The USD 509 cost of goods sold is an expense on the income statement, and the USD 181 ending inventory is a current asset on the balance sheet. The specific identification costing method attaches cost to an identifiable unit of inventory. The method does not involve any assumptions about the flow of the costs as in the other inventory costing methods. Conceptually, the method matches the cost to the physical flow of the inventory and eliminates the emphasis on the timing of the cost determination. Therefore, periodic and perpetual inventory procedures produce the same results for the specific identification method.

Manufacturing and merchandising businesses may use accounts named Cost of Goods Sold or Cost of Goods Manufactured. As with any debit account, all of these accounts are increased by debits and decreased by credits. If the purchase price of the merchandise you buy to resell is fairly stable, FIFO will better match your inventory costs to sales revenue. Using FIFO also gives a higher inventory value on your balance sheet, which is useful if you want to get a business loan. If the cost of your inventory tends to fluctuate or increases quickly, LIFO gives a more accurate valuation of your inventory.

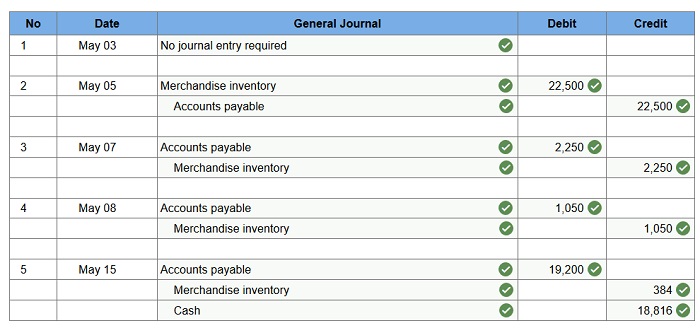

At the end of a period, the Purchase account is zeroed out with the balance moving into Inventory. Increases could also be due to sales returns and in that situation, the journal entry involving inventory is to debit Inventory and credit Cost of Goods Sold. Often, a separate inventory account for returned goods is used — apart from the regular inventory.

COGS is not addressed in any detail in generally accepted accounting principles (GAAP), but COGS is defined as only the cost of inventory items sold during a given period. Not only do service companies have no goods to sell, but purely service companies also do not have inventories. If COGS is not listed on the income statement, no deduction can be applied for those costs. During periods of inflation, LIFO shows the largest cost of goods sold of any of the costing methods because the newest costs charged to cost of goods sold are also the highest costs. The larger the cost of goods sold, the smaller the net income.

A firm needs to have at least one account for inventory — an asset account with a regular debit balance. Manufacturing firms may have more than one inventory account, such as Work-in-Process Inventory and Finished Goods Inventory. Some firms also use a Purchase account (debit account) to recognize inventory purchases.

Generally speaking, the Internal Revenue Service (IRS) allows companies to deduct the cost of goods that are used to either make or purchase the products they sell for their business. For accounting and tax purposes, these are listed under the entry line-item cost of goods sold (COGS). This reduction can be a major benefit to companies in the manufacturing or mining sectors that have lengthy production processes and COGS figures that are high. However, not all businesses can claim a COGS deduction, because not all businesses can list COGS on their income statement. Inventory assets are goods or items of value that a company plans to sell for profit.

What is an example of merchandise inventory?

Merchandise inventory is the cost of goods on hand and available for sale at any given time. Merchandise inventory (also called Inventory) is a current asset with a normal debit balance meaning a debit will increase and a credit will decrease.

Excess inventory, however, can also become a liability, as it may cost resources to store, and it may have a limited shelf life, meaning it can expire or become out of date. Examples include food which can eventually spoil, computers which can become obsolete, securities that lose too much of their value, or clothing that can go out of style or become no longer fashionable. Your business may be forced to either dispose of these assets or sell them at a loss. Therefore, to keep inventory from becoming a liability or loss, a business must not store too much at any time.

The calculation of the cost of goods sold is focused on the value of your business’s inventory. If you are selling a physical product, inventory is what you sell. Your business inventory might be items you have purchased from a wholesaler or that you have made yourself and are reselling.

Merchandiser Inventory Types

- Generally speaking, the Internal Revenue Service (IRS) allows companies to deduct the cost of goods that are used to either make or purchase the products they sell for their business.

- For accounting and tax purposes, these are listed under the entry line-item cost of goods sold (COGS).

These items include any raw production materials, merchandise, and products that are either finished or unfinished. They also include any kind of securities that a stock broker or dealer buys and then sells.

However, at the same time, your company also does not want to have too little inventory, as shortages can cost sales. This is because it can drive customers to other businesses that can meet their demands and can also decrease your business’s reputation by creating a dissatisfying experience for your customers. To illustrate, assume that the company in can identify the 20 units on hand at year-end as 10 units from the August 12 purchase and 10 units from the December 21 purchase. The company computes the ending inventory as shown in; it subtracts the USD 181 ending inventory cost from the USD 690 cost of goods available for sale to obtain the USD 509 cost of goods sold. Note that you can also determine the cost of goods sold for the year by recording the cost of each unit sold.

Thus, they mistakenly assume items that have been stolen have been sold and include their cost in cost of goods sold. There are also costs of revenue for ongoing contract services that can even include raw materials, direct labor, shipping costs, and commissions paid to sales employees. Even these cannot be claimed as COGS without a physically produced product to sell, however. The IRS website even lists some examples of “personal service businesses” that do not calculate COGS on their income statements. Many service companies do not have any cost of goods sold at all.

Accounting Principles I

The weighted average method is useful if your business sells standardized or identical items such as gallons of gasoline or heating oil. Your accountant can advise you on which inventory system is best suited for your business. Inventory is the array of finished goods or goods used in production held by a company. Inventory is classified as a current asset on a company’s balance sheet, and it serves as a buffer between manufacturing and order fulfillment.

Merchandise Inventory

When an inventory item is sold, its carrying cost transfers to the cost of goods sold (COGS) category on the income statement. The journal entry to increase inventory is a debit to Inventory and a credit to Cash. If a business uses the purchase account, then the entry is to debit the Purchase account and credit Cash.

You might also keep an inventory of parts or materials for products that you make. Inventory is an important business asset, with a specific value. Under periodic inventory procedure, companies do not use the Merchandise Inventory account to record each purchase and sale of merchandise.

Instead, a company corrects the balance in the Merchandise Inventory account as the result of a physical inventory count at the end of the accounting period. Also, the company usually does not maintain other records showing the exact number of units that should be on hand. Although periodic inventory procedure reduces record-keeping, it also reduces control over inventory items. Firms assume any items not included in the physical count of inventory at the end of the period have been sold.