Separation of duties can increase efficiency towards the aims and objectives of an organization. This assures that your employees are not burdened with huge workloads and you are providing a stress-free environment.

The second is the detection of control failures that include security breaches, information theft and circumvention of security controls. Correct SoD is designed to ensure that individuals don’t have conflicting responsibilities or are not responsible for reporting on themselves or their superior. When this process is implemented, the credibility of accurate financial reporting is vastly increased. This reduces the risk of fraud as it assures the creation of a culture of accountability. It protects the business from any type of unnecessary or unplanned loss.

Internal controls are policies and procedures put in place to ensure the continued reliability of accounting systems. Without accurate accounting records, managers cannot make fully informed financial decisions, and financial reports can contain errors. Internal control procedures in accounting can be broken into seven categories, each designed to prevent fraud and identify errors before they become problems. Internal controls include the procedures a business implements in order to protect its assets or items of value that it owns as well as its records. Segregation of duties involves dividing employee duties so that the functions of recordkeeping, custody of assets and authorization of asset use are performed by different individuals.

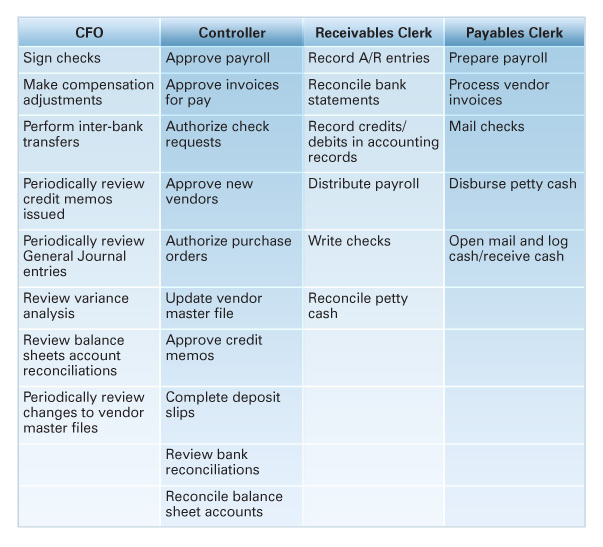

And the separation of duties ensures that no single individual is in a position to authorize, record, and be in the custody of a financial transaction and the resulting asset. Authorization of invoices and verification of expenses are internal controls. In addition, preventative internal controls include limiting physical access to equipment, inventory, cash, and other assets.

For example, in purchasing, it would be unwise to authorize a single person to create and then approve a purchase order (PO). Each of these steps, or duties, should be performed by a separate person. Otherwise, and unfortunately this does happen, a person may be tempted to create a PO for a vendor that she owns, approve it and then pay herself with company money. By splitting the duties up, the control mitigates the risk of fraud in this case and many others.

A SOX auditor looks for SoD and will rate the company’s controls as “deficient” if SoD is not properly implemented. SoD compliance, therefore, is the process of getting SoD into sufficient shape to meet compliance requirements. No two systems of internal controls are identical, but many core philosophies regarding financial integrity and accounting practices have become standard management practices. While internal controls can be expensive, properly implemented internal controls can help streamline operations and increase operational efficiency, in addition to preventing fraud. Internal controls are the mechanisms, rules, and procedures implemented by a company to ensure the integrity of financial and accounting information, promote accountability, and prevent fraud.

Internal audits evaluate a company’s internal controls, including its corporate governance and accounting processes. Internal audits play a critical role in a company’s operations and corporate governance, now that the Sarbanes-Oxley Act of 2002 has made managers legally responsible for the accuracy of its financial statements.

The concept is addressed in technical systems and in information technology equivalently and generally addressed as redundancy. Deterrent controls are administrative mechanisms (such as policies, procedures, standards, guidelines, laws, and regulations) that are used to guide the execution of security within an organization. Deterrent controls are utilized to promote compliance with external controls, such as regulatory compliance.

Internal controls are typically comprised of control activities such as authorization, documentation, reconciliation, security, and the separation of duties. And they are broadly divided into preventative and detective activities. Internal controls are the mechanisms, rules, and procedures implemented by a company to ensure the integrity of financial and accounting information, promote accountability and prevent fraud. Separation of duties (SoD; also known as Segregation of Duties) is the concept of having more than one person required to complete a task. In business the separation by sharing of more than one individual in one single task is an internal control intended to prevent fraud and error.

Read next: Internal controls in accounting: Oversight of financial transactions

What is meant by separation of duties?

The separation of duties concept prohibits the assignment of responsibility to one person for the acquisition of assets, their custody, and the related record keeping. For example, one person can place an order to buy an asset, but a different person must record the transaction in the accounting records.

This is achieved by assuring no single individual has control over all phases of a business transaction. Separation of duties fulfills two purposes, both of which help reduce the risk within an organization. First, it prevents frauds, errors, and abuse of systems and processes, and second, it aids in the discovery of control failures such as theft of information, data breaches, and circumvention of security controls. The Sarbanes Oxley Act (SOX), for example, which requires public companies to audit and attest to the strength of their internal controls over financial reporting, effectively mandates that SoD be in effect.

