What Are the Components of Pension Expenses That Are Reported in an Income Statement?

However, a pension plan is more complex and costly to establish and maintain than other retirement plans. In addition, an excise tax applies if the minimum contribution requirement is not satisfied or if excess contributions are made to the plan.

Is Pension Expense an operating expense?

Pension expense is the amount that a business charges to expense in relation to its liabilities for pensions payable to employees. The amount of this expense varies, depending upon whether the underlying pension is a defined benefit plan or a defined contribution plan.

The excise tax is designed to discourage those distributions, under the theory that pension plan assets should be used exclusively for financing retirement consumption. Once an employer or employee has contributed to a pension plan, the investment earnings on those funds are not taxed.

The rate of return normally decreases pension expense, but can increase it if the assets incur a loss. Interest cost represents the interest accumulated on the unpaid balance of the projected benefit obligation as an employee’s service time increases. Projected benefit obligation refers to the current value of all benefits employees earn during employment.

With each year of complete service, employees are one year closer to receiving retirement benefits. Since pensions are a deferred compensation agreement, the employer incurs a liability until the employees retire. Market interest rates on premium investments or rate of return on retirement annuities set the discount rate.

Furthermore, Entergy did not explain why using the Funded Status is an appropriate methodology to calculate prepaid pension costs in rate base. In some instances, it may be inappropriate to use Funded Status for calculating prepaid pension costs. For example, Entergy’s actuarial disclosure includes a line item for employee contributions for the calculation of Fair Value of Plan Assets, which is a component of Funded Status. However, employee contributions to a pension trust are not shareholder financed funds that the utility has paid out of pocket.

A pension plan is a type of retirement plan where an employee adds money into a fund that includes contributions by the employer. The worker’s pension payments are determined by the length of the employee’s working years and the annual income they earned on the job leading up to retirement. Some companies also include the costs of goods sold (COGS) as an operating expense. For example, direct labor or rent for production facilities may be classified as different types of operating expenses. In addition, compensation and benefits for production personnel and direct labor may be classified under operating expenses for accounting purposes.

This aspect of the tax treatment of pension plans is called the “inside buildup.” Pension assets maintained in the pension plan are also not taxable. However, when an employer terminates an overfunded defined benefit plan and surplus plan assets revert to the employer, those assets are taxed at the corporate income tax rate plus an excise tax of 20 percent. The excise tax rate is increased to 50 percent unless the employer transfers part of the excess assets to a replacement plan or provides a benefit increase under the terminating plan.

AccountingTools

Second, the Omnibus Budget Reconciliation Act of 1987 reduced the amount of funding that could be put into a pension plan that was overfunded. This reduced the amount that could accumulate in a defined benefit plan earning the tax-free rate of return, reducing the tax advantage of defined benefit plans relative to defined contribution plans.

A utility generally receives recovery of pension costs based on the amount of pension expense recorded on the books. Accordingly, a prepaid pension cost (an asset) is the amount by which cumulative contributions to a pension trust exceed cumulative pension expense. An accrued pension cost (a liability) is the amount by which cumulative pension expense exceeds cumulative contributions. As a general matter, it is just and reasonable for a utility to include prepaid pension costs in rate base when its pension expense recovered from customers is less than its contributions to fund pension costs (increase to rate base). Likewise, it is just and reasonable for a utility to include accrued pension costs in rate base when it has recovered pension expense from customers in excess of its pension costs (reduction to rate base).

To protect the Treasury against excessive tax deductions, limits are placed on pension contributions. Limits are placed on the maximum employee earnings that can be used to determine benefits or contributions. There are also contribution limits based on the extent to which pension assets exceed or fall short of liabilities (Hubbard 1994). Private pensions receive favorable tax treatment in the United States and in most other countries.

- Prepaid and accrued pension costs can arise when a utility makes contributions to fund a pension trust in order to meet employee pension plan obligations.

- In a defined-benefit plan, the employer guarantees that the employee receives a definite amount of benefit upon retirement, regardless of the performance of the underlying investment pool.

- First, FERC described pension accounting and when it is appropriate to include prepaid pension costs or accrued pension costs in rate base.

Consequently, it would not be just and reasonable for Entergy to include amounts that employees contribute to pension plans in rate base and earn a return on such amounts. Employer pension contributions and wages are deductible business expenses under the corporate income tax. From a tax perspective, employers are indifferent between paying wages and contributing to pension plans. However, employers are not indifferent between making pension contributions and paying deferred wages. Because there is no way to shelter from the corporate income tax money set aside to pay deferred wages, pensions are preferred by employers to deferred wages when compensation is deferred.

