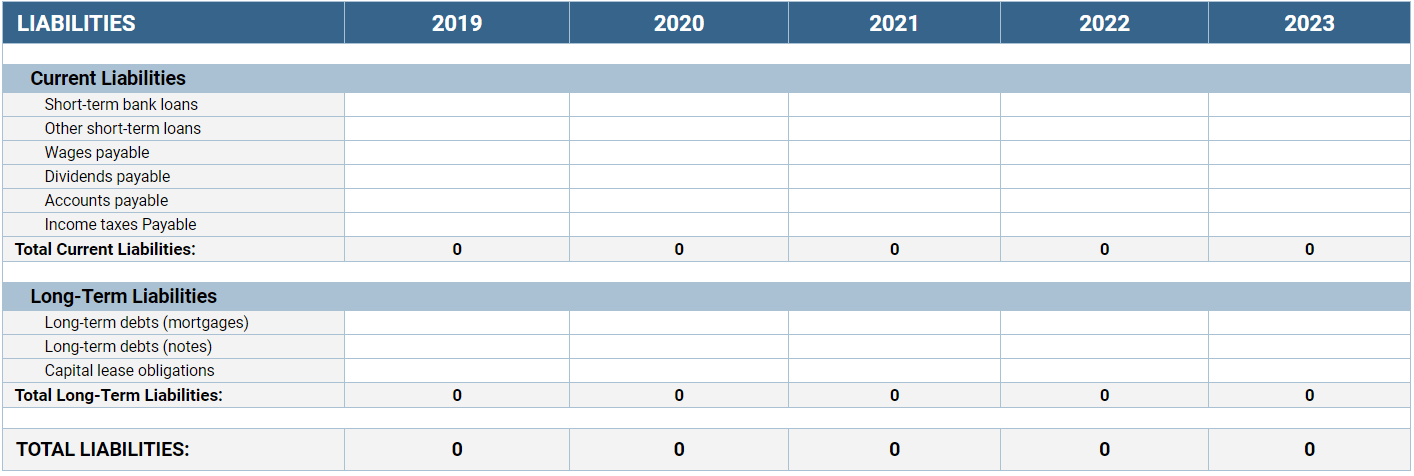

This video shows how to calculate pension expense for a defined-benefit plan. When a company borrows money from a bank or its investors, this money is considered to be debt for the company. On the other hand, liability does not necessarily have to be in the form of money. Future expenses like salaries to employees or payment to suppliers are liabilities for the company and not debt.

Pensions

That means Maria is entitled to receive a specific amount of benefits each month until she dies based on her pay rate and years of service. It’s up to ConSoft to make sure there are enough funds set aside to pay all of the pensioners what they have been promised.

Introduction to Pension Accounting

Total pension liability, or TPL, is a measure that also takes into account future benefits promised by an employer and earned by the worker. When compared with the pension plan’s net assets, the difference between the two is labeled a “net pension liability,” or NPL.

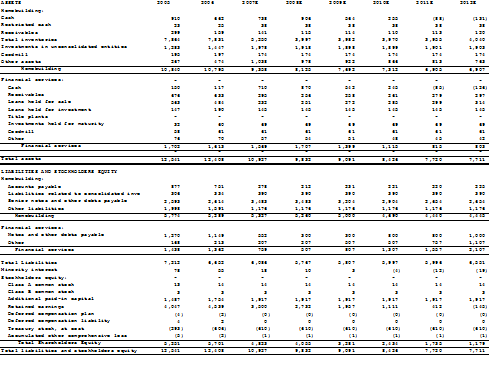

Assets

The term pension plan assets refers to the funds a company will use to meet its future compensation obligations to retired employees. Pension plan assets consist of cash as well as investments such as capital stock, bonds, and annuities.

In other words, the money needed to cover current and future retirements is not readily available. Pension expenses associated with defined contribution plans are simply equal to the contribution made by the company to the plan in the current accounting period. Defined benefit plans specify the monthly payment owed to pensioners based on pay level and service time.

Considerations for investment banking: Pensions

If the fair value of the plan assets is less than the benefit obligation, there is apension shortfall. An underfunded pension plan is a company-sponsored retirement plan that has more liabilities than assets.

Are pensions current liabilities?

The pension asset on the balance sheet is the fair value of the pool of assets at the balance sheet date.

- The pension expense associated with defined benefits plans include service and interest cost, the return on the plan’s assets, as well as the amortization of prior service costs and actuarial gains or losses.

- Expenses associated with defined contribution plans are equal to the contribution made by the company in the current period.

- The term pension expense refers to the costs associated with pension plans that are reported on the company’s income statement.

This can be in a lump sum, but it’s much more likely to be in regular payments. These payments are guaranteed to keep coming until the employee dies. They may even pass on to a surviving spouse or child, depending on the plan.

The term pension expense refers to the costs associated with pension plans that are reported on the company’s income statement. Expenses associated with defined contribution plans are equal to the contribution made by the company in the current period. The pension expense associated with defined benefits plans include service and interest cost, the return on the plan’s assets, as well as the amortization of prior service costs and actuarial gains or losses.

The present value of the projected benefit obligation (PBO) is how much the company anticipates it will have to pay out to present and future retirees discounted to the statement date. If the funded status is positive (as in, assets exceed PBO) it creates a net pension asset on the balance sheet; if negative (as in, PBO exceeds assets) the plan is underfunded, and a net liability is created.

Under the defined benefits plan, the employee is guaranteed a certain amount of benefits/payments in the future. Because pension payments are usually made much later in the future, there is a clear time difference between when employees receive future payments and when employees actually earn those benefits. Because of this difference, companies must use the accrual basis of accounting instead of when cash changes hand.

The terms “pension obligation” and “benefit obligation” describe the amount of total obligation a defined benefit pension plan has accrued for its past and present members and retirees. These obligations are often seen as a liability and calculated against plan assets. Plan obligations are labeled “actuarial accrued liabilities,” or AAL.

Where are pensions on the balance sheet?

Pension Asset or Liability. A corporation reports a pension asset on its balance sheet when the fair value of its plan assets is higher than the present value of its pension benefits, the projected benefit obligation (PBO). It reports a pension liability when the PBO is higher than the fair value of plan assets.

Debt refers to money which is borrowed and is to be paid back at some future date. Whereas, liabilities arising out of other business activities as well.

Pension funds hold mixes of these assets and earn interest on the assets to pay present and future benefits of the plan membership. In plan documents, assets are labeled “actuarial value of assets,” or AVA. A pension plan is a defined benefit plan in which an employer sets money aside for an employee and invests it on the employee’s behalf. When the employee retires, she receives the return from that investment as retirement income.

These changes are designed to provide more transparency in governmental pensions and will be in effect for employers with fiscal years ending June 30, 2015. Plan assets or plan net assets are defined as the value of the investments held by the specific pension plan. These assets can range from cold hard cash to fixed income assets, equities and even alternative investments such as hedge funds.

At the end of 2015, the fair value of the assets and liabilities in the pension amounted to $6 million. In 2016, the pension expense was $10 million and the company contributed $5 million to the pension plan. At the end of 2016, the fair value of the pension assets and liabilities was at $10 million. In 2012, the Governmental Accounting Standards Board announced two statements, No. 67 and 68, that affect the reporting of government pension liabilities.