Thus, before getting into the mathematical details, it’s helpful to put borrowing rates into perspective. An implicit lease rate is actually an interest rate that you need to pay when you getting a loan.

Well, in every lease, whether it be a $3,000,000 piece of manufacturing equipment or a $20,000 car, there is an implicit interest rate that lessees pay to lessors. The interest rate implicit in a lease often incorporates an ‘asset risk premium’ reflecting the lessor’s exposure to the residual value of the asset at the end of the lease term.

What is the lessor’s implicit rate?

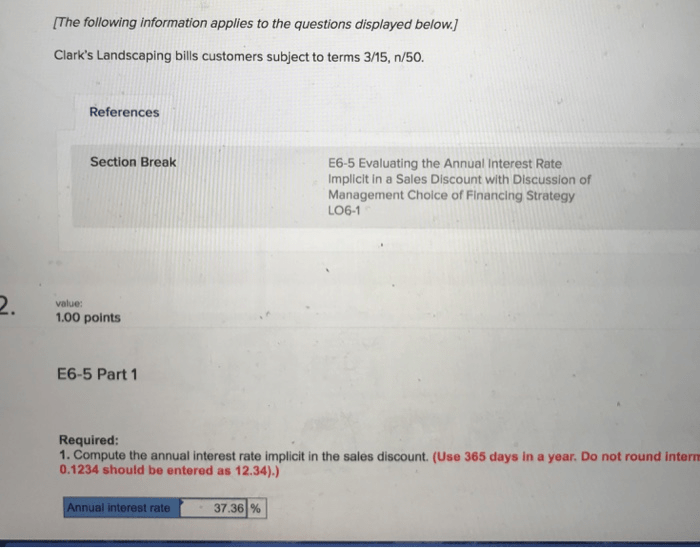

In order to find the interest rate that is “implicit” or “implied” in this agreement, you need to do a mathematical calculation. The formula you will use is total amount paid/amount borrowed raised to 1/number of periods = x. Then x-1 x100 = implicit interest rate.

To calculate the sale price of an item, subtract the discount from the original price. You can do this using a calculator, or you can round the price and estimate the discount in your head. An important accounting issue for lessors recording a lease is how much of the overall value should be recorded as gross investment and how much as unearned income.

How to Calculate Implicit Interest Rate

Also, considering using a certified public accountant to ensure that the implicit rate is correctly calculated. We simply calculated the internal rate of return of our cash flows from operating leases and this is our interest rate implicit in the lease, but auditors told us it was not OK.

How do you calculate implicit interest rate?

implicit interest rate definition. An interest rate that is not explicitly stated. For example, instead of paying $100 cash a person is allowed to pay $9 per month for 12 months. The interest rate is not stated, but the implicit rate can be determined by use of present value factors.

Understanding the discount rate

For lessees, the lease payments are required to be discounted using either the interest rate implicit in the lease (IRIL), if that rate can be readily determined, or the lessee’s incremental borrowing rate (IBR). For lessors, the discount rate will always be the interest rate implicit in the lease.

Calculating a discount is one of the most useful math skills you can learn. You can apply it to tips at a restaurant, sales in stores, and setting rates for your own services. The basic way to calculate a discount is to multiply the original price by the decimal form of the percentage.

If you want to know more, you may refer to Wikihow for more examples on the calculations and also learn how to calculate implicit interest rate lease in excel spreadsheet. Once you know how to calculate a lease accounting implicit interest rate, you can shop around for the best contracts available. Interest, in essence, is the true cost of asset rental and being able to identify it is a great tool for any lessee to have. Variable lease payments can impact the calculation of the interest rate implicit in the lease. Only variable payments based on an index or rate should be included in the calculation of the interest rate implicit in the lease (ie. variable payments that are included in the definition of lease payments).

- With the new lease accounting standards, lessees have to report all their operating and capital leases with contracts lasting longer than 12 months.