Return on Plan Assets

In the United States, an employer’s pension contribution is deductible in computing corporate income taxes, and the investment earnings on plan assets are not taxed. The employee is taxed once—personal income tax liability is deferred until the employee receives a distribution from the plan. In comparison, for savings through wage payments, the employee is taxed twice— when wages are received and when investment earnings are received on the subsequent savings. An operating expense tied to compensation could include pension plan contributions, sales commissions or benefits, and pay for non-production employees. This could be anything from hiring a freelancer, needing a plumber for those broken pipes or needing a Certified Public Accountant (CPA) to remedy the books.

When a defined-benefit plan is made up of pooled contributions from employers, unions or other organizations, it is commonly referred to as a pension fund. Earnings on their investment portfolios are tax-deferred or tax-exempt. The tax system has reduced the desirability of defined benefit plans relative to defined contribution plans. First, employees can make tax-deductible contributions to defined contribution plans but not to defined benefit plans.

Under this plan, the employer’s entire obligation is complete once it has made a contribution payment into the plan, as long as no associated costs are being deferred for recognition in later periods. Thus, the employer commits to pay a specific amount of funds into a plan, but does not commit to the amount of benefits subsequently distributed by that plan. The accounting for a defined contribution plan is to charge its contributions to expense as incurred. Companies provide employees with a pension plan as part of a larger array of employment benefits. The FASB Statement of Financial Accounting Standards No. 87 requires firms to measure and disclose pension obligations as well as the performance and financial condition of their plans at the end of each accounting period.

When considering the COGS, a company may consider the cost of direct materials, repairs of facilities and equipment and property taxes on production facilities as an expenditure classified as an operating expense. Under the defined benefits plan, the employee is guaranteed a certain amount of benefits/payments in the future. Because pension payments are usually made much later in the future, there is a clear time difference between when employees receive future payments and when employees actually earn those benefits. Because of this difference, companies must use the accrual basis of accounting instead of when cash changes hand. In addition to salaries, many companies offer other benefits to their employees such as pension plans, health insurance, stock option benefits, fitness memberships, or life insurance plans.

Pension benefits received at retirement or earlier are taxed under the federal and state personal income tax rates, but are not subject to the Social Security payroll tax. A participant generally recovers tax-free the amounts that have been included previously in his or her taxable income.

The gains or losses components show the changes in the employer’s projected benefit obligation and the market impact on plan assets. For example, prior service cost generally increases the employer’s pension expense, but can decrease the expense if the employer does not provide retroactive pension benefits. Service and interest costs always increase pension expenses.

This tax treatment discourages firms from terminating overfunded defined benefit plans. These costs are not entirely unexpected and are often considered when planning the budget for the next year. A pension fund helps subsidize early retirement for promoting specific business strategies.

The term pension expense refers to the costs associated with pension plans that are reported on the company’s income statement. Expenses associated with defined contribution plans are equal to the contribution made by the company in the current period.

These tax-free amounts are called “basis,” and generally consist of the employee’s after-tax contributions. Because of the progressivity of the income tax system, frequently workers have lower marginal income tax rates in retirement than while working. Lump-sum distributions received before retirement are subject to an excise tax as well as the personal income tax.

The pension expense associated with defined benefits plans include service and interest cost, the return on the plan’s assets, as well as the amortization of prior service costs and actuarial gains or losses. Under this plan, the employer provides a predetermined periodic payment to employees after they retire.

Introduction to Pension Accounting

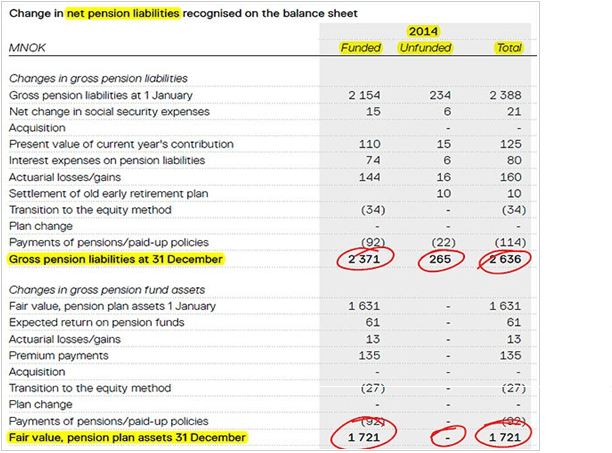

In a defined-benefit plan, the employer guarantees that the employee receives a definite amount of benefit upon retirement, regardless of the performance of the underlying investment pool. First, FERC described pension accounting and when it is appropriate to include prepaid pension costs or accrued pension costs in rate base. Prepaid and accrued pension costs can arise when a utility makes contributions to fund a pension trust in order to meet employee pension plan obligations. While pension obligations and interest increase pension expense, the return on the assets in the trust will generally decrease pension expense.