How to Amortize a Bond Discount

Callable bonds are more risky for investors than non-callable bonds because an investor whose bond has been called is often faced with reinvesting the money at a lower, less attractive rate. As a result, callable bonds often have a higher annual return to compensate for the risk that the bonds might be called early. We report such gains and losses in the income statement, net of their tax effects, as described in Unit 15.

The FASB is currently reconsidering the reporting of these gains and losses as extraordinary items. As a general rule of thumb in investing it’s best to diversify your assets as much as possible.

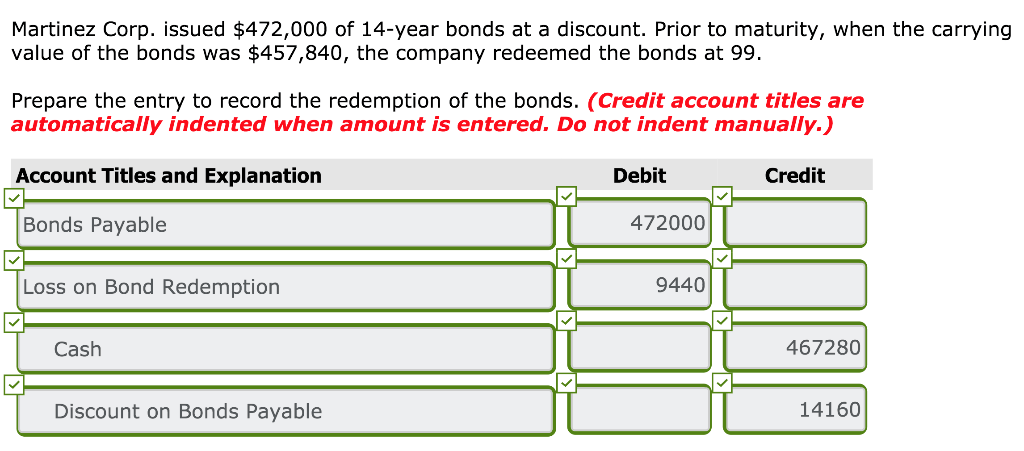

How to Calculate Gain or Loss on a Bond Redemption

This phenomenon is called price compression and is an integral aspect of how callable bonds behave. Overall, callable bonds also come with one big advantage for investors. They are less in demand due to the lack of a guarantee of receiving interest payments for the full term, so issuers must pay higher interest rates to persuade people to invest in them.

In accounting terminology, debiting cash means increasing company money. Bond issuance at par value increases corporate cash — an asset account — and triggers a hike in the bonds payable account, which is a long-term debt. A bond-selling business also records bond issue costs — which include professional fees incurred in issuing the debt instruments — in the “other assets” category on the balance sheet.

Call provisions are often a feature of corporate and municipal bonds. Examples of the financing activities that include the long- term debts comprise the redemption or issuance of bonds. An escalation in the bonds payable is stated as a positive amount in the cash flow statement section.

Callable or Redeemable Bonds

Those appealing short-term yields, can end up costing you in the long run. However, since a callable bond can be called away, those future interest payments are uncertain. So, the more interest rates fall, the less likely those future interest payments become as the likelihood the issuer will call the bond increases. Therefore, upside price appreciation is generally limited for callable bonds, which is another trade-off for receiving a higher-than-normal interest rate from the issuer.

Accountants report interest payments as well as principal remittances and issuance proceeds in operating cash flows and financing cash flows, respectively. A bond is a financial instrument a company uses to borrow money. A company issues bonds to investors in exchange for cash and promises to repay the principal and make periodic interest payments. Your small business might issue its own bonds or might invest excess cash in another company’s bonds.

Normally, when an investor wants a bond at a higher interest rate, they must pay a bond premium, meaning that they pay more than the face value for the bond. With a callable bond, however, the investor can receive higher interest payments without a bond premium. Callable bonds do not always get called; many of them pay interest for the full term, and the investor reaps the benefits of higher interest for the entire duration. Despite the higher cost to issuers and increased risk to investors, these bonds can be very attractive to either party. Investors like them because they give a higher-than-normal rate of return, at least until the bonds are called away.

A balance sheet is the financial synopsis you review to know more about a company’s assets, debts and equity capital — which consists of investors’ money and the entity’s own cash. To record bond issuance, a corporate bookkeeper debits the cash account and credits the bonds payable account. This bookkeeping scenario assumes the company sold the bonds at par value — also called face value — meaning the debt products fetched the exact price shown on the debt covenant.

Accounting for bonds

- A balance sheet is the financial synopsis you review to know more about a company’s assets, debts and equity capital — which consists of investors’ money and the entity’s own cash.