- If the interest rate implicit in the lease is not available to the lessees, determining the present value of the lessee’s lease payments can be calculated using the incremental borrowing rate (IBR).

- Bringing these leases to the forefront requires an appropriate method for reporting leases.

Interest rate implicit in the lease is very hard to determine for all the lessees. The lessee’s incremental borrowing rate if the interest rate implicit in the lease cannot be determined. Being able to calculate implied interest in a lease isn’t very beneficial if the lessee can’t put that information into context.

True variable payments, such as those based on sales or usage, must be excluded. Unfortunately, this can result in rates that are potentially misleading if the lease agreement is structured in a way that most payments are variable. If the calculated interest rate implicit in the lease is negative or otherwise doesn’t make sense, in our view the incremental borrowing rate should be used.

Calculating a Lease’s Implicit Interest Rate

With the new lease accounting standards, lessees have to report all their operating and capital leases with contracts lasting longer than 12 months. Bringing these leases to the forefront requires an appropriate method for reporting leases. If the interest rate implicit in the lease is not available to the lessees, determining the present value of the lessee’s lease payments can be calculated using the incremental borrowing rate (IBR). Calculating an accurate IBR is critical for lease accounting compliance under ASC 842 issued by the Financial Accounting Standards Board (FASB) and International Financial Reporting Standard (IFRS) 16. If you are about to enter into a lease as either a lessor or lessee, consider consulting a licensed attorney in your area to ensure that your rights are protected.

Once this information is available, you can begin to discover the best method for calculating interest rates. The lease on a long-term asset is considered a capital lease or operational lease for accounting purposes. With a capital lease, payments are considered both a liability and an asset on the firm’s balance sheet because the business assumes some of the risk of ownership. The firm can deduct capital lease interest expenses on each year’s tax return. To calculate the interest rate on a capital lease, the firm must know several elements, including the total amount financed, the monthly lease payment amount and the term of the lease.

The definition of interest rate implicit in the lease is the same for both a lessee and a lessor. Because it is based in part upon the initial direct costs of the lessor, it will often be difficult and in many cases impossible for the lessee to readily determine the interest rate implicit in the lease. The interest rate implicit in the lease may be similar to the lessee’s incremental borrowing rate in many cases. Both rates consider the credit risk of the lessee, the term of the lease, the security and the economic environment in which the transaction occurs.

Simple Implicit Lease Rate Formula

Vital to the calculation of these balances is the lessor’s implicit rate on the lease, as that percentage allows the lessor to divide the value of the lease. The nature of the implicit rate calculation is somewhat complex but is manageable by using a lease interest rate formula and either a computer spreadsheet or a calculator. I believe that auditors from this question were right when they refused the internal rate of return of the lease as the interest rate implicit in the lease, because it was the rate of the lessee, not the lessor.

If there is not an explicit interest stated, you should always calculate the implied interest rate before signing a lease or taking out a loan. Do not rely only on monthly payment amounts or short-term yields on bonds before making financing decisions. If the total cost of the lease is $1,000 and the company makes 12 payments of $100 per month, then the lease agreement has an implicit interest rate of 20%. In order to calculate capital lease interest rates, you must first determine whether or not your lease is capital or operational.

The meaning of the term ‘readily determinable’ is open to some interpretation. While it is relatively common for some traditional equipment finance leases to make explicit reference to an interest rate in the lease documentation, caution is warranted. This rate will not represent the interest rate implicit in the lease if it doesn’t include an estimate of residual value for the underlying asset or take the lessor’s initial direct costs into account.

As these premiums reflect the risks and circumstances of the lessor, they should be ignored when estimating the lessee’s incremental borrowing rate. Sometimes, particularly in relation to leases of real estate, the lessee uses a valuation expert to determine the interest rate implicit in the lease. In our view, rates determined by experts would not qualify as readily determinable and the lessee should be using its incremental borrowing rate instead. The interest rate implicit in the lease must be used only if that rate can be readily determined.