I love OnPay because it has a user-friendly interface where other payroll services can sometimes be confusing for a small business owner to understand and use effectively. OnPay also integrates with Quickbooks online seamlessly, which saves me a ton of time from manually inputting payroll reports. Later in your business life, you may be able to take money from your business on a more regular basis, based on your personal financial situation. Ultimately, the decision to take a salary or an owner’s draw should be based on your circumstances and financial goals. It is always a good idea to consult with a financial advisor or tax professional before making major financial decisions.

But instead of one person claiming all the revenue for themselves, each partner includes their share of income (or loss, if business hasn’t been good) on their personal tax return. And your salary is treated as a business expense, which can reduce your company’s net income. Deciding how to pay yourself as a small business owner is an important consideration, one that can have tax ramifications for your and your business.

If the company pays for a computer at the discounted price and gives it to your family, that would also be a form of a draw or compensation. As you pay yourself, there are a few mistakes that can complicate your life that you want to avoid. These mistakes include mixing personal and business finances, not budgeting for taxes, and paying yourself inconsistently. After you choose your payment method, it’s time to calculate the amount.

As a small business owner, there’s lots of terminology to keep track of. It’s the reason why we compiled a glossary with many common payroll terms you’re likely to hear in the course of running your business. After you settle on the best approach to paying yourself, the lingering question to answer is what exactly constitutes “reasonable compensation” in the IRS’ eyes? After all, the guidance from the government tax authority is that the pay should be reasonable.

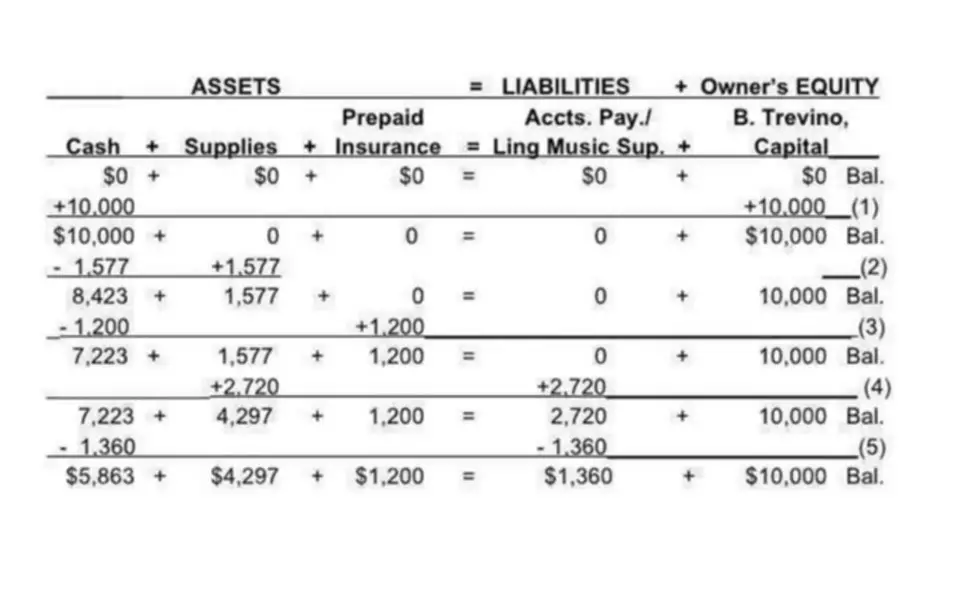

This is especially important if have partners, as taking too large of a draw can dip into your partner’s equity–and salary. Always remember, with a pass through entity you are taxed on the profit of the business regardless of how much money you leave in or take out of the business. A balance sheet is essential if you take multiple draws, or draws in different amounts. The software will automatically track each draw, so it is easy to monitor your spending. But you still need to strike a balance that lets you live comfortably and doesn’t hurt your business.

Salary vs. owner’s draw at a glance

The amount of self-employment tax you must pay is based on the profits of your business; if the business does not make a profit in any one year, no self-employment tax is due. These amounts are not withheld from any payments to business owners. Some S corporations try to pay minimal amounts to corporate officers to avoid employment taxes, but the IRS says corporate officers must be paid a reasonable amount. A salary is subject to payroll taxes, which can increase the overall tax liabilities of the business owner. An owner’s draw is usually not subject to payroll taxes, which can result in lower overall tax liabilities for the business owner.

If you run a corporation or NFP, you have to assign yourself a reasonable salary. The IRS determines what is and isn’t reasonable salaries for CEOs and non-profit founders in order to prevent certain tax benefits from being exploited. As we mentioned earlier, you can determine what a reasonable wage is by comparing your earnings to CEOs in similar positions.

Since an S corp is structured as a corporation, there is no owner’s draw, only shareholder distributions. But a shareholder distribution is not meant to replace the owner’s draw. There are five common business structures, and each one influences the way small business owners pay themselves. Draws are not personal income, however, which means they’re not taxed as such.

