Net Loss

It is a useful number for investors to assess how much revenue exceeds the expenses of an organization. This number appears on a company’s income statement and is also an indicator of a company’s profitability.

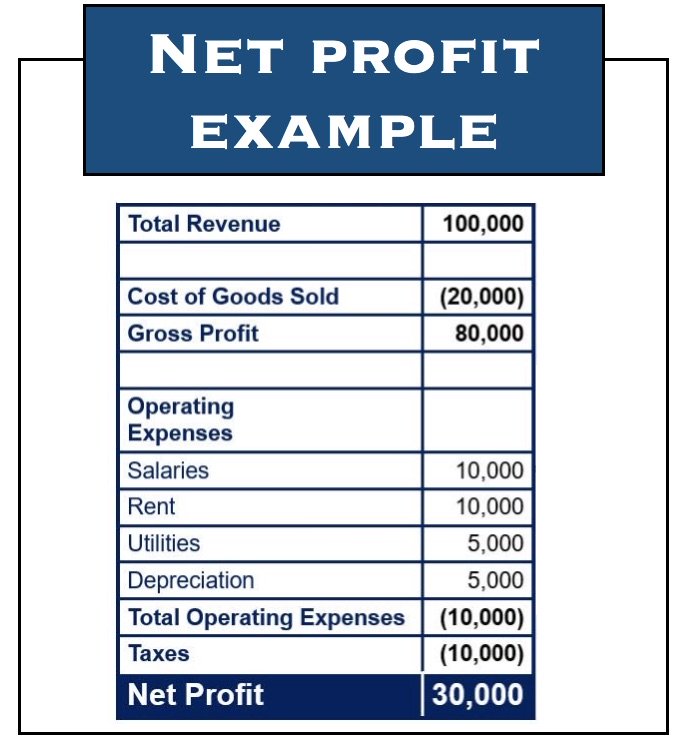

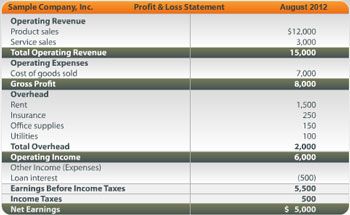

The top line of the P&L statement isrevenue, or the total amount of income from the sale of goods or services associated with the company’s primary operations. Deducting expenses for the running of the business, such as rent, cost of goods, freight, and payroll results in thenet operating income. A greatly reduced operating income relative to revenue indicates that a company can keep the lights on, but little else.

For a company that manufactures products, gross profit is sales less cost of goods sold (COGS). Huntsman Corporation in 2009, the year that the Great Recession took hold, recorded an operating loss of over $71 million. Such expenses in most cases are considered non-recurring, which means that a normalized operating income/loss number would exclude the charge. Instead of the operating loss, then, an “adjusted” result would be an operating profit of $81 million. Revenues, or income, are amounts earned from primary business activities, like product sales, or other financial gains.

For a company, gross income equates to gross margin, which is sales minus the cost of goods sold. Thus, gross income is the amount that a business earns from the sale of goods or services, before selling, administrative, tax, and other expenses have been deducted. For a company, net income is the residual amount of earnings after all expenses have been deducted from sales. In short, gross income is an intermediate earnings figure before all expenses are included, and net income is the final amount of profit or loss after all expenses are included.

The immediate solution is typically to cut back on expenses, as this is within the control of company management. That may entail layoffs, office or plant closings, or reductions in marketing spending. An operating loss can be expected for start-up companies that mostly incur high expenses (with little or no revenues) as they attempt to grow quickly. In most other situations, an operating loss, if sustained, is a sign of deteriorating fundamentals of a company’s products or services.

Determine Total Expenses

The bottom line of the income statement is the net profit or loss, depending on if your revenues are more or less than your expenses. An operating loss could indicate that a company’s core operations are not profitable and that changes need to be made either to increase revenues, decrease costs or both.

How do you calculate net loss?

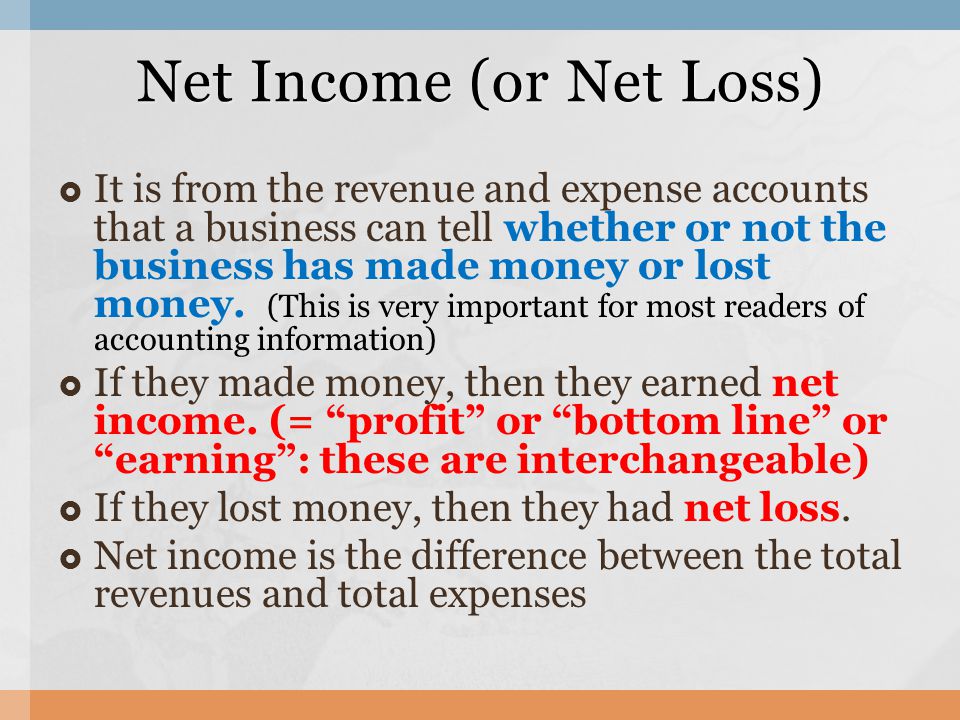

Definition: Net loss, also called loss, refers to a company’s financial position when total expenses exceed total revenues. In other words, net loss is the amount of money the company lost during the period. This is the negative amount of cash that is left over after all the expenses have been paid during the period.

