Because the assets of each subsidiary are also separate, the reach of creditors is limited to only the subsidiary that signed the contract with that particular creditor. Companies create subsidiary ledgers whenever they need to monitor the individual components of a controlling general ledger account. Companies may have hundreds or even thousands of customers who purchase items on credit, who make one or more payments for those items, and who sometimes return items or purchase additional items before they finish paying for prior purchases.

Subsidiary ledgers contain detailed information regarding business transactions and financial accounts. This information is maintained separately from the company’s general ledger. Large business organizations often use subsidiary ledgers because they have large numbers of financial transactions. The general ledger includes information that does not meet the specific requirements of subsidiary ledgers.

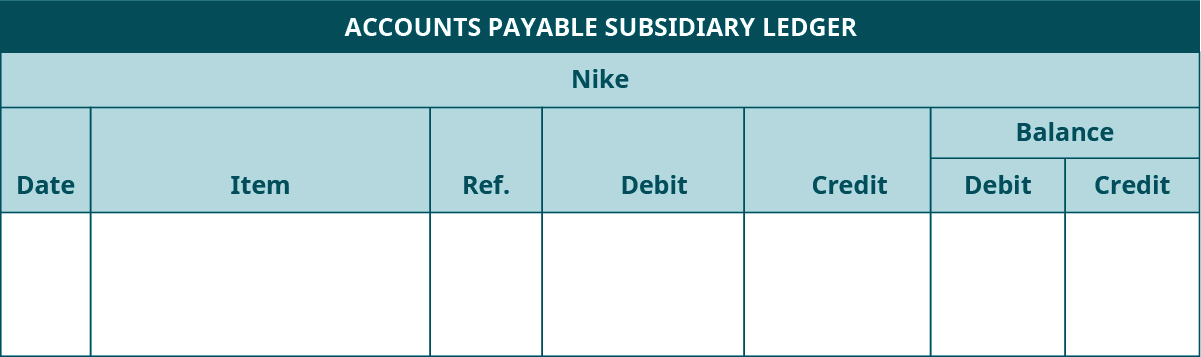

The accounts payable subsidiary ledger is a breakdown of the total amount of payables listed on the general ledger. In other words, the subsidiary ledger contains the individual payables owed to each of the suppliers and vendors, as well as the amounts owed. The general ledger is a master ledger containing a summary of all the accounts that a company uses in operating its business.

The general ledger is a set of master accounts where transactions are recorded. But there are limitations in the recording of the transaction so the sum of a different subset of sub-ledger is added in general ledger.

What is a subsidiary ledger account?

A subsidiary account is an account that is kept within a subsidiary ledger, which in turn summarizes into a control account in the general ledger. A subsidiary account is used to track information at a very detailed level for certain types of transactions, such as accounts receivable and accounts payable.

An accounts payable (AP) is essentially an extension of credit from a supplier that gives a business (the buyer in the transaction) time to pay for the supplies. The subsidiary ledger records all of the accounts payables that a company owes. “I even had a company—and this is probably not so uncommon—that just wanted to give somebody a new title,” Moran says. The bank wanted those assets isolated in a separate legal entity where they would be protected and unencumbered by other potential liabilities, Moran says. But what if Doe decided to form a holding company—called Doe Industries Inc.—and structured J.D.

Free Financial Statements Cheat Sheet

So, it contains detail information regarding the business transaction and financial accounts. A subsidiary ledger stores the details for a general ledger control account.

AccountingTools

According to its 2000 annual report, Enron operated a network of 2,000 corporate subsidiaries in 23 states and 62 countries, including offshore tax havens such as the Cayman Islands. While there is nothing illegal per se about such subsidiaries, Enron ran into accounting trouble with several special purpose entities it created to keep debt off its balance sheet. Special purpose entities are any type of corporate entity, such as a limited liability corporation or limited partnership, created for a specific transaction or business that is usually unrelated to a company’s main business. In some cases, however, it still controlled those entities and even backed their debts, sometimes with notes convertible into Enron shares. In the third quarter of 2001, the company reported a $618 million loss—the stock price plummeted and shareholder equity shrank by $1.2 billion—caused, in part, by problems at the off-balance-sheet partnerships.

Insolvency does not necessarily mean the company is out of business, as long as it takes action to pay creditors or seek legal protection under bankruptcy laws. However, should the company fail to take action to protect itself from dissolution, it will result in the selling of the stock of a subsidiary to raise capital. This scenario is predicated on the subsidiary’s stock being an asset on the balance sheet of the parent company. The GL is a set of master accounts and transactions are recorded and SL is an intermediary set of accounts linked to the general ledger. GL contains all debit and credit entries of transactions and entry for the same is done.

But the accounts receivable subsidiary ledger provides quick access to each customer’s balance and account activity. A subsidiary ledger is a group of similar accounts whose combined balances equal the balance in a specific general ledger account. The general ledger account that summarizes a subsidiary ledger’s account balances is called a control account or master account.

