With respect to variable costs, the company might qualify for a volume discount on fabric purchases above some production level. The high-low method is used to calculate the variable and fixed cost of a product or entity with mixed costs.

If a client wants a price quote for a special order, management only considers the variable costs to produce the goods, specifically material and labor costs. Fixed costs, such as a factory lease or manager salaries are irrelevant, because the firm has already paid for those costs with prior sales. The cost ofaircraft ownership can be divided into fixed costs and variable costs. Determining which ownership costs are fixed and which are variable is essential to successful aircraft ownership.

AccountingTools

When examining a company’s cost structure, mixed costs must be separated into their variable and fixed components. For example, let’s assume that total variable costs of steel in May were $50,000 when 500 bicycles were produced and $75,000 in June when 750 bicycles were produced.

Relevant Cost

This relationship is known as cost-volume-profit (CVP) analysis and assists management in setting targets for profitability given its cost structure and the volume of products it produces. Costs incurred to manufacture a product can be classified as variable, fixed, or mixed. In cost accounting, the high-low method is a way of attempting to separate out fixed and variable costs given a limited amount of data.

An increase in production costs would result in a lower profit margin for each product produced. Mr. Spoke also needs to consider the implications to fixed costs for activity levels that fall outside of the relevant range.

Mr. Spoke’s business incurs many different costs as it produces bicycles. In order to understand how these costs impact profitability, businesses must determine the relationship that exists between its costs, its production volume, and its profit.

If you are a potential aircraft buyer or operator, knowing these costs can help determine if you will be able to afford an airplane. Let’s assume that Rider Bicycle’s total fixed costs are $150,000 per month and 500 bicycles were made in May and 750 bicycles were manufactured in June. To determine our fixed cost per bicycle, we divide the total fixed costs by the number of bicycles produced in that month. It is useful to understand the proportion of variable costs in a business, since a high proportion means that a business can continue to function at a relatively low sales level.

To calculate the variable cost we just divide the total variable costs by the amount of bicycles produced each month. We can see that the variable costs were $100 per bicycle in both May and June. Contribution margin, defined as selling price minus variable cost, is a measure of the ability of a company to cover “””variable costs””” with revenue. The amount leftover, the contribution, covers fixed costs or is profit.

The costs associated with a product, product line, equipment, store, geographic sales region, or subsidiary, consist of both variable costs and fixed costs. To determine both cost components of the total cost, an analyst or accountant can use a technique known as the high-low method. Companies determine the volume of products to manufacture taking into account the cost of production and their target profit. This cost-volume-profit analysis holds true for levels of activity within the relevant range of production, as the cost of manufacturing the product are consistent throughout this range of activity. Activity levels above or below the relevant range could lead to higher costs for materials and/or labor, which would increase the cost to produce an item.

In addition, express it as a dollar amount per unit or as a ratio. CM can be calculated for a product line using total revenues and total variable costs. It can also be calculated at the unit level by using unit sales price and unit variable cost.

What is relevant range and why is it important?

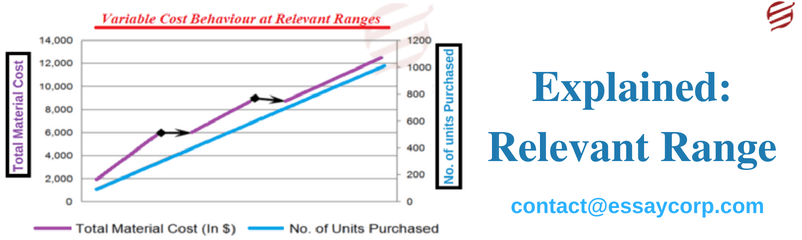

The relevant range refers to a specific activity level that is bounded by a minimum and maximum amount. Within the designated boundaries, certain revenue or expense levels can be expected to occur. Outside of that relevant range, revenues and expenses will likely differ from the expected amount.

Continue Operating vs. Closing Business Units

- For example, if the factory is operating at capacity, increasing production requires additional investment in fixed costs to expand the facility or to lease or build another factory.