How to Utilize an Owner’s Draw for Tax Savings & Capital Growth

For example, if you run a partnership, you can’t pay yourself a salary because you technically can’t be both a partner and employee. While partners often split income evenly, that doesn’t have to be the case so you can arrange a different income draw based on your partnership agreement. If you’re a sole proprietor, it’s all coming from one big pot, but if you’re an LLC, intermingling your business and personal finances can result in losing your limited liability status. Business owners who take a draw or distribution of profits can take any amount they want from their business. Of course, you shouldn’t take money that will be needed to pay employees, pay off business loans, or pay other bills of the business. Your financial situation can also impact your decision to take a salary or an owner’s draw.

The good news is that your salary and the 7.65% of FICA tax the S-corp pays on your salary is tax deductible and will reduce the company’s taxable income. If you request a guaranteed payment, all terms must be stated in the partnership agreement. Guaranteed payments are not taxed as income, and no payroll taxes are withheld from your company.

The best method for you depends on the structure of your business and how involved you are in running the company. As you get your new business up and running, your owner compensation is one of the things you’ll need to consider to make sure you meet your legal obligations and stay in compliance. Visit our resources page for all the forms you need to start your business off right, starting with applying for an Employer Identification Number. Your equity is defined as the amount of accumulated value you’ve invested into the business through things like cash, equipment, and other assets. If your business is an S-corp, you must pay yourself a salary if you are actively involved in running and managing your business.

Many legal factors go into choosing whether to take an owner’s draw or a salary. However, the type of income you make from your company is highly dependent on your business tax structure. When a business owner pays themself a set wage from the business every pay period, they take out a salary. A salary is a regular event that pays out taxed, W-2 income to the owner.

Salary, draws, and the IRS

They can help you calculate expenses and look at projected income, so that you can earn a good living and watch your business grow. A C corp dividend is taxable to the shareholder, though, and is not a tax deduction for the C corp. When you’re evaluating the best method to pay yourself, there are several factors to consider. Since it can be challenging to predict your cash flow, you may be wondering about the best way to pay yourself and still have enough money left over to cover your costs. Yet another IRS website page dedicated to the topic suggests that public libraries may have reference sources that outline the average compensation paid for various types of services.

- However, if you own an LLC, managing your business and personal finances together can lead to losing your limited liability status.

- You will be taxed like a sole proprietor for your percentage of the partnership’s income.

- With the draw method, you can draw money from your business earning earnings as you see fit.

- Generally, sole proprietors, partners, and LLC owner/members take owner draws as their payment.

- Your books need to be up to date so you know your equity balance and ownership interest value.

Single-member LLC owners are considered to be sole proprietors for tax purposes, so they take a draw like a sole proprietor. Multiple-member LLC members are considered to be like partners in a partnership, so they take a distribution. Maximizing the benefits of an owner’s draw involves careful planning and execution. For example, a sole proprietorship that earned $200,000 in profits and has $400,000 in cash has up to $200,000 in available dividend distributions. If more cash funds are needed, the sole proprietor must use an owner’s draw to make up the difference.

How Business Owners Pay Themselves

If you contributed assets to your business, you have equity invested there unless your business is going under and your liabilities outweigh your equity. If you own equity in your business, you can take money out of the business as the owner. Dividends are a shareholder distribution and include a portion or all of the business’s profits since its establishment. A spreadsheet is one possible way to track the owner’s withdrawals. However, you will need to have bookkeeping experience and the ability to make a custom spreadsheet, as most online spreadsheet templates do not have this option. Usually that means each partner will evenly split the income for themselves.

How to track and record your draws

As a sole proprietor, single member LLC, or even as a partner in a partnership, you’ll be required to take an owner’s draw, for which taxes are not initially withheld. Much like an S-corp, C-corp business owners who are actively involved in the business must be paid reasonable compensation. The good news is that, like an S-corp, your salary and the company portion of FICA tax is tax deductible. Do you want to account for income tax yourself or have it already taken out?

An owner’s draw can be uncertain as it depends on the company’s profitability and cash flow. If the company’s revenue decreases, there may not be enough money available for the owner to take a draw. If you plan to sell the business or take on investors, a salary may be a better option since it provides a more stable income stream. However, if you plan to keep the business long-term, an owner’s draw may be a more attractive option. Your books need to be up to date so you know your equity balance and ownership interest value. Your equity balance is the total of your financial contributions to the business along with the accumulation of profits, losses and liabilities.

But many growing companies don’t give dividends but put the profits of the corporation back into growth. Notice the terms “draw” and “distributive share” in the table above. A draw is a direct payment to a sole proprietor from the business. A distributive share is an individual owner’s share of income, gain, loss, deduction, or credit. Instead of spending the owner’s draw on personal expenses, consider reinvesting the funds into the business. This can help to grow the business and increase its value over time.