It is used in financial investment which refers to the cost of a company’s funds or the shareholders return on the company’s existing deals. It is the required rate that a company must achieve to cover the cost of generating funds in the market.

Return of capital (and here I differ with some definitions) is when an investor receives a portion of his original investment back – including dividends or income – from the investment. The ROIC formula is calculated by assessing the value in the denominator, total capital, which is the sum of a company’s debt and equity.

One is to subtract cash and non-interest bearing current liabilities (NIBCL)—including tax liabilities and accounts payable, as long as these are not subject to interest or fees—from total assets. The next step in understanding RoR over time is to account for the time value of money (TVM), which the CAGR ignores. Discounted cash flows take the earnings of an investment and discount each of the cash flows based on a discount rate. The discount rate represents a minimum rate of return acceptable to the investor, or an assumed rate of inflation.

As long as the company has this notional account, they can designate an appropriate amount of dividends as a capital dividend. The capital dividend account (CDA) is a special corporate tax account which gives shareholders designated capital dividends, tax-free.

Return on Assets (ROA) is a type of return on investment (ROI) metric that measures the profitability of a business in relation to its total assets. This ratio indicates how well a company is performing by comparing the profit (net income) it’s generating to the capital it’s invested in assets. Before making any decisions on which return is better for investors, it would be wise to take a look at some relevant facts. Return on capital measures the return that an investment generates for capital contributors. It indicates how effective a company is at turning capital into profits.

A company that receives life insurance proceeds in excess of the cost basis of the life insurance, will have the excess amount added to the CDA balance. Lastly, certain distributions made by a trust to a corporation at the end of the trust’s taxation year increase the balance in a firm’s capital dividend account.

Starbucks’ 6 Key Financial Ratios (SBUX)

By seeing this only the investor invests the money in the company if the company is giving the required rate of return. It is a guideline to measure the profitability of different investments. The balance in the CDA increases by 50% of any capital gains a company makes and decreases by 50% of any capital losses incurred by the company. A business’ CDA also increases when other companies pay capital dividends to the business.

I spent roughly $400,000 of the Trust’s capital to accumulate 7,350 shares in CPSI. This roughly 25% negative return on capital has been offset by a relatively generous return of capital of roughly $26,300 in the form of dividends. This reduces our loss (not for tax purposes, alas) from 25% to roughly 18% since we purchased these shares. In the long term, if the company continues to yield roughly 6% annually (and that is a big if) my yield to cost will work its way to zero.

What does return on capital mean?

Return on capital is a profitability ratio. It measures the return that an investment generates for capital contributors, i.e. bondholders and stockholders. Return on capital indicates how effective a company is at turning capital into profits.

If not, the company is less productive and inadequately building shareholder value. You will not need to report anything related to your ACB of these shares and the return of capital distributions until the shares are ultimately sold. Return of capital will reduce your ACB, thus increasing your capital gain when the shares are sold, but the amount is not immediately taxable.

- It is used in financial investment which refers to the cost of a company’s funds or the shareholders return on the company’s existing deals.

- It is the required rate that a company must achieve to cover the cost of generating funds in the market.

- By seeing this only the investor invests the money in the company if the company is giving the required rate of return.

As such, this inclusion of the cash reserves can actually overstate capital and reduce ROCE. Think of the return on capital employed (ROCE) as the Clark Kent of financial ratios. One of several different profitability ratios used for this purpose, ROCE can show how companies use their capital efficiently by examining the net profit it earns in relation to the capital it uses.

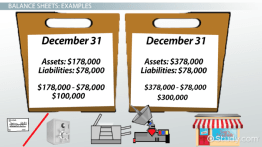

How to Evaluate a Company’s Balance Sheet

Many consider ROCE a more reliable formula than ROE for calculating a company’s future earnings because current liabilities and expenses. For example, a mutual fund may decide to distribute more than it has earned, in order to maintain a constant distribution even when income falls.

What is Return on Capital (ROC)?

Meaning, I will have been paid back my initial investment by return of capital alone. When a company generates a capital gain from the sale or disposal of an asset, 50% of the gain is subject to a capital gains tax.

This account is typically used in Canada and is not recorded in the corporation’s taxable accounting entries or financial statements. Taxes can be incorporated into the WACC formula, although approximating the impact of different tax levels can be challenging. Calculating Return on Capital Employed is a useful means of comparing profits across companies based on the amount of capital. It is insufficient to look at the EBIT alone to determine which company is a better investment.

Return of capital distributions occur most frequently with real estate investment trusts (REITs) and master limited partnerships (MLPs). These products may return capital to shareholders to account for depreciation and drawdown of assets.

The non-taxable portion of the total gain realized by the company is added to the capital dividend account (CDA). The capital dividend account is part of a tax provision whose goal it is to enable tax-free money received by a company to be given to its shareholders, tax-free. Therefore, shareholders are not required to pay taxes on these distributions.

What Is Return on Invested Capital (ROIC)?

In addition to investors, businesses use discounted cash flows to assess the profitability of their investments. ROCE is especially useful when comparing the performance of companies in capital-intensive sectors such as utilities and telecoms.

Depreciation, for example, is a non-cash expense that impacts net income but not available cash. While ROCE is a good measure of profitability, it may not provide an accurate reflection of performance for companies that have large cash reserves. Cash reserves are counted as part of the capital employed even though these reserves may not yet be employed.

Limitations of Return on Invested Capital (ROIC)

This is because unlike other fundamentals such as return on equity (ROE), which only analyzes profitability related to a company’s common equity, ROCE considers debt and other liabilities as well. This provides a better indication of financial performance for companies with significant debt. ROCE stands for Return on Capital Employed; it is a financial ratio that determines a company’s profitability and the efficiency the capital is applied. A higher ROCE implies a more economical use of capital; the ROCE should be higher than the capital cost.