Join PRO or PRO Plus and Get Lifetime Access to Our Premium Materials

Debit accounts payable for $1,000, credit cash for $980 and credit purchase discounts for $20. As mentioned earlier, in any business offering discounts is an integral part of their marketing and sales scheme. Wholesalers want their goods to be bought in bulk, and to be paid early. Retailers mark down their products when they want to get rid of the old stock and replace them with new inventory. They wanted to attract more customers with their seemingly affordable prices.

A cash discount is a type of sales discount, sometimes called an early settlement discount, and is recorded in the accounting records using two journals. The first journal is to record the cash being received from the customer. The second journal records the cash discount to clear the remaining balance on the customers account.

BUSINESS OPERATIONS

Another part of the entry debits purchase discounts and credits accounts receivable for the discount taken by the buyer. If the buyer does not take the discount, then accountants do not make the second entry. They simply debit cash and credit accounts receivable for the full amount.

Getting a purchase discount also encourages the retailers to offer sales discounts to their customers. Many discounts are designed to give consumers the perception of saving money when buying products, but not all discounted prices are viewed as favorable to buyers. Therefore, before making a purchase, consumers may weigh their options as either a gain or a loss to avoid the risk of losing money on a purchase.

These supplier discounts are usually offered because the retailer buys products in bulk, or for early payment of an invoice. For example, for a sale worth 100 rupees, a supplier might let the retailer pay 20 rupees less if the retailer agrees to pay within 5 days. If the retailer pays at a later date, the purchase discount gets canceled.

Let’s also assume that a sales invoice is for $1,000 and the buyer has been authorized to return $100 of goods. However, the buyer may deduct $9 (1% of $900) if the buyer pays the seller $891 within 10 days of the invoice date. The seller will usually record the $9 cash discount with a debit to the account Sales Discounts. The buyer will record the $9 savings as a credit to Purchase Discounts or as a reduction to the cost recorded in inventory.

FINANCE YOUR BUSINESS

If he pays half the amount In accounting, gross method and net method are used to record transactions of this kind. Under the gross method, the total cost of purchases are credited to accounts payable first, and discounts realized later if the payments were made in time. And if the payments are not made in time, an anti-revenue account name purchase discounts lost is debited to record the loss. Companies make credit sales to increase sales revenue without requiring immediate cash payment. This allows more consumers to purchase goods using the seller as a short-term financing option.

A sales discount is a reduction in price the customer receives when he buys a product from a retailer or store. Retailers sometimes offer a sales discount to attract attention to products or to move merchandise out of the retailer’s facility, to make room for new inventory. A retailer may also offer a sales discount because it received a purchase discount. If the retailer doesn’t pay as much for the inventory, it can still generate a profit while selling it at a lower price. If the business pays the supplier within the 10 days and takes the purchases discount of 30, then the business will only pay cash of 1,470 and accounts for the difference with the following purchases discounts journal entry.

Customers may stop responding to sales discounts if they receive them too often because the discounts become “normal” instead of a privilege. Even if customers remain responsive over time, they eventually may question why prices have gone back up once the retailer stops offering the sales discounts. Purchase discounts are the reductions that retailers and stores get from their wholesalers. Purchase discounts offered to stores can depend on variety of factors such as size of order, a cut in prices of raw material, etc.

- Companies that take advantage of sales discounts usually record them in an account named purchases discounts, which is another contra‐expense account that is subtracted from purchases on the income statement.

You record the purchase by debiting your inventory account $10,000 and crediting accounts payable $10,000. As you sell the merchandise, you credit inventory and debit cost of goods sold for the amount equivalent to the number of units sold.

Example of Purchase Discount

For instance, consumers will pass on a buy-three-get-one-half-off discount if they believe they are not benefitting from the deal. Specifically, consumers will consider their options because “…the sensation of loss is 2.5 times greater than the sensation of gain for the same value”.

A “gain” view on a purchase results in chance taking For example, if there is a buy-one-get-one-half-off discount that seems profitable, a shopper will buy the product. On the other hand, a “loss” viewpoint results in consumer aversion to taking any chances.

