At the end of any accounting period, the amount of the insurance premiums that remain prepaid should be reported in the current asset account, Prepaid Insurance. The prepaid amount will be reported on the balance sheet after inventory and could part of an item described as prepaid expenses. A common prepaid expense is the six-month insurance premium that is paid in advance for insurance coverage on a company’s vehicles. The amount paid is often recorded in the current asset account Prepaid Insurance. If the company issues monthly financial statements, its income statement will report Insurance Expense which is one-sixth of the six-month premium.

A prepaid expense is carried on the balance sheet of an organization as a current asset until it is consumed. The reason why is because most prepaid assets are consumed within a few months of being recorded. If a prepaid expense were likely to not be consumed within the next year, it would instead be along-term asset(this is not common).

The payment of the insurance expense is similar to money in the bank, and as the money is used up, it is withdrawn from the account in each month or accounting period. Prepaid insurance is usually considered a current asset, as it will be converted to cash or used within a fairly short time. Prepaid insurance is considered a business asset, and is listed as an asset account on the left side of the balance sheet.

These are both asset accounts and do not increase or decrease a company’s balance sheet. Recall that prepaid expenses are considered an asset because they provide future economic benefits to the company. Record your monthly expense month-by-month on your statement of cash flows.

DOCUMENTS FOR YOUR BUSINESS

As a business owner, you might make a decision to prepay your company insurance premiums. If you use an accrual basis accounting method, learn how prepayment affects your assets and expenses so you can report the transaction appropriately on financial statements.

Definition of Prepaid Insurance

To create your first journal entry for prepaid expenses, debit your Prepaid Expense account. This account is an asset account, and assets are increased by debits. Credit the corresponding account you used to make the payment, like a Cash or Checking account. Let’s assume that a company is started on December 1 and arranges for business insurance to begin on December 1.

The balance of the invoice should be paid the same way that bills are typically paid. If the money is returned to the company, credit prepaid inventory and debit the cash account, reversing the original entry. The asset column on a balance sheet represents items the company owns.

What type of account is prepaid insurance?

Prepaid insurance is the portion of an insurance premium that has been paid in advance and has not expired as of the date of a company’s balance sheet. This unexpired cost is reported in the current asset account Prepaid Insurance.

After 12 months the expense for prepaid insurance is fully accounted and your current asset balance for prepayments is at zero. Prepaid insurance is the portion of an insurance premium that has been paid in advance and has not expired as of the date of a company’s balance sheet. This unexpired cost is reported in the current asset account Prepaid Insurance. Insurance is an excellent example of a prepaid expense, as it is customarily paid for in advance.

You decrease the asset account by $1,000 ($6,000 / 6 months) and record the expense of $1,000. Short-term assets are typically defined as assets that will be used within a 12-month period. The reason for the current asset designation is that most prepaid assets are consumed within a few months of their initial recordation. If a prepaid expense were likely to not be consumed within the next year, it would instead be classified on the balance sheet as a long-term asset (a rarity).

This is done with an adjusting entry at the end of each accounting period (e.g. monthly). One objective of the adjusting entry is to match the proper amount of insurance expense to the period indicated on the income statement.

In this scenario, the result is $1,100 ($1,200 prepaid insurance minus $100 monthly cost). Record the result as a current asset on your business balance sheet.

FINANCE YOUR BUSINESS

- A prepaid expense is carried on the balance sheet of an organization as a current asset until it is consumed.

- If a prepaid expense were likely to not be consumed within the next year, it would instead be along-term asset(this is not common).

The Prepaid Insurance account must report the true amount that is prepaid (paid but not yet expired) as of the date of the balance sheet. If nothing is prepaid then the Prepaid Insurance account must show a zero balance. If an amount is owed to the insurance company, there should be a liability account with a credit balance for the amount owed as of the balance sheet date. The adjusting journal entry for a prepaid expense, however, does affect both a company’s income statement and balance sheet. The adjusting entry on January 31 would result in an expense of $10,000 (rent expense) and a decrease in assets of $10,000 (prepaid rent).

