Settlement of litigation against the entity after the reporting date, in respect of events that occurred before the end of reporting period, may provide evidence of the existence and amount of liability at the reporting date. A liability in respect of the litigation may be recorded in the financial statements if not recognized initially or the amount of liability may be adjusted in accordance with IAS 37 Provisions, Contingent Liabilities and Contingent Assets.

The $2,400 transaction was recorded in the accounting records on December 1, but the amount represents six months of coverage and expense. By December 31, one month of the insurance coverage and cost have been used up or expired.

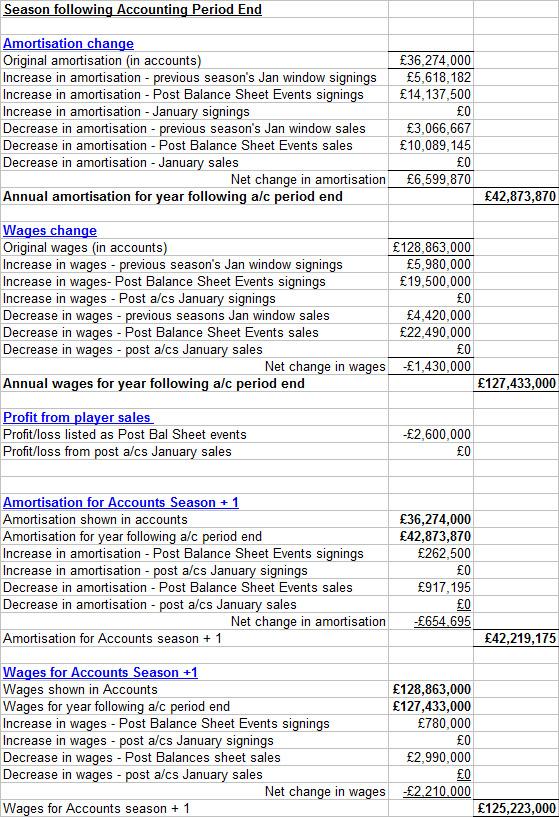

IAS 10 — Events After the Reporting Period

The balance sheet, usually prepared monthly, provides a summary of a company’s assets, liabilities and equity. By dating and issuing a balance sheet a company represents that the summary includes all transactions and events recorded through the balance sheet date. The adjustment of records for subsequent events can improve a company’s financial picture, an important consideration for a business that hopes to attract lenders or investors.

IAS 10 Events after the Reporting Period provides guidance as to which events should lead to adjustments in the financial statements and which events shall be disclosed in the notes to financial statements. Accounting policies are a set of standards that govern how a company prepares its financial statements. These policies may differ from company to company, but all accounting policies are required to conform to generally accepted accounting principles (GAAP) and/or international financial reporting standards (IFRS).

AccountingTools

Non-recognized subsequent events do not require adjustments to the financial statements. Such events are those that relate to financial conditions that did not exist on the balance sheet date but arose after the date. A fire in your company plant that destroys inventory and other assets is a non-recognized subsequent event because conditions did not exist prior to the balance sheet date. Another example is the loss of expected income due to conditions suffered by a client. The Federal Accounting Standards Advisory Board cautions that while adjustments are not required, disclosure of certain non-recognized events might be necessary to avoid issuing misleading financial information.

History of IAS 10

IAS 10 Events After The Reporting Period contains requirements for when events after the end of the reporting period should be adjusted in the financial statements. Another situation requiring an adjusting journal entry arises when an amount has already been recorded in the company’s accounting records, but the amount is for more than the current accounting period. To illustrate let’s assume that on December 1, 2019 the company paid its insurance agent $2,400 for insurance protection during the period of December 1, 2019 through May 31, 2020.

- An example of a recognized subsequent event is if your company resolves a legal case for an amount that differs from the expected liability recorded before the balance sheet date.

- Recognized subsequent events require adjustments to the financial statements, according to the Federal Accounting Standards Advisory Board.

