On site, property managers tend to rely on the cash-based accounting system as it keeps everything simple. Suppose you have a rental property by the sea, and your tenant pays 6 months in advance. What is the difference between your personal and business bank account? You can have a checking, and a savings account for personal use and business.

For one, it can help you keep track of your expenses and income in one place. Additionally, it can help you see which expenses are deductible and which are not. Finally, it can help you prepare your taxes in a more efficient way. Good bookkeeping practices will help you stay organized and on top of your finances. By keeping track of your expenses, you can make sure that you are only spending money on necessary repairs and maintenance.

Do the monthly accounting cycle

It integrates with close to 100 other programs like Avidxchange, Beanworks, Safeguard, and ZeGo by PayLease. Rent Manager has the most complete accounting system with advanced features that handle all aspects of a business’s finances and documents. The cost of each plan depends on the number of units you manage. Essential starts at $52 a month and offers features for up to 150 units. Growth offers more features, the ability to service up to 5,000 units, and starts at $166 a month.

Finally, having separate accounts simplifies rental property accounting. All transactions, business expenses, rental cash flow, and online payments take place in a designated account. As a landlord, tracking your monthly rental income and expenses is an essential part of effectively managing your rental property and getting the most out of your investment.

There are also expenses related to the cost of doing business, such as marketing expenses, property management fees, accountant or attorney fees, and any other professional services that you may hire. Finally, the landlord is required to pay the mortgage, the property tax and insurance, and any other fees related to their mortgage or loans. All of these are expenses that the landlord must pay for and keep records of.

- So, you will know when your tenant is due and how much money you owe to your owners.

- That’s because the buck stops with you, and not your CPA or accountant.

- Finally, unexpected expenses may include paying for marketing tools if there are too many vacancies.

- By avoiding commingling, your life will be much easier when it comes time to reconcile, prepare profit and loss statements, and file taxes.

- It’s an extremely good idea to set up a business bank account for your rental property.

It’s easy to set up online rent payments with Zillow Rental Manager, the simplest way to manage your rental. We reviewed 12 accounting software programs for rental properties before deciding on the seven best for these different categories. Lower costs and minimum fee requirements fared better than more expensive programs. We liked programs with moderate fees and low monthly unit costs, offering superior value for their large suite of features. Rentec Direct comes with features that include general ledger accounting and financial reporting with QuickBooks synchronization. This streamlines the whole tenant rent payment process to one step that takes around 30 seconds.

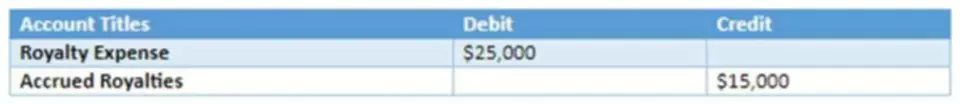

With the cash method, you track when cash actually comes into or leaves your account. And with the accrual method, you track when cash is earned or owed. Analyzing patterns in your current expenses can also help you plan for future expenses so they don’t sneak up on you.

Reconcile monthly and report at year-end

But without invoice and receipts management, that is difficult to achieve. But what is the difference between an invoice and a receipt in accounting terms? You can try FreshBooks for free and use their many resources to learn everything you need about bookkeeping for property management.

There are formulas work in the background that do those calculation for you. Visit a business banker at your local bank to set up a checking account for each rental property. You can also create a property savings account to keep CapEx funds in. An even better option is to digitize your bookkeeping by using a system such as Stessa. You can use Stessa to connect accounts quickly and securely so that income and expenses are automatically synced to your performance dashboard.

Landlords with just a few properties who have the discipline to record their income and expenses into a spreadsheet might do fine with a program like Excel. Aside from the time savings, accounting software can give you a progress report on the health of your real estate portfolio and quickly alert you to late payments. Perhaps most critically, it can help you accurately account for rental property depreciation. Setting up a rental property accounting and bookkeeping system will pay dividends for your real estate business.

The best way to keep track of rental income and expenses is to use a software application specifically designed for tracking rental income and expenses. There are many software applications available, and they vary in terms of features and price. Some applications are more comprehensive than others, but all of them will allow you to track your income and expenses in one place.

Commercial

What is the best way to handle all of your property management accounting needs? Investing in high-quality property management accounting software is the answer that comes to mind. Property management accounting aims to show how much profit a property is making. Whether you’re managing personal or rental property, accurate property accounting is essential. Those financial statements are profit and loss, balance sheet, cash flow and equity statements. You don’t need to understand accounting to generate those statements correctly.

If you want to get a loan on the property or sell it, the first thing you will be asked for is a rent roll. Having one accurate and up to date will go a long way toward making interacting with third parties easier — not to mention helping you identify delinquent tenants faster. When you run your annual financials, work on preparing a cash flow statement. The cash flow statement and appraisal will let you grade each property on those four key metrics each year. Having an accounting system in place for managing your properties will help you ensure you don’t miss any due dates and — ideally — it will save you a lot of time. While you can’t directly deduct capital expenses from your taxes, these costs factor into depreciation, which can help reduce your total tax bill.

It should go without saying, but seek out a tax professional with expertise in real estate investing; that will reduce the chances you’ll accidentally underpay or overpay your taxes. Now, managing multiple accounts for each property can get unwieldy. But we strongly suggest linking them all to your accounting or bookkeeping software to help you stay on track. Rental property accounting also includes managing invoices and receipts. Your business bank account may have more requirements and even restrictions.

The main difference between the 2 is in the timing for recognizing revenue and expenses. Cash accounting focuses on immediate recognition, whereas accrual deals with anticipated revenue and expenses. No one wants to think about their business going under, but it happens. If everything above sounds confusing or overwhelming, you might want to enlist the help of a CPA. Even if you use an accountant or CPA to file your year-end tax returns, it’s still a good idea to know what the basic tax forms look like and what they’re used for.

First, it can help you keep track of your expenses and income so that you can more easily calculate your profits. Whichever method you choose, the important thing is to be consistent in how you track your income and expenses. This will make it easier to spot trends over time and make sure that you’re keeping on top of your finances.

This type of bookkeeping may create an appearance of profitability. That’s often the best course of action, especially if you’re happy with their service. Furthermore, if the bank already recognizes you as a loyal client, it might be easier to open a business account. Property management business owners likely view accounting as the least favorite part of their job.

But getting started from scratch can feel overwhelming, so it’s important to take things step by step. Property management accounting is within the scope of this profession. Property managers have various responsibilities, including rent collection, maintenance, and property management accounting. The complexity and extent of the bookkeeping they complete varies. They may outsource the job to another company or use accounting software.

Accounting for property management is done best when it’s like every other business. So normal accounting software will have all the functionality that you need. Check out our accounting software reviews and go with the one you like the most — it will work for property management. The services your property management company provides will vary depending on who you choose to work with, so it’s important to discuss your needs upfront if you’re looking around for a property manager. This is especially true if you’re specifically looking for bookkeeping services. Past that, you’ll want to shop around for property management software and/or accounting software.