Instead of being a form of debt equity, preferred stock works more like a bond than it does like a share in a company. Companies issue preferred stock as a way to obtain equity financing without sacrificing voting rights. A participating preferred dividend is a type of preferred stock that pays a set rate of interest per year. The advantage of this type of preferred stock is that investors can also receive a portion of retained earnings paid to common shareholders in addition to the fixed dividend payment.

This differs from how common stock shareholders, who benefit whenever a company grows, are paid. Why companies issue preferred stock is different than the reason they go public and offer common stock. Preferred stock is a form of equity, or a stake in the company’s ownership.

Nonetheless, there can be a place for preferred shares in a diversified investment portfolio. One way of looking at them is not so much as an alternative to common stock, but as an equity related to a bond. These shares have terms from 30 to 50 years in length, or are perpetual with no maturity date no matter how long they are held. Plus, some of the 30-year stocks can be extended for an extra 19 years if desired. Preferred shareholders receive a return that’s based on dividend yield, and this can be a floating or a fixed rate.

Participating preferred stock is mainly issued by newer companies that are in need of a cash infusion. Preferred stock derives its name from the fact that it carries a higher privilege by almost every measure in relation to a company’s common stock. Preferred stock owners are paid before common stock shareholders in the event of the company’s liquidation. Preferred stockholders enjoy a fixed dividend that, while not absolutely guaranteed, is nonetheless considered essentially an obligation the company must pay. Preferred stockholders must be paid their due dividends before the company can distribute dividends to common stockholders.

Preference Shares: Advantages and Disadvantages

Although the guaranteed return on investment makes up for this shortcoming, if interest rates rise, the fixed dividend that once seemed so lucrative can dwindle. This could cause buyer’s remorse with preference shareholder investors, who may realize that they would have fared better with higher interest fixed-income securities.

Preferred stock shareholders may or may not enjoy any of the voting rights of those holding common stock. Also, unlike common stock, a preferred stock pays a fixed dividend that does not fluctuate.

Common stockholders fall in line to receive payment after preferred shareholders, but if the company folds, all debt holders get paid before any stockholders, preferred or common. Preference shares are valued by investors as a way to reduce risk while ensuring preferred status for payment if the company files bankruptcy. Like common stock, preferred stocks represent partial ownership in a company.

Preferred Stocks

When companies issue stock, they typically offer both common and preferred shares. Preferred stock differs from common stock in that it takes priority, which means that a company must pay dividends to preferred stockholders before making payments to holders of common stock. Additionally, preferred stock dividends generally yield more than those of common stock. Preferred stock holders also get to claim assets from a company’s liquidation before common stock holders but after debt holders.

A preferred stock is an equity investment that shares many characteristics with bonds, including the fact that they are issued with a face value. Like bonds, preferred stocks pay a dividend based on a percentage of the fixed face value. The market value of a preferred stock is not used to calculate dividend payments, but rather represents the value of the stock in the marketplace. It’s possible for preferred stocks to appreciate in market value based on positive company valuation, although this is a less common result than with common stocks. Preferred stocks usually trade right around par value, and almost all preferred stock issued is callable at par value.

The benefits of preferred stock are very limited, and when the call date is near, there’s almost no upside. Preferred stocks are rarely ever rated highly and are sometimes called junk bonds, though not all qualify as junk bonds. Long-term investors who are focused on earning dividends at a fixed rate of return choose preferred stocks. This is a way to earn a fixed rate of return and avoid the rising and falling values of common shares in the stock market. While basically a form of stock investment, preferred stockholders are in the payout lineup right behind the debt holders in a company’s credit holder lineup.

Preference shares, which are issued by companies seeking to raise capital, combine the characteristics of debt and equity investments, and are consequently considered to be hybrid securities. On the upside, they collect dividend payments before common stock shareholders receive such income. But on the downside, they do not enjoy the voting rights that common shareholders typically do. They may issue preferred stocks because they’ve already loaded their balance sheet with a large amount of debt and risk a downgrade if they piled on more.

- Like bonds, preferred stocks pay a dividend based on a percentage of the fixed face value.

- A preferred stock is an equity investment that shares many characteristics with bonds, including the fact that they are issued with a face value.

Issuing preferred stock provides a company with a means of obtaining capital without increasing the company’s overall level of outstanding debt. This helps keep the company’s debt to equity (D/E) ratio, an important leverage measure for investors and analysts, at a lower, more attractive level.

