Imagine that you loaned a friend $1,000 dollars for one year at an interest rate of 10%. When you adjust your nominal rate of return to adjust for the inflation, your real rate of return is only 6%.

A real rate of return is the annual percentage return realized on an investment, which is adjusted for changes in prices due to inflation or other external factors. Adjusting the nominal return to compensate for factors such as inflation allows you to determine how much of your nominal return is a real return. Conversely, the nominal rate of return strips out outside factors that can affect performance such as taxes and inflation. For example, if the nominal interest rate offered on a three-year deposit is 4% and the inflation rate over this period is 3%, the investor’s real rate of return is 1%.

Its periodic interest rate is 0.00033, or if you are compounding the daily periodic rate, it would be the equivalent of 0.03%. In this analysis, the nominal rate is the stated rate, and the real interest rate is the interest after the expected losses due to inflation. Since the future inflation rate can only be estimated, the ex ante and ex post (before and after the fact) real interest rates may be different; the premium paid to actual inflation (higher or lower). The Fisher Effect can be seen each time you go to the bank; the interest rate an investor has on a savings account is really the nominal interest rate.

What is the difference between real and nominal?

A real interest rate is an interest rate that has been adjusted to remove the effects of inflation to reflect the real cost of funds to the borrower and the real yield to the lender or to an investor. A nominal interest rate refers to the interest rate before taking inflation into account.

An interest rate is called nominal if the frequency of compounding (e.g. a month) is not identical to the basic time unit in which the nominal rate is quoted (normally a year). In the Fisher Effect, the nominal interest rate is the provided actual interest rate that reflects the monetary growth padded over time to a particular amount of money or currency owed to a financial lender.

Difference Between Effective and Nominal Interest Rates

A real interest rate is an interest rate that has been adjusted to remove the effects of inflation to reflect the realcost of fundsto the borrower and the real yield to the lender or to an investor. The effective annual interest rate is the real return on an investment, accounting for the effect of compounding over a given period of time. To avoid purchasing power erosion through inflation, investors consider the real interest rate, rather than the nominal rate.

The Fisher Effect is an economic theory created by economist Irving Fisher that describes the relationship between inflation and both real and nominal interest rates. The Fisher Effect states that the real interest rate equals the nominal interest rate minus the expected inflation rate. Therefore, real interest rates fall as inflation increases, unless nominal rates increase at the same rate as inflation.

You must know a loan’s nominal rate and the number of compounding periods to calculate its effective annual interest rate. Now add this number to 1 and take the sum by the power of the number of compounding interest rates. A periodic interest rate is a rate than can be charged on a loan, or realized on an investment over a specific period of time.

What Is the Effective Interest Method of Amortization?

One way to estimate the real rate of return in the United States is to observe the interest rates on Treasury Inflation-Protected Securities (TIPS). The difference between the yield on a Treasury bond and the yield on TIPS of the same maturity provides an estimate of inflation expectations in the economy. The number of compounding periods directly affects the periodic interest rate of an investment or a loan. An investment’s periodic rate is 1% if it has an effective annual return of 12% and it compounds every month.

For example, if the nominal interest rate on a savings account is 4% and the expected rate of inflation is 3%, then the money in the savings account is really growing at 1%. The smaller the real interest rate, the longer it will take for savings deposits to grow substantially when observed from a purchasing power perspective. Fisher’s equation reflects that the real interest rate can be taken by subtracting the expected inflation rate from the nominal interest rate.

A nominal rate can mean a rate before adjusting for inflation, and a real rate is a constant-prices rate. Nominal interest rates are not comparable unless their compounding periods are the same; effective interest rates correct for this by “converting” nominal rates into annual compound interest. Whether you’re paying interest on a debt or earning interest on savings and investments, the nominal interest rate is the figure used before considering inflation. Nominal interest rates are the ones advertised on financial products, but once they are adjusted for inflation, these can go up or down in real terms. The nominal interest rate is the interest rate before taking inflation into account, in contrast to real interest rates and effective interest rates.

If an investment generated a 10% return, the nominal rate would equal 10%. After factoring in inflation during the investment period, the actual return would likely be lower.

A real interest rate is the interest rate that takes inflation into account. This means it adjusts for inflation and gives the real rate of a bond or loan. To calculate the real interest rate, you first need the nominal interest rate. The calculation used to find the real interest rate is the nominal interest rate minus the actual or expected inflation rate.

- The real interest rate represents the recent nominal interest rate minus the recent inflation rate.

- The nominal interest rate is the quoted interest rate, while the real interest rate is defined as the nominal interest rate minus the expected rate of inflation.

