The Phases Of Physical Inventory

Physical inventory is a process where a business physically counts its entire inventory. Businesses may use several different tactics to minimize the disruption caused by physical inventory. Counting your inventory correctly is critical because it’s used to calculate one of the most important financial indicators for some types of business – Cost of Goods Sold (COGS).

Cycle Counts

By performing a physical inventory count a business can keep its information accurate and current. How often should a company go through the warehouse and track their products and supplies? Inventory controlling helps revenue and expenses be recognized.

There are companies that only perform inventory counts once a year or right before a given sales season. Usually, these companies do not have many products to track. Other organizations might opt for this method because they do not have the staff to carry out frequent inventory or the tools to make physical counts simpler. This type of stocktake is performed regularly, such as once every week, and includes the counting of a warehouse’s smaller manageable parts.

It is clear to most businesses that performing stocktaking at least once a month is essential to maintain healthy stock levels, prevent stock losses and ensure the accuracy of inventory/accounting records. However, if not done right, stocktaking can be energy-draining, time-consuming and frustrating. Businesses face the risk of serious human errors such as undercounting or overcounting that could result in losses worth thousands if they don’t devise a clear plan for success.

The most important thing to know about inventory is that it’s essential in calculating the cost of goods sold (COGS). COGS is used to determine gross profit for a business that sells products, and it’s used on every business tax form, for sole proprietorships, partnerships, LLC’s, and corporations. Periodic stocktaking – an inventory method that happens at the end of an accounting period or on a set periodic basis. This method will help you effortlessly keep up-to-date records of either your inventory or costs of goods sold.

Controlling Inventory

The auditors will examine your procedures for halting any further receiving into the warehouse or shipments from it at the time of the physical inventory count, so that extraneous inventory items are excluded. They typically test the last few receiving and shipping transactions prior to the physical count, as well as transactions immediately following it, to see if you are properly accounting for them. When you sell that inventory THEN it becomes an expense through the Cost of Goods Sold account. To start with, you don’t want too large a portion of your business’s funds to be tied up in merchandise, and you could risk losing money if you’re not able to sell the products in time.

Boundless Accounting

General business supplies are shown as an expense in your business tax report, while supplies used in sales are included in cost of goods sold. Smooth and painless stocktakes don’t happen by accident.

As a result, an incorrect inventory balance causes an error in the calculation of cost of goods sold and, therefore, an error in the calculation of gross profit and net income. A general rule is that overstatements of ending inventory cause overstatements of income, while understatements of ending inventory cause understatements of income. Since financial statement users depend upon accurate statements, care must be taken to ensure that the inventory balance at the end of each accounting period is correct. It is also vital that accountants and business owners fully understand the effects of inventory errors and grasp the need to be careful to get these numbers as correct as possible.

- The cost of selling your inventory (called cost of goods sold) is an important cost for your business.

- It includes the cost of buying those products, raw materials, and component parts.

This is because rising costs have a direct impact on profitability. In order to calculate the cost of inventory you must determine the beginning and ending value of inventory along with the value of purchased inventory over a given time period. Be sure you know the difference between supplies used in your business and supplies used in the cost of sales.

Even with good inventory management software, periodically you still need to actually count your inventory to make sure what you have in stock matches what you think you have. Goods should be sold in the same chronological order as they were purchased or created. This is especially important for perishable products like food, flowers, and makeup.

To complete a full cycle over a specific time- period, people performing cyclic stocktaking choose a range to count and incrementally work around a warehouse. A new cycle begins after the completion of one full cycle. Unlike full stocktake, cyclic stocktake is not performed once a month to achieve operational benefit.

The cost of selling your inventory (called cost of goods sold) is an important cost for your business. It includes the cost of buying those products, raw materials, and component parts. It also includes costs of warehousing (storing) inventory, shipping products to customers, running a storage facility or warehouse, and hiring people to work in the warehouse.

A bar owner, for example, has to be cognizant of the materials behind the bar and apply FIFO methods to improve bar inventory. It’s also a good idea for nonperishable goods since items sitting around for too long might become damaged, or otherwise out of date and unsellable. The best way to apply FIFO in a storeroom or warehouse is to add new items from the back so the older products are at the front.

