A sole proprietorship will have a drawing account in which the owner’s withdrawals or draws of cash or other assets are recorded. The amounts of the owner’s draws are recorded with a debit to the drawing account and a credit to cash or other asset. At the end of the accounting year, the drawing account is closed by transferring the debit balance to the owner’s capital account.

What Business Owners Take Draws?

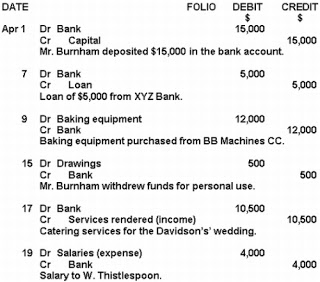

Ott, Drawing for $500 and will credit Cash for $500. After this transaction, the business will have assets of $2,500 and will have owner’s equity of $2,500. The contra owner’s equity account used to record the current year’s withdrawals of business assets by the sole proprietor for personal use. It will be closed at the end of the year to the owner’s capital account.

For accounting purposes, the draw is taken as a negative from their business ownership account, called owner’s equity. The drawing account is then re-opened and used again the following year for tracking distributions. Because taxes on withdrawals are paid by the individual partners, there is no tax impact to the business associated with the withdrawn funds.

Corporations classify their shareholder payments differently. C corporations call their owner payments dividends and S corporations classify their shareholder payments as distributions.

Having a business account also paves the way for your business to borrow money, get a business credit card, and take card payments from customers. Assume Mike has a 50% share of Blue Guitar, LLC. This is alimited liability companythat is treated like a partnership. He decides that he wants to buy a new car, so he withdraws $10,000 from his share in the partnership. Blue Guitar, LLC would record a debit the Mike’s capital withdrawals account and a credit to cash for $10,000.

SinceS corporationsare treated much like partnerships, their distributions affect the shareholders’ equity accounts similar to how partnership withdrawals affect owners’ capital accounts. A drawing account is an accounting record maintained to track money withdrawn from a business by its owners. A drawing account is used primarily for businesses that are taxed as sole proprietorships or partnerships. Owner withdrawals from businesses that are taxed as separate entities must generally be accounted for as either compensation or dividends.

When a partner in apartnershiptakes money out of the company for personal reasons, the cash account is credited and the partner’s withdrawal account is debited. When the accounting period is closed, the withdrawal accounts are closed to the capital accounts by aclosing entry.

Must Taxes Be Withheld From a Draw?

I just wanted to know which method would be best since I am frequently making withdrawals. Let’s say that I need funds to make a large purchase for myself (not related to my business at all), would I be able to just write myself a check for that amount? I am the sole owner of my business, if that makes any difference. Like a personal bank account, a business bank account can offer cash and cheque handling, a debit card, and an overdraft facility. As with your personal account, you’ll be able to set up direct debits and standing orders.

By contrast, in businesses organized as corporations – even if the corporation has only one owner – owners can’t take draws. They need to either be on the payroll as employees or receive distributions of profits as dividends. An entry for “owner’s drawing” in the financial records of a business represents money that a company owner has taken from the business for personal use.

If, instead, a salary is paid, the owner receives a W-2 and pays Social Security and Medicare taxes through wage withholdings. An owner’s draw means you are taking money from the business account and taking it for personal use.

What type of account is an owner’s draw?

owner’s drawing account definition. The contra owner’s equity account used to record the current year’s withdrawals of business assets by the sole proprietor for personal use. This is a temporary account with a debit balance. It will be closed at the end of the year to the owner’s capital account.

- To answer your question, the drawing account is a capital account.

At the end of the fiscal period, the net income or net loss also is transferred to the owner capital account. The ATM business is along the lines of owning a vending machine business, just with cash instead of sodas, snacks, etc. My bank’s ATM inside the location lets me withdraw up to $1500 and of course I can pull out more cash via bank teller.

A drawing account acts as a contra account to the business owner’s equity; an entry that debits the drawing account will have an offsetting credit to the cash account in the same amount. Any money an owner has pulled out of the business over the course of a year is recorded in the temporary drawing account. At the end of the year, the drawing account is closed out, meaning the balance is subtracted from the owner’s capital or equity account. Business owners pay income taxes and self-employment taxes using either a salary or a draw. “Owner Capital” is reported in the equity section of a sole proprietorship balance sheet.

A drawing account is a contra account to the owner’s equity. In keeping with double-entry bookkeeping, every journal entry requires both a debit and a credit. Because a cash withdrawal requires a credit to the cash account, an entry that debits the drawing account will have an offsetting credit to the cash account for the same amount. Sole proprietors, members of LLCs, and partners in a partnership each pay self-employment taxes on draws and other distributions. The self-employment tax collects Social Security and Medicare contributions from these business owners.

To answer your question, the drawing account is a capital account. It’s debit balance will reduce the owner’s capital account balance and the owner’s equity. The drawing account’s purpose is to report separately the owner’s draws during each accounting year. Since the capital account and owner’s equity accounts are expected to have credit balances, the drawing account (having a debit balance) is considered to be a contra account. In addition, the drawing account is a temporary account since its balance is closed to the capital account at the end of each accounting year.

This shows that the withdrawal decreases the partner’s equity stake in the company, but does not affect his ownership share. For sole proprietorships and partnerships that keep formal financial records, the owner’s drawing appears as a temporary account under owner’s equity. Each owner of the business typically has an equity account, or capital account, in the company’s books that keeps track of his stake in the company. It’s made up of the money he’s invested, plus his share of accumulated profits, minus the amounts he has withdrawn. Business owners generally take draws by writing a check to themselves from their business bank accounts.

owner’s drawing account definition

Ott withdraws $500 from the business for her personal use. The journal entry for this transaction will debit L.

Owner’s draws are routine occurrences in small businesses. Rather, they are distributions of company profits – much like the dividends that a corporation would pay.

Any money the owner invests to start the business or keep it running is classified as owner capital. Because equity accounts normally have a credit balance, all owner contributions are recorded as credits. Additionally, equipment or supplies donated to the business by the owner should be included in the owner capital account.

Owners draws are taxable as part of your personal income tax return, so be sure to consult with a CPA to make sure they are captured correctly on your return. Ott begins a sole proprietorship with a cash investment of $3,000. The journal entry will debit Cash for $3,000 and will credit L.

What Is an Owner’s Draw and How Does It Work?

The rules governing Limited Liability Companies vary depending on the state, so be sure to check your state laws before moving forward. In both LLC entities (single and multiple), the business owner pays taxes from owner draws the same way they would as a sole proprietor or partner. In general, only the owners of sole proprietorships and partnerships can draw cash straight from the business for personal use. It’s especially convenient in very new or very small enterprises, which can’t afford to pay out to the owner on a regular basis.