What are some examples of current liabilities?

The cluster of liabilities comprising current liabilities is closely watched, for a business must have sufficient liquidity to ensure that they can be paid off when due. All other liabilities are reported as long-term liabilities, which are presented in a grouping lower down in the balance sheet, below current liabilities.

Technically, a negative liability is a company asset, and so should be classified as a prepaid expense. A negative liability typically appears on the balance sheet when a company pays out more than the amount required by a liability. Unearned revenue is money received or paid to a company for a product or service that has yet to be delivered or provided. Unearned revenue is listed as a current liability because it’s a type of debt owed to the customer. Once the service or product has been provided, the unearned revenue gets recorded as revenue on the income statement.

Contingent Liabilities

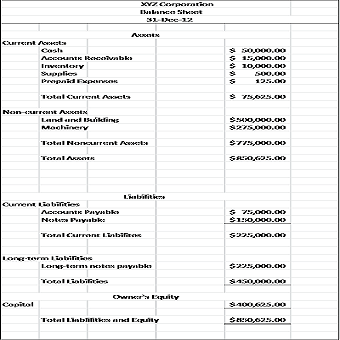

Current liabilities are listed on the balance sheet under the liabilities section and are paid from the revenue generated from the operating activities of a company. Short-term debts can include short-term bank loans used to boost the company’s capital.

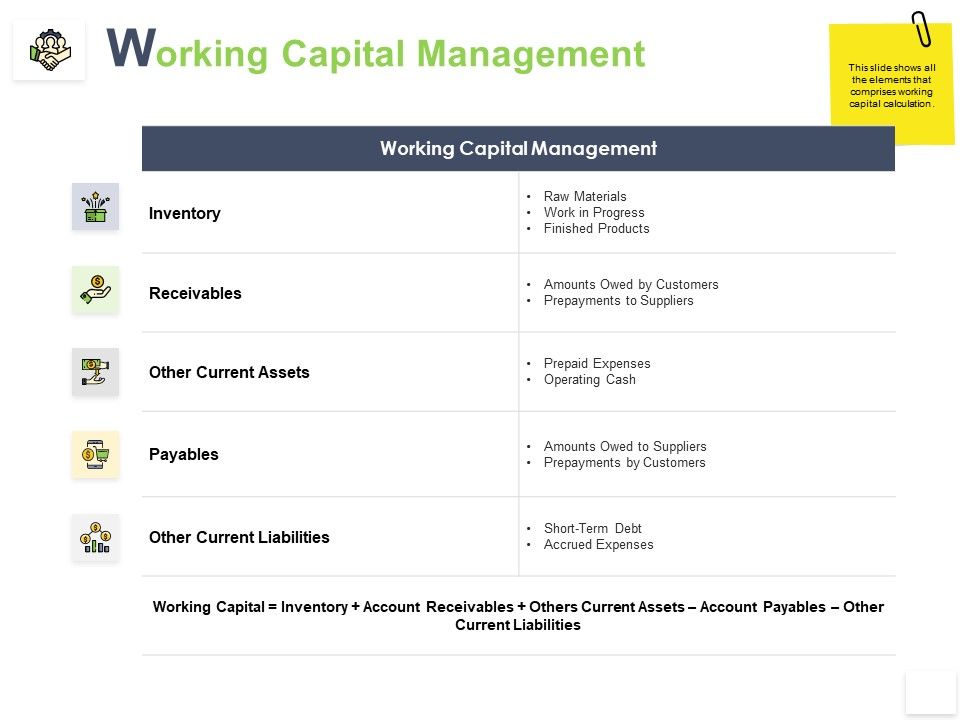

What is included in other current liabilities?

Other current liabilities, in financial accounting, are categories of short-term debt that are lumped together on the balance sheet. Other current liabilities are simply current liabilities that are not important enough to occupy their own lines on the balance sheet, so they are grouped together.

Recorded on the right side of the balance sheet, liabilities include loans, accounts payable, mortgages, deferred revenues, earned premiums, unearned premiums, and accrued expenses. Liabilities are obligations of the company; they are amounts owed to creditors for a past transaction and they usually have the word “payable” in their account title. Along with owner’s equity, liabilities can be thought of as a source of the company’s assets.

Warranties covering more than a one-year period are also recorded as noncurrent liabilities. Other examples include deferred compensation, deferred revenue, and certain health care liabilities. Current liabilities may also be settled through their replacement with other liabilities, such as with short-term debt. If every asset and liability account were listed by line item, the balance sheet could balloon to many pages, which would be less useful to readers.

The AT&T example has a relatively high debt level under current liabilities. With smaller companies, other line items like accounts payable (AP) and various future liabilities likepayroll, taxes, and ongoing expenses for an active company carry a higher proportion.