- While detective controls usually occur irregularly, preventative controls usually occur on a regular basis.

- They range from locking the building before leaving to entering a password before completing a transaction.

- Preventative internal controls are put into place to keep errors and irregularities from happening.

Benefits of internal controls

For instance, either preventative or detective controls alone are unlikely to be effective in stopping attacks. To this end, while SOX measures seek to govern the financial operations and disclosures of corporate entities and any of their contracted financial service providers, the regulations pertain to a breadth of departments, and a few to IT. In 2002, Congress passed the Sarbanes-Oxley Act, named after its sponsors Senator Paul Sabanes (D-MD) and Representative Michael G. Oxley (R-OOH-4).

ISO 27001 Risk Management in Plain English

Besides complying with laws and regulations and preventing employees from stealing assets or committing fraud, internal controls can help improve operational efficiency by improving the accuracy and timeliness of financial reporting. The first is the prevention of conflict of interest (real or apparent), wrongful acts, fraud, abuse and errors.

Involving multiple employees in a single task can prevent any type of potential error. Involving more than one person in the transaction cycle can prevent one person from gaining complete control over a single process. SoD is a control that prevents the same person from executing multiple steps in a business transaction that could unlock the potential for fraud.

Internal controls have become a key business function for every U.S. company since the accounting scandals in the early 2000s. In their wake, the Sarbanes-Oxley Act of 2002 was enacted to protect investors from fraudulent accounting activities and improve the accuracy and reliability of corporate disclosures. This has had a profound effect on corporate governance, by making managers responsible for financial reporting and creating an audit trail.

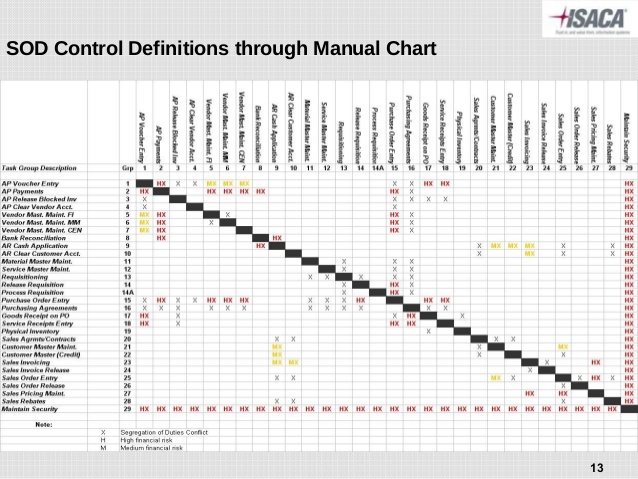

Segregating incompatible functions helps a company prevent becoming a victim of fraud or an intentional attempt to deceive others for the purposes of personal gain. Segregation of Duties (SoD) are a primary internal control intended to prevent or decrease the risk of errors or irregularities, identify problems, and ensure corrective action is taken.

Managers found guilty of not properly establishing and managing internal controls face serious criminal penalties. Where it is not possible to have adequate preventative internal controls including segregation of duties, it is important to implement a compensating control. An example of this could be increased periodic oversight by you or the board of directors. The following section will introduce a number of these control categories. When designing a control framework it is necessary to include multiple levels of controls.

These controls are designed to complement other controls (such as preventative and detective controls). We ensure that all of our clients have preventative controls in place and provide an appropriate level of oversight and challenge for the company’s financial books and records. A recognized expert in the field of SAP security and compliance, Scott has over 20 years of expertise in SAP security and is a regular presenter at SAP industry tradeshows and ASUG events. His experience includes working for one of the Big Four accounting firms and developing auditing tools, including those for segregation of duties (SOD). Scott is also responsible for architecting the ControlPanelGRC® solution which provides audit automation and acceleration of security and control processes.

Application in general business and in accounting

Preventative internal controls are put into place to keep errors and irregularities from happening. While detective controls usually occur irregularly, preventative controls usually occur on a regular basis. They range from locking the building before leaving to entering a password before completing a transaction. Preventive control activities aim to deter errors or fraud from happening in the first place and include thorough documentation and authorization practices.

The concept is alternatively called segregation of duties or, in the political realm, separation of powers. In democracies, the separation of legislation from administration serves a similar purpose.

Internal controls are the procedures that a business uses to protect its records and its assets or things of value that it owns. Internal controls also help a business ensure that it is using its resources most effectively and it helps to prevent and detect errors. If only one person is doing all the financial reporting errors can occur and be missed. Having segregation of duties put in place can help prevent these errors in the first place.

Types of internal controls: Preventative and detective

Detective controls are backup procedures that are designed to catch items or events that have been missed by the first line of defense. Here, the most important activity is reconciliation, used to compare data sets, and corrective action is taken upon material differences. Other detective controls include external audits from accounting firms and internal audits of assets such as inventory. Besides complying with laws and regulations, and preventing employees from stealing assets or committing fraud, internal controls can help improve operational efficiency by improving the accuracy and timeliness of financial reporting.

SoD involves breaking down tasks that might reasonably be completed by a single individual into multiple tasks so that no one person is solely in control. Payroll management, for example, is an administrative area in which both fraud and error are risks.