- Subsidiary ledgers contain detailed information regarding business transactions and financial accounts.

- Large business organizations often use subsidiary ledgers because they have large numbers of financial transactions.

- This information is maintained separately from the company’s general ledger.

Shortly afterwards Enron filed for protection from creditors under Chapter 11 of the federal bankruptcy code. Sub-ledger is an intermediary set of accounts linked to the general ledger. It is the subset of the general ledger in the accounting it is not possible to record all transactions in general ledger hence transactions are recorded in sub-ledger in a different account and their total sum is reflected in general ledger. The total of sub-ledger should always match with the line item amount on the general ledger.

Accounting is a detailed process for recording and reporting a company’s financial information. Businesses often use several different ledgers and journals to maintain records of financial transactions. Rather than placing all business and financial transactions into one ledger, companies often use several subsidiary ledgers for this information. Business owners can then review specific information and conduct an analysis on a portion of their company’s financial information. When the financial statements are prepared, the accounts payable total is listed with other short-term financial obligations under the current liabilities section of the balance sheet.

A subsidiary is a legal entity that issues its own stock and is a separate and distinct operating business that is owned by a parent company. The stock of the subsidiary is an asset on the balance sheet of the parent company. The subsidiary has its own bank accounts, operating capital and ownership of assets, except for the stock issued to the parent company. The purpose of a subsidiary/parent business structure is to limit the liability and legal exposure one company has if either company fails. Recording of financial information is books of account as per standard accounting principle.

Differences Between General Ledger and Sub Ledger

However, companies prefer to use subsidiary ledgers when recording financial transactions to limit the amount of detailed information in the general ledger. Subsidiary ledgers allow business owners to separate accounting duties and responsibilities. Individual employees usually complete functions relating to one subsidiary ledger. General staff accountants may be responsible for reviewing the company’s general ledger and other subsidiary ledgers.

The subsidiary ledgers roll up to the general ledger, which records the aggregate totals of the subsidiary ledgers. The general ledger, in turn, allocates these totals into assets, liabilities, and equity accounts. Within most accounting systems, the process is performed via accounting software. The CPAs may also ascertain that employees of the subsidiary are properly covered under the parent company’s employee benefit plans. Enron Corp. came under fire for its aggressive use of subsidiaries in what now appears to have been an attempt to avoid U.S. taxes and hide high-stakes deals from investor scrutiny.

The general ledger usually contains the aggregate total for each subsidiary ledger. Staff accountants review the information in the general ledger to ensure it includes all financial transactions. In addition to the tax benefits of forming a subsidiary, many companies crave the legal protections from potential plaintiffs and creditors it can provide. Lee Reicher, CPA, attorney and managing partner of the Los Angeles law firm Reish Luftman McDaniel & Reicher, says that liabilities and creditor claims of a subsidiary are “trapped” in that subsidiary and can’t be passed on to the parent company. As a result, if the subsidiary runs into financial trouble, the parent company’s assets and its credit rating are protected.

FROM AN ACCOUNTING PERSPECTIVE, creating a subsidiary makes sense because it allows companies to enjoy substantial tax benefits and creditor protections. The costs involved can be as little as a few thousand dollars for smaller companies, and when costs are higher, they are almost always nominal compared with potential rewards.

The entire organization may be able to save on its taxes if the parent company owns over 80 percent of one or more subsidiaries. The parent can file a consolidated tax return and use a losses from a failing subsidiary to offset income from other subsidiaries. Keeping each company separate allows the parent company to sell unprofitable subsidiaries without disrupting its own business activities.

What is the purpose of subsidiary ledgers?

For federal tax reporting purposes, U.S. companies can file a consolidated return for themselves and all subsidiaries in which they own at least an 80% stake, with certain exclusions for foreign subsidiaries. In this case, filing a consolidated return permits Doe Industries to offset the $10 million profit by J.D. Doe’s corporate empire would owe federal income taxes on just $5 million, not $10 million. Other times, companies need to form subsidiaries to facilitate the potential sale of part of the company.

GL has all account which is needed in double-entry accounting books which means that each financial transaction affects at least two sun ledger accounts and each entry has at least one debit against which one credit transaction is there. Sub-ledger is a detailed subset of accounts that contains transaction information.

Once information has been recorded in a subsidiary ledger, it is periodically summarized and posted to a control account in the general ledger, which in turn is used to construct the financial statements of a company. Most accounts in the general ledger are not control accounts; instead, individual transactions are recorded directly into them. Subsidiary ledgers are used when there is a large amount of transaction information that would clutter up the general ledger. This situation typically arises in companies with significant sales volume. An accounts payable subsidiary ledger is an accounting ledger that shows the transaction history and amounts owed to each supplier and vendor.