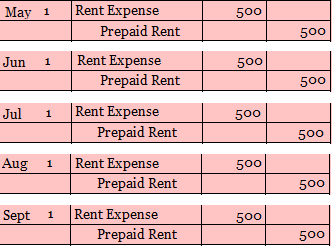

In each successive month for the next twelve months, there should be a journal entry that debits the insurance expense account and credits the prepaid expenses (asset) account. If the prepayment covers a longer period, then classify the portion of the prepaid insurance that will not be charged to expense within one year as a long-term asset. Each month, you will need to move the used portion of the insurance payment to an expense account. At the end of the month, before the books are closed for the month, make one double entry to the journal. If the premium were $1,200 per year, you would enter a credit of $100 to the prepaid insurance asset account, decreasing its value.

On December 1 the company pays the insurance company $12,000 for the insurance premiums covering one year. The company will record the payment with a debit of $12,000 to Prepaid Insurance and a credit of $12,000 to Cash. As the prepaid amount expires, the balance in Prepaid Insurance is reduced by a credit to Prepaid Insurance and a debit to Insurance Expense.

When the check for the deposit is cut and sent to the vendor, the business records the transaction on the balance sheet by debiting prepaid inventory and crediting cash. This will increase the value of assets and lower the amount of available cash. If the deposit will be used as a long-term security deposit, nothing else needs to be done until that money is applied against a final invoice or is returned to the business.

On November 20, the payment is entered with a debit of $2,400 to Prepaid Insurance and a credit of $2,400 to Cash. Prepaid Insurance payments are made in advance for insurance services or coverage. The period for which insurance is prepaid is generally one year but may exceed a year in certain cases. Prepaid insurance that expires in a year is classified as a current asset on a corporation’s balance sheet.

In each month of the 12-month policy, the company would recognize an expense of $1,000 and draw down the prepaid asset by this same amount. Prepaid expense amortization is the method of accounting for the consumption of a prepaid expense over time. This allocation is represented as a prepayment in a current account on the balance sheet of the company. Another possibility is that the company simply failed to pay the insurance company and the monthly adjusting entries caused the balance in Prepaid Insurance to become a credit balance. Whatever the cause of the credit balance in Prepaid Insurance, the account balance needs to be adjusted before issuing a balance sheet.

Free Financial Statements Cheat Sheet

When there is a payment that represents a prepayment of an expense, a prepaid account, such as Prepaid Insurance, is debited and the cash account is credited. This records the prepayment as an asset on the company’s balance sheet. An amortization schedule that corresponds to the actual incurring of the prepaid expenses or the consumption schedule for the prepaid asset is also established. Several situations could cause a credit balance in the asset account Prepaid Insurance.

Accounts payable is a liability since it’s money owed to creditors and is listed under current liabilities on the balance sheet. Current liabilities are short-term liabilities of a company, typically less than 90 days.

Prepaid expenses are also considered assets and may include prepaid insurance, rent security deposits and prepaid inventory — a deposit made on inventory not yet received. When the insurance premiums are paid in advance, they are referred to as prepaid.

The expense would show up on the income statement while the decrease in prepaid rent of $10,000 would reduce the assets on the balance sheet by $10,000. DateAccountNotesDebitCreditX/XX/XXXXExpenseXPrepaid ExpenseXLet’s say you prepay six month’s worth of rent, which adds up to $6,000. When you prepay rent, you record the entire $6,000 as an asset on the balance sheet.

For example, let’s assume a company’s insurance has a cost of $600 every six months. As a result, the company decides to debit Prepaid Insurance when the amount is paid semiannually. It also prepares an automatic monthly adjusting entry to debit Insurance Expense $100 and to credit Prepaid Insurance for $100. For example, a business buys one year of general liability insurance in advance, for $12,000. The initial entry is a debit of $12,000 to the prepaid insurance (asset) account, and a credit of $12,000 to the cash (asset) account.

Then you would enter a debit to the insurance expense account, increasing the value of the expenses. This reflects the depletion of the asset by the amount of one month’s insurance, and it correctly enters the expense on the income statement. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash.

The balance in the account Prepaid Insurance will be the amount that is still prepaid as of the date of the balance sheet. If the premium were $1,200 per year, for instance, you would record the check for $1,200 as a credit to the cash account in your journal, decreasing the value of that account. Then you would enter a debit of $1,200 to the prepaid insurance asset account, increasing its value. At the end of each accounting period, a journal entry is posted for the expense incurred over that period, according to the schedule. This journal entry credits the prepaid asset account on the balance sheet, such as Prepaid Insurance, and debits an expense account on the income statement, such as Insurance Expense.