How to Calculate Owner’s Equity: Definition, Formula & Examples

Revenue is only increased when receivables are converted into cash inflows through the collection. Revenue represents the total income of a company before deducting expenses.

Owner’s Equity Examples

Split between assets, liabilities, and equity, a company’s balance sheet provides for metric analysis of a capital structure. Debt financing provides a cash capital asset that must be repaid over time through scheduled liabilities. Equity financing provides cash capital that is also reported in the equity portion of the balance sheet with an expectation of return for the investing shareholders.

If the treasury stock is sold at equal to its repurchase price, the removal of the treasury stock simply restores shareholders’ equity to its pre-buyback level. It is assumed that every business that is established is growth oriented and growth is foeither profit based or on a no profit no loss basis.

To acheive these ends, capital needs to be infused into the business by the promoter/s. Irrespective of the number of promoters, the possibility that the business runs in loss or is sold to another company needs to be taken into account when the balance sheet is prepared. This is so because a balance sheet has to account for all events in business. Balance sheet is prepared based on transactions and transactions can take place only between two entities.

When the accounting period is closed, the withdrawal accounts are closed to the capital accounts by aclosing entry. This shows that the withdrawal decreases the partner’s equity stake in the company, but does not affect his ownership share. The owner’s equity is recorded on the balance sheet at the end of the accounting period of the business.

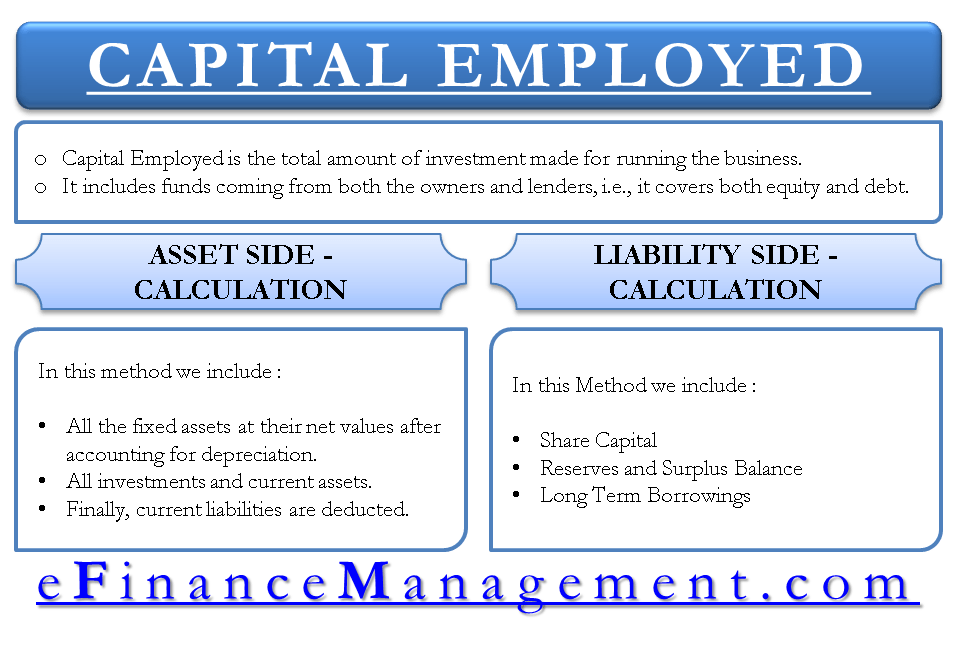

This capital employed appears on the assets side of the balance sheet, and its amount is exactly equal to its sources of funds included on the liability side. When a partner in apartnershiptakes money out of the company for personal reasons, the cash account is credited and the partner’s withdrawal account is debited.

For a sole proprietorship or partnership, the value of equity is indicated as the owner’s or the partners’ capital account on the balance sheet. The balance sheet also indicates the amount of money taken out as withdrawals by the owner or partners during that accounting period. Apart from the balance sheet, businesses also maintain a capital account that shows the net amount of equity from the owner/partner’s investments.