Some companies find it more convenient to use the gross method to record purchases and discounts. If you use this method, you would credit accounts payable and debit purchases for the invoice amount. When you pay the invoice, debit accounts payable for the total amount, credit your purchases discount account for the amount of the discount and credit cash for the difference between the invoice and the discount. For example, suppose you receive an invoice for $1,000 offering a 2 percent discount if paid by the 25th of the following month. Debit your purchases account for $1,000 and credit accounts payable for the same amount.

However, if you do not pay by the discount date, you need to remit $3,000. Credit cash for $3,000, debit accounts payable for $2,940 and debit lost purchase discounts for $60. Purchase discount is an offer from the supplier to the purchaser, to reduce the payment amount if the payment is made within a certain period of time. For example, a purchaser brought a $100 item, with a purchase discount term 3/10, net 30.

Getting at least occasional purchase discounts, because they let stores and retailers generate consumer surplus, is one way for a business to improve its overall image. Obtaining purchase discounts and offering sales discounts is, therefore, a distinct marketing strategy. However, marketers should be careful not to abuse the relationship between purchase discounts and sales discounts.

One of the most important reasons that discounts are offered is to generate consumer surplus. Retailers might want to move new products into their outlets, and thus, will reduce the prices of the old merchandise in order to get customers to buy it. If the season for a particular type of clothing is over (winter clothes, for example), then they are typically put on sale. Bigger brands might want to seem attractive to a wider market and could, therefore, offer big discounts in order to seem more affordable. Some retailers might just offer discounts because they themselves have received purchase discounts.

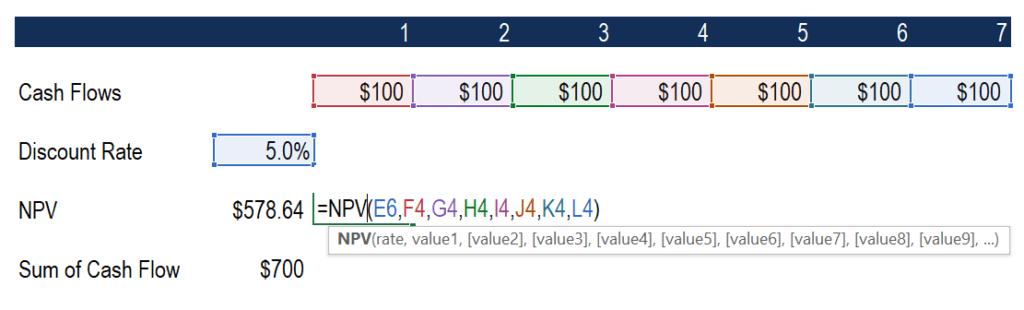

Companies that take advantage of sales discounts usually record them in an account named purchases discounts, which is another contra‐expense account that is subtracted from purchases on the income statement. Let’s assume that a company offers a cash discount and it is printed on its sales invoices as 1/10, net 30.

If the merchandise you purchase is for inventory, you might need to make an additional entry. Your inventory value should be the net cost; typically, this is the cost of the merchandise and freight, less your cash discount. Therefore, you might need to adjust your inventory cost to reflect the discount.

To illustrate, suppose you make a $3,000 purchase from a vendor offering a 2 percent discount if you pay the invoice within 10 days. The discount would be $60; subtracting the discount from the invoice amount yields a net of $2,940. Your entry would be a debit to purchases of $2,940 and a credit to accounts payable for $2,940. If you pay the invoice according to terms, you would then debit accounts payable for $2,940 and credit cash for the same amount.

The credit entry to the accounts receivable represents a reduction in the amount owed by the customer. Purchase credit journal entry is recorded in the books of accounts of the company when the goods are purchased by the company on credit from the third party (vendor).

You might prefer to record your purchases as the invoice amount, less the discount, which yields the net purchase amount. Under this method, you would record any lost discounts in a separate account.

Your supplier offers a 2 percent discount if paid by the 10th, which would save you $200. You debit accounts payable for $10,000, credit cash for $9,800 and credit purchase discounts for $9,800. You must credit your inventory account for $200 and debit your cost of goods sold account for $200. Accountants must make specific journal entries to record purchase discounts. When a buyer pays the bill within the discount period, accountants debit cash and credit accounts receivable.

What is a purchase discount account?

A purchase discount is a deduction that a company may receive if the supplier offers it and the company pays the supplier’s invoice within a specified period of time. (A supplier offering the discount will record the discounts taken by its customers in the account Sales Discounts.)