For existing small companies, Blue Matrix Business Services can be your accountant and your IT department, handling all of your data and improving upon existing processes. We are up to date with the latest changes in tax and accounting laws and also with the latest developments in the world of online marketing.

Based on this framework, it is assumed that the same basic framework, linked to economic substance, can induce the understanding that the adoption of international accounting standards can bring financial and managerial accounting together. The methodology began with a content analysis of selected accounting standards, to identify likely points of greatest relevance to the study. Then, a structured questionnaire was sent to 638 Brazilian companies, completed by just over 10%.

SAMs are currently in widespread use, and many statistical bureaus, particularly in OECD countries, create both a national account and this matrix counterpart. Matrix Accounting & Tax was founded by Chris Bryant, in 2003 to serve the expanding small business community in Lincoln, Nebraska and surrounding communities after working for nearly 26 years in the accounting and tax fields. We specialize in bookkeeping and payroll services necessary for the day-to-day operation and tax preparation needs of small businesses.

SAMs refer to a single year providing a static picture of the economy. This paper reports on the findings of a postal questionnaire survey relating to the management accounting practices in UK manufacturing organizations.

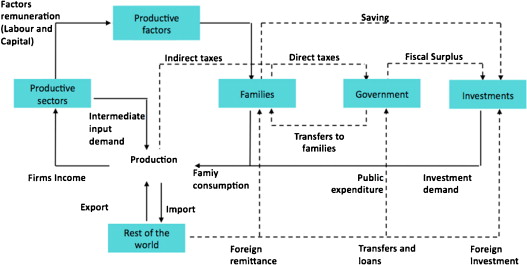

SAMs are square (having the same number of columns as rows) because all institutional agents (Firms, Households, Government and ‘Rest of Economy’ sector) are both buyers and sellers. Columns represent buyers (expenditures) and rows represent sellers (receipts). SAMs were created to identify all monetary flows from sources to recipients, within a disaggregated national account. The SAM is read from column to row, so each entry in the matrix comes from its column heading, going to the row heading.

Small Business Accounting

Often rows for ‘capital’ and ‘labor’ are included, and the economy can be disaggregated into any number of sectors. Each extra disaggregated source of funds must have an equal and opposite recipient.

Within the context of the globalization of the practice and profession of accounting, it is increasingly important that accounting faculty and students are aware of the international accounting environment. In addition, the continued growth in the crossnational flows of students increases the need for accounting faculty to be aware of international differences in the teaching and learning of accounting. This paper contributes to this arena by looking at the context, structure, and content of a successful introductory accounting course at a major university in the Russian Federation that uses matrix accounting theory in its introductory accounting course. In addition, as part of the important contextual background, the paper provides a rich description of the course, which could be used for comparison with other introductory accounting courses. By looking at introductory accounting from a different perspective, the paper has the potential to help and encourage accounting faculty to think afresh about our discipline by questioning some of the taken-for-granted assumptions that underlie the approaches used in teaching accounting.

Additionally we are future focused so we champion new online software and accessible easy-to-use options that are built to make life easier for you. MATRIX Accounting & Tax Inc. provides small businesses with all of the services they need to easily manage their accounts and cash flow, and to facilitate the preparation of tax returns. With nearly 30 years of accounting and tax experience, and licensed to practice before the Internal Revenue Service, we are qualified to handle a variety of services in relationship to your small business.

Accounting Matrix Limited

- The international literature describes the convergence of national accounting standards for equity – IFRS has provided an integration process between management and financial accounting.

- We used a qualitative exploratory study with composed of open and semi-structured interview questions.

In 2009, CNN named Lincoln, Nebraska one of the top 10 places to start a small business. MATRIX Accounting & Tax Inc. can provide small businesses with all of the services they need to easily manage their accounts and cash flow, and to facilitate the preparation of tax returns. These hypotheses are to be applied within an interdisciplinary theoretical structure of financial accounting.

If you are looking for Chartered Accountants in Logan that can provide you with relevant, timely and professional accounting and taxation services and business advice, look no further than Matrix Accounting. With a strong focus on tailored advice to suit your individual or business needs, Matrix Accounting Services will provide you with the service you are looking for. I was a little nervous at first because I was used to filing my own taxes. She shared with me valuable information as to how to file taxes and more importantly write off certain expenses.

The focus of financial accounting research is applied to a philosophical framework of accountability and standardisation of measurement. Interdisciplinary aspects of management accountability can promote identification of the ‘common good’ undefined (Dewey, 1922) for the firm, towards which periodic invested costs are directed for the induction of periodic gain. Non traditional additions of economic values in balance sheets remains subjective for practice in this sense, leading consequently to community uncertainty, chaos and ultimately to uncertainty. If data is consistently recorded the same way, there should be no issue comparing year to year, but the 1% precision is often a better indicator of the accountant, as opposed to the quality of the data. A theoretical SAM always balances, but empirically estimated SAM’s never do in the first collation.

economic phenomena, the new rules introduced concepts such as fair value measurement of assets. In turn, management accounting has discretion in determining transaction to the decision makers of companies.

Outsourced accounting services

Results showed that there were similarities between management and financial accounting, even though not in all cases. moderated in firms audited by Big-six auditors because high quality audit mitigates agency problem associated with low managerial ownership firms. The original result holds for firms having different sizes and information environment. It is inferred from the result that by collectively owning large percentage of outstanding common stock in a corporation, institutional investors mitigate the adverse effects of agency problem arising out of separation of ownership and con- trol on reported accounting numbers.

Yelp for Business

This was noted as early as 1984 by Mansur and Whalley, and numerous techniques have been devised to ‘adjust’ SAMs, as “inconsistent data estimated with error, [is] a common experience in many countries”. Using a SAM includes the institutional structure assumed in the national accounts into any model.

Finally columns and rows are added up, to ensure accounting consistency, and each column is added up to equal each corresponding row. In the illustration below for a basic open economy, the item C (consumption) comes from Households and is paid to Firms. A social accounting matrix (SAM) represents flows of all economic transactions that take place within an economy (regional or national). It is at the core, a matrix representation of the national accounts for a given country, but can be extended to include non-national accounting flows, and created for whole regions or area.

The international literature describes the convergence of national accounting standards for equity – IFRS has provided an integration process between management and financial accounting. The research sought to scale, through a non-probabilistic sample in three Brazilian regions, the perception of teachers graduate of the impacts of IFRS on management accounting and the way these impacts must be orchestrated in teaching practice. We used a qualitative exploratory study with composed of open and semi-structured interview questions.

This means that variables and agents are not treated with monetary source-recipient flows in mind, but are rather grouped together in different categories according to the United Nations Standardised National Accounting (SNA) Guidelines. For example, the national accounts usually imputes the value of household investment or home-owner ‘rental’ income and treats some public sector institutional investment as direct income flows – whereas the SAM is trying to show just the explicit flows of money. Thus the data has to be untangled from its inherent SNA definitions to become money flow variables, and they then have to equal across each row and column, which is a process referred to as ‘Benchmarking’. SAMs can be easily extended to include other flows in the economy, simply by adding more columns and rows, once the standard national account (SNA) flows have been set up.

After collecting and organizing data, the technique of content analysis through categorical analysis of words, dyads and triads was used, comparing the statements of the financial district teachers with teachers of management area. The results indicated that there is perception of approach between financial and managerial accounting by teachers and the need for inter-relationship with other areas of knowledge. Additionally, the findings indicated a gradual integration, long-term between both accounts, especially regarding the role to be developed by Brazilian universities in the training of accountants.