What is Net Loss?

A net loss usually means lower retained earnings, which account for a company’s accumulated net income. The ending retained earnings balance of an accounting period is the beginning balance plus the net income or loss minus dividend payments.

It is the owner’s share of the proceeds if you were to liquidate the company today. The relationship between net income and owner’s equity is through retained earnings, which is a balance sheet account that accumulates net income. Investors and lenders use this information in calculations to determine a company’srisk level. To apply for loans, companies must provide evidence of their financial standing and ability to make consistent payments. If the P&L statement reflects that a company does not create enough revenue to adequately cover existing loan payments, banks are less likely to loan additional funds.

- An operating loss occurs when a company’s operating expenses exceed gross profits (or revenues in the case of a service-oriented company, generally speaking, instead of a manufacturer).

- These items are ‘below the line,’ meaning they are added or subtracted after the operating loss (or income, if positive) to arrive at net income.

Identify Accounts with Debit Balances

Extraordinary items refer to one-time events, such as fire damages or the proceeds from a lawsuit. The retained earnings account accumulates the portion of the company’s net income that it does not distribute to shareholders as cash dividends.

An operating loss occurs when a company’s operating expenses exceed gross profits (or revenues in the case of a service-oriented company, generally speaking, instead of a manufacturer). An operating loss does not consider the effects of interest income, interest expense, extraordinary gains or losses, income or losses from equity investments or taxes. These items are ‘below the line,’ meaning they are added or subtracted after the operating loss (or income, if positive) to arrive at net income.

The difference between revenue and cost of goods sold is the gross profit. The income from continuing operations is the difference between gross profit and the sum of operating expenses, proceeds from disposal of assets and unusual items. The net income is the income from continuing operations minus the sum of interest expenses, taxes, proceeds from discontinued operations and extraordinary items.

Operating expenses include marketing, rental and administrative expenses. Discontinued operations refer to sold or shuttered business units.

In such a scenario, a company may be hit with a few or several quarters of operating losses until the bump-up of these expenditures declines and the benefits of added spending begin to manifest in the top line. The concepts of gross and net income have different meanings, depending on whether a business or a wage earner is being discussed.

If a company’s annual revenues are $5 million and its cost of goods sold is $1 million, the gross profit is $4 million. If operating and nonoperating expenses are $2 million, then the net income is $4 million minus $2 million, or $2 million. If the company pays dividends of $1 million to shareholders, the retained earnings are $2 million minus $1 million, or $1 million. Therefore, the owner’s equity or stockholders’ equity would increase by $1 million. Net income (NI), also called net earnings, is calculated as sales minus cost of goods sold, selling, general and administrative expenses, operating expenses, depreciation, interest, taxes, and other expenses.

The profit and loss (P&L) statement, also referred to as the income statement, is one of three financial statements companies regularly produce. They are carefully reviewed by market analysts, investors, and creditors to evaluate a company’s financial condition and prospects for future growth. Net income is what remains after subtracting cost of goods sold, operating expenses and nonoperating expenses from revenues.

Successful companies drive revenue growth, manage costs and grow net income. Execution problems and competitive pressures usually lead to declining revenues and profits.

In its first month of operations, it provides $10,000 of services to its clients and allows them to pay 30 days later. It also incurs $2,000 of expenses of which it pays $1,100 immediately and will pay $900 in 30 days. In its first month, the company had a profit of $8,000 (revenues of $10,000 minus $2,000 of expenses), but its cash decreased by $1,100 (cash receipts of $0 with cash payments of $1,100).

Is net loss bad?

Find Net Income or Loss Subtract total expenses from total revenue to determine your net income or net loss. If your result is positive, you have net income. If it is negative, you have a net loss. In this example, subtract $10,000 in total expenses from $15,000 in total revenue to get $5,000 in net income.

Your net income or net loss equals your total revenues minus your total expenses for an accounting period. Net income or loss is represented on the income statement and statement of owner’s equity in year-end or quarterly financial statements. The inner financial workings of a company are of great interest to numerous people, including accountants, economists, and investors. Because certain companies are so large, even the business owners themselves may not have a comprehensive understanding of all the company’s financial movements without consulting the P&L.

Examples of a Net Loss

The accounting process involves transferring or closing the revenue and expense accounts at period end to a temporary income summary account. After subtracting dividends, the balance in this account is added to the starting retained earnings for the period. The ending retained earnings balance is higher if the net income is positive and lower if the net income is negative or a loss. Net income is the portion of a company’s revenues that remains after it pays all expenses. Owner’s equity is the difference between the company’s assets and liabilities.

A company could have positive cash flow even if it incurs a net loss because accrual accounting requires companies to record incurred expenses and accrued revenues, whether or not cash exchanges hands. However, consecutive quarters of losses would force a company to raise funds to continue operating, failing which it may have to consider strategic alternatives. Companies may be able to use net losses to reduce taxable income in previous or future years.