represent how the company has managed its profits (i.e. whether it has distributed them as dividends or reinvested them in the business).

Each statement covers a specified time period, as noted in the statement. Before interpreting the meaning of the retained earnings to assets ratio, you need to understand retained earnings. This refers to the profits your company has earned over time for use in business growth, expansion or reinvestment. Strong retained earnings typically mean that the company remains in a growth stage and wants to use earnings to expand.

Prepare the Heading for the Statement of Retained Earnings

This statement of retained earnings can appear as a separate statement or as an inclusion on either a balance sheet or an income statement. The statement is a financial document that includes information regarding a firm’s retained earnings, along with the net income and amounts distributed to stockholders in the form of dividends. An organization’s net income is noted, showing the amount that will be set aside to handle certain obligations outside of shareholder dividend payments, as well as any amount directed to cover any losses.

The balance sheet gives an overall view of the financial position of the business at a certain point in time. It lists various financial features of the business, including its retained earnings. Retained earnings represent the amount of profits the business keeps in the company in general.

These funds are also held in reserve to reinvest back into the company through purchases of fixed assets or to pay down debt. Equity refers to the worth of a business or the value the business’ owners have. It includes capital stock, which is the amount the business owners invest in the company, and retained earnings. Retained earnings are the portion of a company’s profits that its owners do not withdraw from the company and the company does not distribute as dividends to its shareholders. A business has to prepare various financial statements to meet accounting rules and regulations, and to provide information to the equity holders.

Positive earnings are more commonly referred to as profits, while negative earnings are more commonly referred to as losses. The retained earnings normal balance is the money a company has after calculating its net income and dispersing dividends. By definition, retained earnings are the cumulative net earnings or profits of a company after accounting for dividend payments. It is also called earnings surplus and represents the reserve money, which is available to the company management for reinvesting back into the business. When expressed as a percentage of total earnings, it is also calledretention ratio and is equal to (1 – dividend payout ratio).

Statement of Retained Earnings

Ending retained earnings are the retained earnings at the end of a certain accounting period. One piece of financial data that can be gleaned from the statement of retained earnings is the retention ratio.

- If you have shareholders, dividends paid is the amount that you pay them.

- Your company’s net income can be found on your income statement or profit and loss statement.

- You can find your business’s previous retained earnings on your business balance sheet or statement of retained earnings.

Some laws, including those of most states in the United States require that dividends be only paid out of the positive balance of the retained earnings account at the time that payment is to be made. This protects creditors from a company being liquidated through dividends. A few states, however, allow payment of dividends to continue to increase a corporation’s accumulated deficit. The retained earnings account carries the undistributed profits of your business. To calculate retained earnings, add the net income or loss to the opening balance in the retained earnings account, and subtract the total dividends for the period.

This gives you the closing balance of retained earnings for the current reporting period, a figure that also doubles as the account’s opening balance for the next period. Record your retained earnings under the owner’s equity section of your balance sheet. Retained earnings are the portion of a company’s net income that management retains for internal operations instead of paying it to shareholders in the form of dividends. In short, retained earnings is the cumulative total of earnings that have yet to be paid to shareholders.

What is on a statement of retained earnings?

The Statement of Retained Earnings, or Statement of Owner’s Equity, is an important part of your accounting process. Retained earnings represent the amount of net income or profit left in the company after dividends are paid out to stockholders. The company can then reinvest this income into the firm.

The retention ratio (or plowback ratio) is the proportion of earnings kept back in the business as retained earnings. The retention ratio refers to the percentage of net income that is retained to grow the business, rather than being paid out as dividends. It is the opposite of thepayout ratio, which measures the percentage of profit paid out to shareholders as dividends.

When reinvested, those retained earnings are reflected as increases to assets (which could include cash) or reductions to liabilities on the balance sheet. Retained earnings refer to the amount of net income that a business has after it has paid out dividends to its shareholders.

Are Dividends Considered a Company Expense?

You can find your business’s previous retained earnings on your business balance sheet or statement of retained earnings. Your company’s net income can be found on your income statement or profit and loss statement. If you have shareholders, dividends paid is the amount that you pay them.

Retained Earnings

Your company’s balance sheet displays the variables for the retained earnings to assets ratio. Total assets are the culmination of the left-hand side of the statement where current and long-term assets add together. Retained earnings and common stock typically make up the lower right-hand portion of the statement. The balance sheet follows the basic accounting formula that assets equal liabilities plus owners equity. Retained earnings is listed on a company’s balance sheet under the shareholders’ equity section.

The Statement of Retained Earnings, or Statement of Owner’s Equity, is an important part of your accounting process. Retained earnings represent the amount of net income or profit left in the company after dividends are paid out to stockholders.