Overdraft credit lines for bank accounts and other short-term advances from a financial institution might be recorded as separate line items, but are short-term debts. The current portion of long-term debt due within the next year is also listed as a current liability. A liability is something a person or company owes, usually a sum of money. Liabilities are settled over time through the transfer of economic benefits including money, goods, or services.

Current liabilities of a company consist of short-term financial obligations that are due typically within one year. Current liabilities could also be based on a company’s operating cycle, which is the time it takes to buy inventory and convert it to cash from sales.

Other Current Liability—This is debt that is expected to be paid within one year. This grouping includes the QuickBooks-created Payroll Liabilities account and Sales Tax Payable account, in addition to other user-defined liability accounts. If a company has a loan payable that requires it to make monthly payments for several years, only the principal due in the next twelve months should be reported on the balance sheet as a current liability. The remaining principal amount should be reported as a long-term liability. The interest on the loan that pertains to the future is not recorded on the balance sheet; only unpaid interest up to the date of the balance sheet is reported as a liability.

- Ideally, analysts want to see that a company can pay current liabilities, which are due within a year, with cash.

- Some examples of short-term liabilities include payroll expenses and accounts payable, which includes money owed to vendors, monthly utilities, and similar expenses.

Commercial paper is also a short-term debt instrument issued by a company. The debt is unsecured and is typically used to finance short-term or current liabilities such as accounts payables or to buy inventory. Current liabilities are listed on the balance sheet and are paid from the revenue generated from the operating activities of a company. Non-current liabilities, also known as long-term liabilities, are debts or obligations that are due in over a year’s time.

Such obligations are normally settled with current assets (e.g. cash), and thus, they are considered current liabilities. Current liabilities are the sum of Notes Payable, Accounts Payable, Short-Term Loans, Accrued Expenses, Unearned Revenue, Current Portion of Long-Term Debts, Other Short-Term Debts. Noncurrent liabilities include debentures, long-term loans, bonds payable, deferred tax liabilities, long-term lease obligations, and pension benefit obligations. The portion of a bond liability that will not be paid within the upcoming year is classified as a noncurrent liability.

Items like rent, deferred taxes, payroll, and pension obligations can also be listed under long-term liabilities. Other current liabilities, in financial accounting, are categories of short-term debt that are lumped together on the balance sheet. The term “current liabilities” refers to items of short-term debt that a firm must pay within 12 months. Like most assets, liabilities are carried at cost, not market value, and underGAAPrules can be listed in order of preference as long as they are categorized.

Ideally, analysts want to see that a company can pay current liabilities, which are due within a year, with cash. Some examples of short-term liabilities include payroll expenses and accounts payable, which includes money owed to vendors, monthly utilities, and similar expenses. In contrast, analysts want to see that long-term liabilities can be paid with assets derived from future earnings or financing transactions.

They can include a future service owed to others; short- or long-term borrowing from banks, individuals, or other entities; or a previous transaction that has created an unsettled obligation. The most common liabilities are usually the largest likeaccounts payableand bonds payable. Most companies will have these two line items on their balance sheet, as they are part of ongoing current and long-term operations. Accounts payables are obligations of a company to vendors, suppliers, etc.

Examples of current liabilities include accounts payables, short-term debt, accrued expenses, and dividends payable. Liabilities is an account in which the company maintains all its records like such as debts, obligations, payable income taxes, customer deposits, wages payable, expenses occurred. Noncurrent liabilities, also called long-term liabilities or long-term debts, are long-term financial obligations listed on a company’s balance sheet. These liabilities have obligations that become due beyond twelve months in the future, as opposed to current liabilities which are short-term debts with maturity dates within the following twelve month period. A current liability is an obligation that is payable within one year.

Why Use Other Current Liabilities?

For example, a company’s balance sheet reports assets of $100,000 and Accounts Payable of $40,000 and owner’s equity of $60,000. The source of the company’s assets are creditors/suppliers for $40,000 and the owners for $60,000. The creditors/suppliers have a claim against the company’s assets and the owner can claim what remains after the Accounts Payable have been paid. Liabilities are also known as current or non-current depending on the context.

Accrued expenses are listed in the current liabilities section of the balance sheet because they represent short-term financial obligations. Companies typically will use their short-term assets or current assets such as cash to pay them.

Definition of Other Current Liabilities

Considering the name, it’s quite obvious that any liability that is not current falls under non-current liabilities expected to be paid in 12 months or more. Referring again to the AT&T example, there are more items than your garden variety company that may list one or two items. Long-term debt, also known as bonds payable, is usually the largest liability and at the top of the list.

What Are Other Current Liabilities?

Negative liabilities are usually for small amounts that are aggregated into other liabilities. They frequently appear on the accounts payable register as credits, which the company’s accounts payable staff can use to offset future payments to suppliers.