- Investors require a positive real return, which suggests that they will only invest funds if the nominal interest rate is expected to exceed inflation.

Lenders typically quote interest rates on an annual basis, but the interest compounds more frequently than annually in most cases. The periodic interest rate is the annual interest rate divided by the number of compounding periods. Confusingly, in the context of inflation, ‘nominal’ has a different meaning.

A nominal rate of return or a raise in the nominal wage rate may not nearly be as valuable when adjusted for inflation. On the other hand, some assets’ real value may greatly exceed their nominal values, as in the case of collectible coins, stamps, and securities.

However, a necessary condition for such stimulus measures is that inflation should not be a present or a near-term threat. for interest rates “as stated” without adjustment for the full effect of compounding (also referred to as the nominal annual rate).

On the other hand, if the nominal interest rate is 2% in an environment of 3% annual inflation, the investor’s purchasing power erodes by 1% per year. The annual interest rate typically quoted on loans or investments is the nominal interest rate—the periodic rate before compounding has been taken into account. The effective interest rate is the actual interest rate after the effects of compounding have been included in the calculation. Calculating the real fed funds rate allows you to look at changes in interest rates in terms of purchasing power, or without the effects of changes in inflation. For additional information on the difference between nominal and real interest rates, see the August 2003 Dr. Econ.

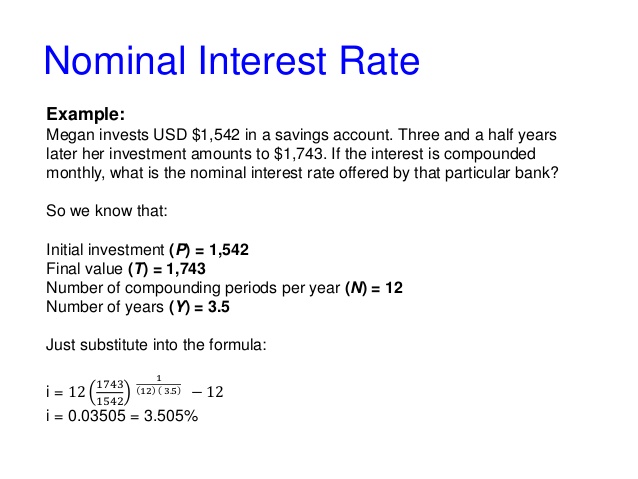

Nominal Interest Rate

What is nominal and real interest rate?

Nominal interest rate refers to the interest rate before taking inflation into account. Nominal can also refer to the advertised or stated interest rate on a loan, without taking into account any fees or compounding of interest.

It’s important to understand whether you are looking at a nominal term or a real term. Sound financial and economic analysis often requires you to adjust nominal terms to their real value.

Real Interest Rates

As inflation rises, nominal interest rates should rise as well since investors would require a nominal return that exceeds the inflation rate. The nominal rate of return helps investors gauge the performance of their portfolio whether it’s comprised of stocks, bonds, or other investments. The nominal rate of return strips out outside factors that can affect performance such as taxes and inflation. By using the nominal rate of return, investors can compare the performance of different investments over different time periods that might have different inflation rates.

Central banks set short-term nominal interest rates, which form the basis for other interest rates charged by banks and financial institutions. Nominal interest rates may be held at artificially low levels after a major recession to stimulate economic activity through low real interest rates, which encourage consumers to take out loans and spend money.

Real interest rate is the amount that mirrors the purchasing power of the borrowed money as it grows over time. The after-tax rate of return of an investment takes the effect of taxation on the investment’s returns into account. In most cases, investors pay different amounts of tax on investments based on the investment, how long the investment was held, and the investor’s tax bracket.

To find the real interest rate, we take the nominal interest rate and subtract the inflation rate. For example, if a loan has a 12 percent interest rate and the inflation rate is 8 percent, then the real return on that loan is 4 percent. The nominal rate of return is the amount of money generated by an investment before factoring in expenses such as taxes, investment fees, and inflation.

The nominal interest rate is the quoted interest rate, while the real interest rate is defined as the nominal interest rate minus the expected rate of inflation. The real interest rate represents the recent nominal interest rate minus the recent inflation rate. Investors require a positive real return, which suggests that they will only invest funds if the nominal interest rate is expected to exceed inflation.

The nominal rate of return doesn’t include inflation or taxes when calculating the performance of an investment. For example, if an investment earned 10% over one year, but inflation was 2.5% for the same period, the actual rate of return would be 7.5%, or 10% – 2.5% inflation.