The weighted average method requires valuing both inventory and the cost of goods sold based on the average cost of all materials bought during the period. Many companies are aware of how important it is too keep track of their inventory. Faulty inventory projections create shortages, unsold goods and wasted warehouse space.

Periodic inventory is when information about amount and availability of a product is updated only periodically. Physical inventories are conducted at set time intervals; both cost of goods sold and the inventory are adjusted at the time of the physical inventory. Most companies who use periodic inventory perform this at year-end.

What is the meaning of physical inventory?

Physical inventory is a process where a business physically counts its entire inventory. A perpetual inventory system tracks the receipt and use of inventory, and calculates the quantity on hand. Cycle counting, an alternative to physical inventory, may be less disruptive.

So, you can see that if your inventory count is incorrect, your COGS won’t be accurate either! In some businesses, COGS accounts for one third of the total business expenses, so it is important to have a good handle on these costs. In addition, monitoring your COGS is a good way to identify operational problems within your business. The cost of inventory is one of the most important considerations of any business trying to make a profit.

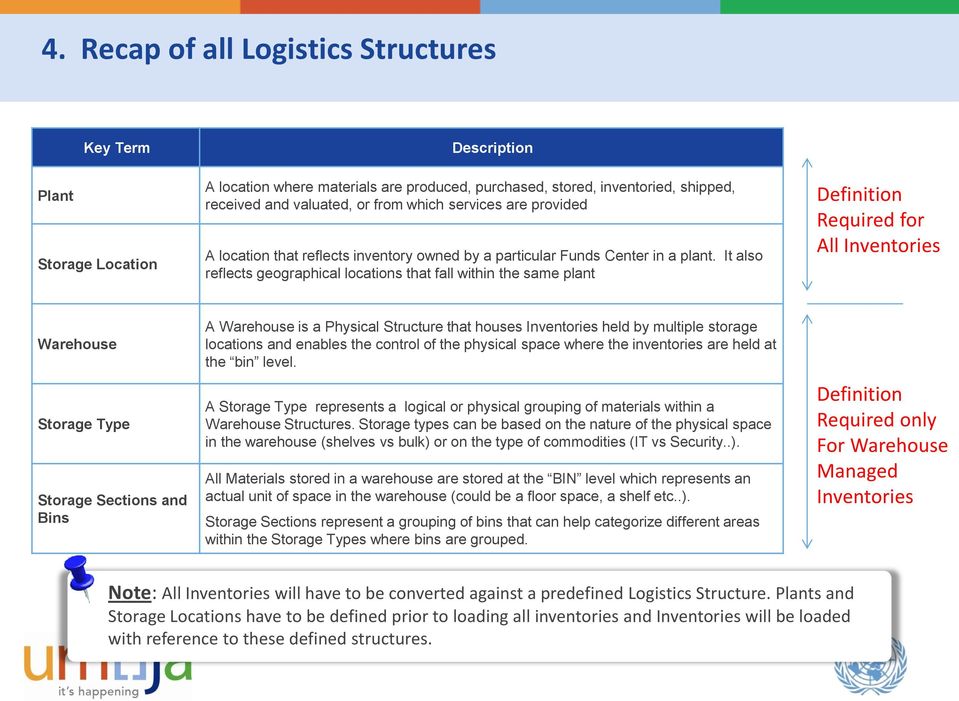

The process typically involves a retail staff member (or team of workers) going through the retailer’ sales floor and stock room and counting each item. The data is then recorded either manually, using pen and paper or electronically using a mobile device. Inventory management is the part of supply chain management that aims to always have the right products in the right quantity for sale, at the right time. When done effectively, businesses reduce the costs of carrying excess inventory while maximizing sales.

Periodic Inventory

Good inventory management can help you track your inventory in real time to streamline this process. Companies perform a physical inventory for several reasons including to satisfy financial accounting rules or tax regulations, or to compile a list of items for restocking.

Details are planned well in advance and the products, materials, and tools you’ll be using are prepared beforehand. If you intend to do physical inventory counts anytime soon, be sure to complete the tasks we talked about above. A physical inventory count is the practice of counting your retail products in person.