On mortgage-backed security, the higher the interest rate relative to current interest rates, the higher the probability that the underlying mortgages will be refinanced. Prepayments are most commonly prepaid expenses in the corporate environment. These expenditures are paid in full in one accounting period for an underlying asset to be consumed in a future period. The prepayment is reclassified as a normal expense when the asset is actually used or consumed.

The calculation of this estimate is based on a number of factors, such as historical prepayment rates for previous loans similar to ones in the pool and future economic outlooks. These calculations are important when evaluating assets like mortgage-backed securities or other securitized bundles of loans. A bond is a debt investment in which an entity borrows money from an investor. The entity makes regular interest payments to the investor throughout the bond’s maturity period, at the end of which it returns the investor’s principal.

Prepayment risk is the risk involved with the premature return of principal on a fixed-income security. The risk of prepayment is most prevalent in fixed-income securities such as callable bonds and mortgage-backed securities (MBS). CPR helps anticipate prepayment risk, which is the risk involved with the premature return of principal on afixed-income security. The risk of prepayment is most prevalent in fixed-income securities such as callable bonds andmortgage-backed securities (MBS).

Prepayments by Individuals

For example, a pool of mortgages with a CPR of 8% indicates that for each period, 8% of the pool’s outstanding principal will be paid off. The CPR represents the anticipated paydown rate, stated as a percentage and calculated as an annual rate. It is often used for securities backed by debts, such as mortgage-backed securities (MBS), where a prepayment by the associated debtors may result in lower returns. A conditional prepayment rate (CPR) is a loan prepayment rate equivalent to the proportion of a loan pool’s principal that is assumed to be paid off ahead of time in each period.

Prepayment

A prepaid expense is first categorized as a current asset on the company’s balance sheet. Examine your mortgage papers and read the fine print in your loan statement regarding prepayment.

Is prepayment an expense?

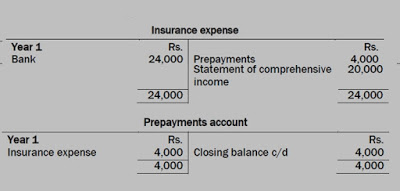

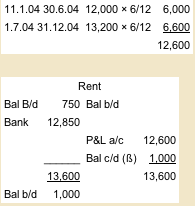

Accounting for Prepayments From the perspective of the buyer, a prepayment is recorded as a debit to the prepaid expenses account and a credit to the cash account. When the prepaid item is eventually consumed, a relevant expense account is debited and the prepaid expenses account is credited.

Additionally, investments in collateralized mortgage obligations (CMOs) and collateralized debt obligations (CDOs), structured through investment banks, lower the prepayment risk by design. Borrowers must be made aware of and agree to this provision at the time they take out the loan. The penalty typically only applies to paying off the entire balance, such as through refinancing. A borrower can usually make intermittent extra principal payments without penalty. For a bond with an embedded call option, the higher a bond’s interest rate relative to current interest rates, the higher the prepayment risk.

In addition to being highly correlated with falling interest rates, mortgage prepayments are highly correlated with rising home values. That’s because rising home values provide an incentive for borrowers to trade up in homes or use cash-out refinances, both leading to mortgage prepayments. There is no risk of CPR with corporate bonds or Treasury bonds (T-bonds), as these do not allow for prepayment.

- CPR helps anticipate prepayment risk, which is the risk involved with the premature return of principal on afixed-income security.

- Prepayment risk is the risk involved with the premature return of principal on a fixed-income security.

While this indicates that the investment is lower risk, since the amount owed is being paid back, it also leads to lower overall rates of returns. The higher the CPR, the faster the associated debtors prepay on their loans.

Prepayment charges are not necessarily final – you can negotiate with your bank and if you have good credit history they may reduce or even waive the prepayment fee. If your loan has a lower interest rate than the current rate of interest (if you have taken a fixed home loan) then banks would be more open to letting you prepay and waiving the fee. Our favourite fictional character, Mr. Shah has taken a loan 5 years ago, and wants to reduce his debt burden by making part prepayments. In some cases like with SBI, if the prepayment is out of your own income and not borrowed money, you can prepay any amount without incurring any penalty. You can opt to partly prepay your loan regularly, for example every 3 months, constantly reducing your principal outstanding, bringing down the amount of interest you will owe the bank.

Remember, the longer the tenure of the loan, the more the interest you are paying, so part prepayments are a good way of saving on interest payments. A high prepayment rate means the debts associated with the security are being paid back at a faster rate than the required minimum.

Does Working Capital Include Prepaid Expenses?

With a callable bond, the issuer has the option to return the investor’s principal early, after which the investor receives no more interest payments. Consequently, prepayment risk, which describes the chance of the issuer returning principal early and the investor missing out on subsequent interest, is only associated with callable bonds. Prepayment risk exists in some fixed-income securities with embedded call options that may be exercised by the issuer, or in the case of a mortgage-backed security, the borrower. These options give the issuer the right, but not the obligation, to redeem the bond before its scheduled maturity.

How are prepayments treated in accounting?

Prepayment is an accounting term for the settlement of a debt or installment loan before its official due date. Prepayments are the payment of a bill, operating expense, or non-operating expense that settle an account before it becomes due.

Determine the lender’s method of prepayment penalty by reading the loan agreement carefully. Mortgage holders seeking to pay off the loan principal early may incur a stiff penalty from their lender. These fees–called prepayment penalties–protect a lender from lost interest revenue incurred when a mortgage holder pays off a mortgage early. When considering mortgage prepayment, calculate a prepayment penalty on your mortgage to analyze the financial situation and minimize penalty fees.

How Credit Card Balance Transfers Work

The SMM is determined by taking the total debt payment owed and comparing it against the actual amounts received. For example, mortgages, student loans and pass-through securities all use CPR as estimates of prepayment.

In mortgage-backed security, mortgage holders may refinance or pay off their mortgages, which results in the security holder losing future interest. Because the cash flows associated with such securities are not certain, their yield-to-maturity cannot be known for certain at the time of purchase. If the bond was purchased at a premium (a price greater than 100), the bond’s yield is then less than what was estimated at the time of purchase. A conditional prepayment rate (CPR) indicates a loan prepayment rate at which a pool of loans, such as a mortgage backed security’s (MBS), outstanding principal is paid off. Investors who pay a premium for a callable bond with a high-interest rate take on prepayment risk.

The Public Securities Association Standard Prepayment model (PSA) is a model designed to forecast prepayment risk in a mortgage-backed security. As you might imagine, lenders and investors don’t always appreciate when you pay off debts early. When issuing a loan, lendersplanto earn a profit and receive regular payments from your loan. For most home loans issued after January 10, 2014, lenders can only impose prepayment penalties for the first three years of your loan, and the maximum penalty allowed is 2%. If you’re borrowing to buy a house, verify whether or not there is any prepayment penalty, and see if your loan falls under these rules—most loans do.