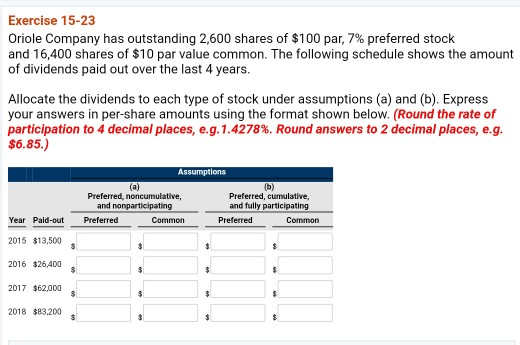

What is the difference between nonparticipating and participating preferred stock?

Put another way, participating preferred stock entitles the holder to its investment amount back (plus an accrued dividend, if applicable) first AND its pro rata “common upside” in the company, while nonparticipating preferred stock entitles the holder to the GREATER OF its investment amount back (plus an accrued

Thus, the company must pay all unpaid preferred dividends accumulated during previous periods before it can pay dividends to common shareholders. If the company is unable to pay this dividend, the preferred shareholders may have the right to force a liquidation of the company. If the dividend is not cumulative, preferred shares are not paid a dividend until the board of directors approves of a dividend.

What Is Participating Preferred Stock?

Often, preferred stock does not come with the same voting rights that all common stock confers. Preferred shareholders have a prior claim on a company’s assets if it is liquidated, though they remain subordinate to bondholders. Preferred shares are equity, but in many ways, they are hybrid assets that lie between stock and bonds. They offer more predictable income than common stock and are rated by the major credit rating agencies. Unlike with bondholders, failing to pay a dividend to preferred shareholders does not mean a company is in default.

The additional dividend paid to preferred shareholders is commonly structured to be paid only if the amount of dividends that common shareholders receive exceeds a specified per-share amount. Sometimes preferred stock is issued without a maturity date, in which case the shares are considered perpetual.

Preference shares, more commonly referred to as preferred stock, are shares of a company’s stock with dividends that are paid out to shareholders before common stock dividends are issued. If the company enters bankruptcy, preferred stockholders are entitled to be paid from company assets before common stockholders. Most preference shares have a fixed dividend, while common stocks generally do not. Preferred stock shareholders also typically do not hold any voting rights, but common shareholders usually do. Preferred stocks are technically stock investments, standing behind debt holders in the credit lineup.

Preferred shareholders receive preference over common stockholders, but in the case of a bankruptcy all debt holders would be paid before preferred shareholders. And unlike with common stock shareholders, who benefit from any growth in the value of a company, the return on preferred stocks is a function of the dividend yield, which can be either fixed or floating.

Preferred stock is sold at a par value and paid a regular dividend that is a percentage of par. Preferred stockholders do not typically have the voting rights that common stockholders do, but they may be granted special voting rights. The market prices of preferred stocks tend to act more like bond prices than common stocks, especially if the preferred stock has a set maturity date. Preferred stocks rise in price when interest rates fall and fall in price when interest rates rise.

Participating preferred stock is a type of preferred stock in which preferred stockholders may be issued a special dividend if certain financial goals are achieved by the company. One financial goal may be that the share price of the common stock increases above a predetermined level.

Understanding Preferred Stocks

Adjustable-rate shares specify certain factors that influence the dividend yield, and participating shares can pay additional dividends that are reckoned in terms of common stock dividends or the company’s profits. The decision to pay the dividend is at the discretion of a company’s board of directors. The nature of preferred stock provides another motive for companies to issue it. With its regular fixed dividend, preferred stock resembles bonds with regular interest payments. However, unlike bonds that are classified as a debt liability, preferred stock is considered an equity asset.

For example, regulators might limit the amount of debt a company is allowed to have outstanding. Suppose Company A issues participating preferred shares with a dividend rate of $1 per share. The preferred shares also carry a clause on extra dividends for participating preferred stock, which is triggered whenever the dividend for common shares exceeds that of the preferred shares. Participating preferred stock—like other forms of preferred stock—takes precedence in a firm’s capital structure over common stock but ranks below debt in liquidation events.

The yield generated by a preferred stock’s dividend payments becomes more attractive as interest rates fall, which causes investors to demand more of the stock and bid up its market value. This tends to happen until the yield of the preferred stock matches the market rate of interest for similar investments. The main disadvantage of owning preference shares is that the investors in these vehicles don’t enjoy the same voting rights as common shareholders. This means that the company is not beholden to preferred shareholders the way it is to traditional equity shareholders.

Because preferred shareholders do not enjoy the same guarantees as creditors, the ratings on preferred shares are generally lower than the same issuer’s bonds, with the yields being accordingly higher. Preferred shareholders have priority over common stockholders when it comes to dividends, which generally yield more than common stock and can be paid monthly or quarterly. These dividends can be fixed or set in terms of a benchmark interest rate like the LIBOR.