Accumulated depreciation is shown in the face of the balance sheet or in the notes. Using depreciation, a business expenses a portion of the asset’s value over each year of its useful life, instead of allocating the entire expense to the year in which the asset is purchased.

On a business’s balance sheet, capital assets are represented by the property, plant, and equipment (PP&E) figure. Property, plant, and equipment (PP&E) are long-term assets vital to business operations and not easily converted into cash. Purchases of PP&E are a signal that management has faith in the long-term outlook and profitability of its company. Companies that are expanding may decide to purchase fixed assets to invest in the long-term future of the company. These purchases are called capital expenditures and significantly impact the financial position of a company.

What are characteristics of plant assets?

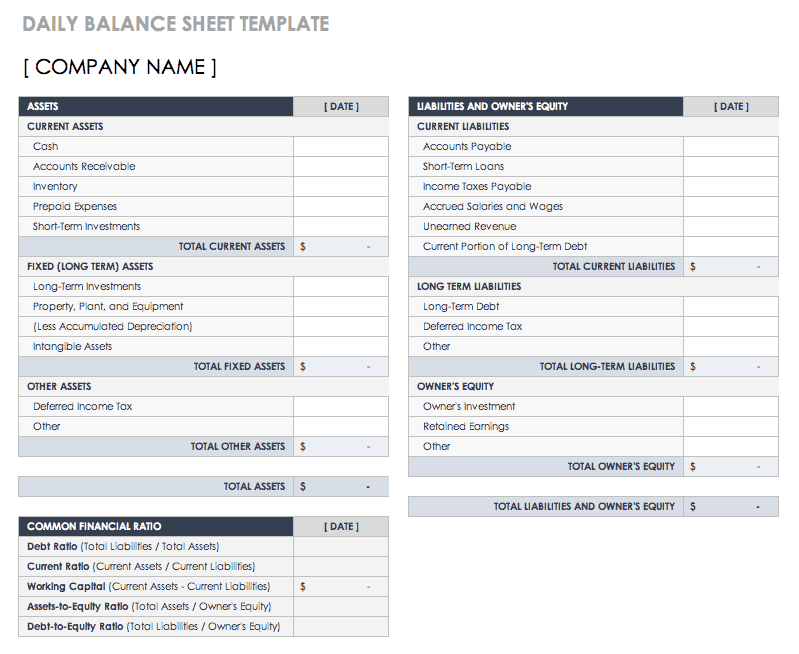

Current assets include items such as cash, accounts receivable, and inventory. Property, plant, and equipment – which may also be called fixed assets – encompass land, buildings, and machinery including vehicles. Finally, intangible assets are goods that have no physical presence.

Prepaid Assets

In cases where this is not possible and the cost of moving is substantial, it is capitalized and depreciated appropriately over the period during which it makes a contribution to operations. (g) Cost of plywood partitions erected in the remodeling of the office. This is a part of the remodeling cost and may be capitalized as part of the remodeling itself is of such a nature that it is an addition to the building and not merely a replacement or repair. This seems more in the nature of a repair than anything else and as such should be treated as an expense.

Free Financial Statements Cheat Sheet

(f) Trade or exchange of assets—when one asset is exchanged for another asset, the accountant is faced with several issues in determining the value of the new asset. The basic principle involved is to record the new asset at the fair value of the new asset or the fair value of what is given up to acquire the new asset, whichever is more clearly evident. However, the accountant must also be concerned with whether the exchange has commercial substance and whether monetary consideration is involved in the transaction. The commercial substance issue rests on whether the expected cash flows on the assets involved are significantly different. In addition, monetary consideration may affect the amount of gain recognized on the exchange under consideration.

As such it may be viewed as an extraordinary repair and charged against the accumulated depreciation on the truck. The remaining service life of the truck should be estimated and the depreciation adjusted to write off the new book value, less salvage, over the remaining useful life. A more appropriate treatment is to remove the cost of the old motor and related depreciation and add the cost of the new motor if possible.

In a deferred payment situation, there is an implicit (or explicit) interest cost involved, and the accountant should be careful not to include this amount in the cost of the asset. (e) Lump sum or basket purchase—sometimes a group of assets are acquired for a single lump sum. When a situation such as this exists, the accountant must allocate the total cost among the various assets on the basis of their relative fair value.