The entry for interest payments is a debit to interest expense and a credit to cash. savings bondsis taxed at the federal level but not at the state or local levels for income. Bonds typically earn interest, which is the amount that a bond can be redeemed for above its face value. The interest on savings bonds is also subject to federalgift, estate, and excise taxes. On the state level, the tax on the interest applies for estates or inheritances.

The positive amount signifies cash that was generated by the issuance of extra bonds or simply a source of cash. A decline in the bonds payable is reported as a negative sum in the financing activities segment of the SCF. A negative sum implies that cash was used up in redeeming or repurchasing the bonds of the corporation.

Most financial institutions will redeem your savings bonds. But because your savings bank does not, it should be able to point you to a bank that will handle the redemption. You also could convert your paper bonds to electronic form through TreasuryDirect.gov and then redeem them into your bank account. I’d only suggest this if you plan to hold the bonds to maturity, which is what I’m going to recommend. An equity statement includes elements such as accumulated profits, dividends, common stock and preferred shares.

There is no free lunch, and the higher interest payments received for a callable bond come with the price of reinvestment-rate risk and diminished price-appreciation potential. However, these risks are related to decreases in interest rates and make callable bonds one of many tools for investors to express their tactical views on financial markets. (For further reading on investment diversification practices, check out Achieving Optimal Asset Allocation). A bond is a debt product a company sells to investors — such as investment banks, rich people and pension funds — privately or on public exchanges, also known as debt markets.

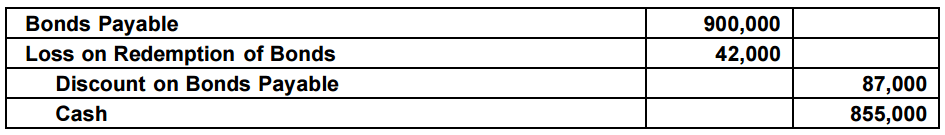

What is redemption of bonds payable?

The redemption of bonds payable refers to the repurchase of bonds by their issuer. This usually occurs at the maturity date of the bonds, but may occur earlier if the bonds contain a call feature.

Callable or redeemable bonds arebondsthat can be redeemed or paid off by the issuer prior to the bonds’ maturity date. When an issuer calls its bonds, it pays investors the call price (usually the face value of the bonds) together with accrued interest to date and, at that point, stops making interest payments.

If you comb through the report, you see things like operating cash flows along with incoming and outgoing cash stemming from investing, lending and fundraising initiatives. Bond transactions affect a liquidity report — the other name for a cash flow statement — through various entries.

Unless the bond matures in a year or less it is shown on the balance sheet in the long-term liabilities section. If current assets will be used to retire the bonds, a Bonds Payable account should be listed in the current liability section. If the bonds are to be retired and new ones issued, they should remain as a long-term liability. All bond discounts and premiums also appear on the balance sheet.

Conversely, callable bonds are attractive to issuers because they allow them to reduce interest costs at a future date should rates decrease. Moreover, they serve an important purpose to financial markets by creating opportunities for companies and individuals to act upon their interest-rate expectations. An issuer may choose to call a bond when current interest rates drop below the interest rate on the bond. That way the issuer can save money by paying off the bond and issuing another bond at a lower interest rate. This is similar to refinancing the mortgage on your house so you can make lower monthly payments.

The recorded amount of interest expense is based on the interest rate stated on the face of the bond. Any further impact on interest rates is handled separately through the amortization of any discounts or premiums on bonds payable, as discussed below.

Bonds Payable & The Balance Sheet

Bond transactions affect various financial statements, from income statements and balance sheets to statements of cash flows and shareholders’ equity reports. In addition to reinvestment-rate risk, investors must also understand that market prices for callable bonds behave differently than normal bonds. Typically as rates decrease, you will see bond prices increase, but this is not the case for callable bonds.

It would most likely recall its bonds and issue new bonds at the lower interest rate. People that invested in Firm B’s callable bonds would now be forced to reinvest their capital at much lower interest rates.

To compensate investors for this uncertainty, an issuer will pay a slightly higher interest rate than would be necessary for a similar, but non-callable bond. Additionally, issuers may offer bonds that are callable at a price in excess of the original par value. For example, the bond may be issued at a par value of $1,000, but be called away at a par value of $1,050. The issuer’s cost takes the form of overall higher interest costs, and the investor’s benefit is overall higher interest received.

Effective tactical use of callable bonds depends on one’s view of future interest rates. Keep in mind that a callable bond is composed of two primary components, a normal bond and an embedded call option on interest rates. Now, assume interest rates fall in five years so that Firm B could issue a normal 30-year bond at only 3%.