An example of a recognized subsequent event is if your company resolves a legal case for an amount that differs from the expected liability recorded before the balance sheet date. A recognized subsequent event that adds information about an existing condition is the write-off of a long-standing overdue account when the customer closes his business or files bankruptcy. The Federal Accounting Standards Advisory Board recommends evaluating financial conditions affected by subsequent events if the information is known prior to issuing the balance sheet or the financial statements.

Recognized subsequent events require adjustments to the financial statements, according to the Federal Accounting Standards Advisory Board. Recognized events, such as changes to assets or liabilities, add evidence about the financial picture reflected on the balance sheet date and alter the estimates or summarization of the financial information included in the report.

IASB issues improvements to 20 IFRSs

The balance sheet is used by the company, investors and others who make decisions based on the company’s financial health. Financial statements, the full set of which is usually released at the end of the company’s fiscal year, include the balance, sheet, income statement, statement of cash flows and, if necessary, supplementary notes. Accounting policies are the specific principles, bases, conventions, rules and practices applied by an entity in preparing and presenting financial statements. (IAS 8)Events after Reporting Period are those that occur between the end of the reporting period and when the financial statements are authorized for issue.

The Financial Accounting Standards Board, the authority entrusted with establishing generally accepted accounting principles, publishes detailed requirements for defining and recording subsequent events in financial records. Events after the balance sheet date are significant financial events that occur after the date of the balance sheet, but prior to the date that the financial statements are issued. For example, a company’s balance sheet that has the heading of December 31, 2012 might not be finalized and distributed until February 1, 2013.

During January new information may arise that has financial significance. Perhaps there is an event that provides more information about the conditions actually existing on December 31. The second type of event would be a new January event that does not change the December 31 amounts, but needs to be disclosed to the readers of the December 31 financial statements.

Detection of fraud or errors after the reporting period may indicate that the financial statements are misstated. Financial statements may be adjusted to reflect accounting for those errors or frauds that relate to the present or prior reporting periods in accordance with IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors. If any events occur after the end of the reporting period that provide further evidence of conditions that existed at the end of reporting period (i.e. Adjusting Events), then the financial statements must be adjusted accordingly. Events may occur between the end of the reporting period and the date when financial statements are authorized for issue which may present information that should be considered in the preparation of financial statements.

(c) Events after the reporting period include all events up to the date when the financial statements are authorized for issue, even if those events occur after the public announcement of profit or of other selected financial information. The notes (or footnotes) to the balance sheet and to the other financial statements are considered to be part of the financial statements. The notes inform the readers about such things as significant accounting policies, commitments made by the company, and potential liabilities and potential losses. The notes contain information that is critical to properly understanding and analyzing a company’s financial statements. Entity shall not adjust the financial statements in respect of those events after the end of reporting period that reflect conditions that arose after the end of reporting period (i.e. Non-Adjusting Events).

What is event after balance sheet date?

Post balance sheet events. A post balance sheet event is something that occurs after a reporting period, but before the financial statements for that period have been issued or are available to be issued.

Hence the income statement for December should report just one month of insurance cost of $400 ($2,400 divided by 6 months) in the account Insurance Expense. The balance sheet dated December 31 should report the cost of five months of the insurance coverage that has not yet been used up. Since it is unlikely that the $2,400 transaction on December 1 was recorded this way, an adjusting entry will be needed at December 31, 2019 to get the income statement and balance sheet to report this accurately. Subsequent event is the accounting term for a financial transaction that occurs after completion of the balance sheet for a specified period but before the company’s full set of financial statements is prepared. Subsequent events clarify information about a business’ financial picture as reflected by the balance sheet, a financial report that includes all transactions through the report date.

Accountants evaluate financial transactions or events that occur after the balance sheet has been prepared to determine if the events affect the picture reflected in the company’s financial statements. In 2009, the Financial Accounting Standards Board changed elements of its official subsequent event guidance. Accounting events related to goods being returned are documented in the final accounts as they have a monetary impact on the financial statements of a company. Depending on the terms and conditions of a transaction, goods sold both in cash and credit may be returned.