Plant assets and the related accumulated depreciation are reported on a company’s balance sheet in the noncurrent asset section entitled property, plant and equipment. Accounting rules also require that the plant assets be reviewed for possible impairment losses. In financial accounting, an asset is any resource owned by the business. Anything tangible or intangible that can be owned or controlled to produce value and that is held by a company to produce positive economic value is an asset. Simply stated, assets represent value of ownership that can be converted into cash (although cash itself is also considered an asset).

Is plant assets a current asset?

A plant asset is an asset with a useful life of more than one year that is used in producing revenues in a business’s operations. Plant assets are also known as fixed assets. Plant assets are recorded at their cost and depreciation expense is recorded during their useful lives.

Noncurrent assets are a company’s long-term investments for which the full value will not be realized within the accounting year. Examples of noncurrent assets include investments in other companies, intellectual property (e.g. patents), and property, plant and equipment. Noncurrent assets appear on a company’s balance sheet. Accumulated depreciation is an asset account with a credit balance known as a long-term contra asset account that is reported on the balance sheet under the heading Property, Plant and Equipment.

The amount of a long-term asset’s cost that has been allocated, since the time that the asset was acquired. Also referred to as PPE (property, plant, and equipment), these are purchased for continued and long-term use in earning profit in a business. They are written off against profits over their anticipated life by charging depreciation expenses (with exception of land assets).

- (a) Overhead of a business that builds its own equipment.

(c) Interest paid during construction of a building. This is an addition to the machine and should be capitalized in the machinery account if material. (e) Freight on equipment returned before installation, for replacement by other equipment of greater capacity. If ordering the first equipment was an error, whether due to judgment or otherwise, the freight should be regarded as a loss. Normally, only the cost of one installation should be capitalized for any piece of equipment.

Contributions received should be credited to revenue unless the contribution is from a governmental unit. Even in that case, we believe that the credit should be to Contribution Revenue. (c) Cash discount—when assets are purchased subject to a cash discount, the question of how the discount should be handled occurs. If the discount is taken, it should be considered a reduction in the asset cost. Different viewpoints exist, however, if the discount is not taken.

Understanding Noncurrent Assets

(a) Assets acquired by issuance of capital stock—when property is acquired by issuance of common stock, the cost of the property is not measured by par or stated value of such stock. If the market value of the common stock is not determinable, then the market value of the property should be established and used as the basis for recording the asset and issuance of common stock. (b) Assets acquired by gift or donation—when assets are acquired in this manner a strict cost concept would dictate that the valuation of the asset be zero. However, in this situation, accountants record the asset at its fair value.

How Do Tangible and Intangible Assets Differ?

However, a more realistic figure for cost of equipment results if the plant asset account is charged for overhead applied on the same basis and at the same rate as used for production. Some accountants treat all cash discounts as financial or other revenue, regardless of whether they arise from the payment of invoices for merchandise or plant assets. Others take the position that only the net amount paid for plant assets should be capitalized on the basis that the discount represents a reduction of price and is not income. The latter position seems more logical in light of the fact that plant assets are purchased for use and not for sale and that they are written off to expense over a long period of time.

Whether a portion of available cash is used, or the asset is financed by debt or equity, how the asset is financed has an impact on the financial viability of the company. This can be misleading when an outsider is trying to gain an understanding of the value of a business by perusing its financial statements. The first class of expenditures represents the day-to-day service and in general is chargeable to operations as incurred. These expenditures should not be charged to the asset accounts.

One approach is that the discount must be considered a reduction in the cost of the asset. The rationale for this approach is that the terms of these discounts are so attractive that failure to take the discount must be considered a loss because management is inefficient. The other view is that failure to take the discount should not be considered a loss, because the terms may be unfavorable or the company might not be prudent to take the discount. (d) Deferred payments—assets should be recorded at the present value of the consideration exchanged between contracting parties at the date of the transaction.

What is a plant asset?

(a) Overhead of a business that builds its own equipment. Some accountants have maintained that the equipment account should be charged only with the additional overhead caused by such construction.

This means that each year that the equipment or machinery is put to use, the cost associated with using up the asset is recorded. The rate at which a company chooses to depreciate its assets may result in a book value that differs from the current market value of the assets.

The balance sheet of a firm records the monetary value of the assets owned by that firm. It covers money and other valuables belonging to an individual or to a business. A capital asset is generally owned for its role in contributing to the business’s ability to generate profit. Furthermore, it is expected that the benefits gained from the asset will extend beyond a time span of one year.