What is owner’s capital on a balance sheet?

Definition: Owner’s Capital, also called owner’s equity, is the equity account that shows the owners’ stake in the business. In other words, this account shows the how much of the company assets are owned by the owners instead of creditors. Typically, the owner’s capital account is only used for sole proprietorships.

How Owner’s Equity Gets Into and Out of a Business

In other words, the capital account is concerned with payments of debts and claims, regardless of the time period. The balance of the capital account also includes all items reflecting changes in stocks. In economic terms, the current account deals with the receipt and payment in cash as well as non-capital items, while the capital account reflects sources and utilization of capital. The sum of the current account and capital account reflected in the balance of payments will always be zero. Any surplus or deficit in the current account is matched and canceled out by an equal surplus or deficit in the capital account.

- The current and capital accounts represent two halves of a nation’s balance of payments.

Companies looking to increase profits want to increase their receivables by selling their goods or services. Typically, companies practice accrual-based accounting, wherein they add the balance of accounts receivable to total revenue when building the balance sheet, even if the cash hasn’t been collected yet. It is a general ledger account used to record the contributed capital of corporate owners as well as their retained earnings. These balances are reported in a balance sheet’s shareholder’s equity section.

Current liabilities are short-term liabilities of a company, typically less than 90 days. Assets, liabilities, and subsequently the owner’s equity can be derived from a balance sheet, which shows these items at a specific point in time. Business owners and other entities, such as banks, can look at a balance sheet and owner’s equity to analyze a company’s change between different points in time.

Accounts payable is considered a current liability, not an asset, on the balance sheet. Individual transactions should be kept in theaccounts payable subsidiary ledger. In economics, the capital account is the part of the balance of payments that records net changes in a country’s financial assets and liabilities.

Debt capital typically comes with lower relative rates of return alongside strict provisions for repayment. Some of the key metrics for analyzing business capital include weighted average cost of capital, debt to equity, debt to capital, and return on equity. All capital, that is the funds put in by the owners of a business or a firm appear on the liability side of a balance sheet. These funds may appear under different account heads such as owners funds, share capital, and retained earnings. An a wider meaning of capital, which is generally used in some phrase like ‘capital employed’ refers to what ever is the value of the assets owned by the including its fixed assets and working capital.

The financial account measures the net change in ownership of foreign and domestic assets. The current account measures the international trade of goods and services plus net income and transfer payments. It measures financial transactions that affect a country’s future income, production, or savings. An example is a foreigner’s purchase of a U.S. copyright to a song, book, or film.

The current and capital accounts represent two halves of a nation’s balance of payments. The current account represents a country’s net income over a period of time, while the capital account records the net change of assets and liabilities during a particular year. Businesses need a substantial amount of capital to operate and create profitable returns. Balance sheet analysis is central to the review and assessment of business capital.

What is Owner’s Capital?

For this purpose, promoter/s are considered as entity/ies separate from business. Having shown business as a separate entity in the balance sheet, should a promoter choose to retire/withdraw from business, investment made by the promoter becomes a liability for business. Since the balance sheet is prepared for the business and not the promoter, capital is shown under liabilities although it is an investment made by the promoter. The other two parts of the balance of payments are the financial account and the current account.

Owner’s Equity

It is obtained by deducting the total liabilities from the total assets. The assets are shown on the left side, while the liabilities and owner’s equity are shown on the right side of the balance sheet. The owner’s equity is always indicated as a net amount because the owner(s) has contributed capital to the business, but at the same time, has made some withdrawals. Accounts payable is a liability since it’s money owed to creditors and is listed under current liabilities on the balance sheet.

TheFederal Reservecalls these transactions non-produced, nonfinancial assets. Tax accounting is more concerned with the taxation of owner’s basis in the capital account.