- Alternatively, production might be reduced below a threshold at which point one of the companys factories is no longer needed, and the fixed costs associated with that factory can be avoided.

In a business, the “activity” is frequently production volume, with sales volume being another likely triggering event. Thus, the materials used as the components in a product are considered variable costs, because they vary directly with the number of units of product manufactured. In most real-world cases, it should be possible to obtain more information so the variable and fixed costs can be determined directly.

An increase in labor costs would lead to a higher variable cost per bicycle. Fixed costs are those costs that do not change with the volume of production. For example, Mr. Spoke will have to pay the same amount of rent on his building whether he produces one bicycle or 1,000 bicycles. Although the total fixed cost remains unchanged, the fixed cost per bicycle will change depending on the volume of bicycles produced. Variable costs are those costs that change with the amount of activity.

The metric is commonly used in cost-volume-profit analysis and break-even analysis. A variable cost is a cost that changes in relation to variations in an activity.

Conversely, a high proportion of fixed costs requires that a business maintain a high sales level in order to stay in business. If the variable cost is a fixed charge per unit and fixed costs remain the same, it is possible to determine the fixed and variable costs by solving the system of equations. Hence, an experienced accountant would say that the company’s fixed costs are approximately $200,000 per month within a relevant range of activity. Only selling price, variable cost per unit, and total fixed costs are known and constant. A key relationship in CVP analysis is the level of activity at which total revenue equals total costs (both fixed and variable).

For example, if Rider Bicycle’s current facilities do not support the production of 1,000 bicycles per month, Mr. Spoke may have to expand his current factory or relocate to larger premises. Both of these scenarios have implications for Mr. Spoke’s fixed costs, as he will likely have to pay higher rent for a larger production facility. For example, Rider Bicycle’s costs are assumed to remain constant over its relevant range, which is between 500 and 750 bicycles. This would increase the variable cost to produce each bicycle above the current level of $100 per bicycle.

It considers the total dollars of the mixed costs at the highest volume of activity and the total dollars of the mixed costs at the lowest volume of activity. The total amount of fixed costs is assumed to be the same at both points of activity. The change in the total costs is thus the variable cost rate times the change in the number of units of activity. The profit margin is the difference between the price charged to the customer and the cost to manufacture a good. Over the long-run, increasing the price charged for each bicycle may lead consumers to Mr. Spoke’s competition if the price of their bicycles is lower than that of Rider Bicycle.

Definition of Relevant Range

For example, if the factory is operating at capacity, increasing production requires additional investment in fixed costs to expand the facility or to lease or build another factory. Alternatively, production might be reduced below a threshold at which point one of the companys factories is no longer needed, and the fixed costs associated with that factory can be avoided.

The high-low method involves taking the highest level of activity and the lowest level of activity and comparing the total costs at each level. Fixed costs, as opposed to variable costs, are defined as costs that remain the same over a period of time. Conversely, variable costs are subject to change and include things like fuel, oil, maintenance, landing fees, etc. An aircraft’s fixed costs remain the same no matter how many hours you fly your plane. However, the “cost per unit” of a fixed cost will increase (or decrease) depending on the level of activity of the airplane.

For example, the total amount of steel used by Rider Bicycle will vary depending on how many bicycles are produced, but the variable cost per unit will remain the same. Similarly, if the company’s volume were to increase dramatically, the company would likely have to increase the total amount of its fixed costs . As you can see, even though the total fixed costs remain unchanged at $150,000, the fixed cost per unit will change depending on how many bicycles are produced. In May, the fixed costs per bicycle were $300, while in June, that number was $200. Contribution margin means a measurement of the profitability of a product.

What is relevant range?

Thus, the high-low method should only be used when it is not possible to obtain actual billing data. A special order occurs when a customer places an order near the end of the month, and prior sales have already covered the fixed cost of production for the month.

Mixed costs are those costs that have elements of both fixed and variable costs. For example, Rider Bicycle’s utility costs would be a mixed cost as part of the cost depends on the amount of electricity used (which is a variable cost). The business also has a constant cost for delivery of the hydro regardless of usage (which is a fixed cost).