There are a number of financial ratios that can be reviewed to gauge a company’s overall financial health and to make a determination of the likelihood of the company continuing as a viable business. Standalone numbers such as total debt or net profit are less meaningful than financial ratios that connect and compare the various numbers on a company’s balance sheet or income statement. The general trend of financial ratios, whether they are improving over time, is also an important consideration. Assets and liabilities are separated on the balance into short- and long-term accounts.

Assets:

Liquidity will tell you about a firm’s ability to ride out short-term rough patches and solvency tells you about how readily it can cover longer term debt and obligations. Efficiency and profitability say something about its ability to convert inputs into cash flows and net income. All of these together, however, are necessary to get a complete and holistic view of a company’s stability. Financial statements prepared by accountants are classified as either audited or unaudited. An audited financial statement signifies that the accountant has verified virtually every transaction and account on the company’s books.

Short-term assets include cash on hand, accounts receivable and inventory. Goods in inventory may be further separated into the amount of raw materials, work in progress, and finished goods ready for sale and shipping. Long-term assets are real estate, buildings, equipment and investments.

Also, the accuracy of this document can be suspect when the cash basis of accounting is used. Thus, the income statement, when used by itself, can be somewhat misleading. Return on Assets (ROA) is a type of return on investment (ROI) metric that measures the profitability of a business in relation to its total assets. This ratio indicates how well a company is performing by comparing the profit (net income) it’s generating to the capital it’s invested in assets.

What are the 3 elements of statement of financial position?

financial position. For example, a company with fairly valued and relatively liquid assets, combined with a small amount of debt compared to owner’s equity, is generally described as being in a strong financial position. Also called financial condition.

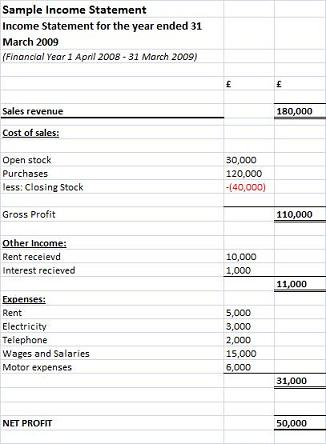

Expenses: Operating Expenses or Administration Expenses

There are four different statement of financial position forms that a company’s accountant prepares, and they each cover a very important piece of the company’s financial health. Statements of financial position forms provide a snapshot of the performance, overall financial position and cash flows of a business. These documents are reviewed by investors, lenders, creditors and management to evaluate a company. The Income Statement is one of a company’s core financial statements that shows their profit and loss over a period of time.

What is a strong financial position?

Financial position is the current balances of the recorded assets, liabilities, and equity of an organization. More broadly, the concept can refer to the financial condition of a business, which is derived by examining and comparing the information in its financial statements.

It includes profit& loss account, balance sheet, and cash flow statement. The most important financial statement for the majority of users is likely to be the income statement, since it reveals the ability of a business to generate a profit. Also, the information listed on the income statement is mostly in relatively current dollars, and so represents a reasonable degree of accuracy. However, it does not reveal the amount of assets and liabilities required to generate a profit, and its results do not necessarily equate to the cash flows generated by the business.

Accounts receivable are confirmed by asking customers to verify the balances owed. For inventory, the accountants check purchase orders and receipts, and physically count the raw materials and stock on the premises. Government regulations require all publicly traded companies to prepare audited financial statements.

Main Elements of Financial Statements: Assets, Liabilities, Equity, Revenues, Expenses

The statement shows itemized accounts and overall balances in each of these categories. Assets are current accounts, such as cash and securities, as well as long-term depreciating assets like buildings and equipment. The difference is owners’ equity, commonly referred to as the accounting net worth of the business. Although this brochure discusses each financial statement separately, keep in mind that they are all related. The changes in assets and liabilities that you see on the balance sheet are also reflected in the revenues and expenses that you see on the income statement, which result in the company’s gains or losses.

financial position

- There are a number of financial ratios that can be reviewed to gauge a company’s overall financial health and to make a determination of the likelihood of the company continuing as a viable business.

- Standalone numbers such as total debt or net profit are less meaningful than financial ratios that connect and compare the various numbers on a company’s balance sheet or income statement.

- The general trend of financial ratios, whether they are improving over time, is also an important consideration.

A balance sheet or statement of financial position, reports on a company’s assets, liabilities, and owners equity at a given point in time. The income statement is useful in seeing how well a company generated profit in a given period. While making money is the ultimate point of operating a business, the income earned in a given period doesn’t necessarily tell the full story of the financial position. A company could have a strong bottom line profit in a given period, yet owe more money on debt payments than it earned in the period to pay them. No single metric can identify the overall financial and operational health of a company.

Definition of Net Financial Position

Short-term liabilities are bank loans, accounts payable, accrued expenses, sales tax payable and payroll taxes payable. The equity portion of the balance sheet has all the company’s investor contributions and the accumulated retained earnings. The information is divided into the general classifications of assets, liabilities and equity. As a rule, the total amount of the company’s assets is equal to the total amount of its liabilities plus the owners’ equity in the company.

This guide to financial statements provides step-by-step instructions on how to read a balance sheet, income statement, and other important accounting documents. The best metric for evaluating profitability is net margin, the ratio of profits to total revenues. It is crucial to consider the net margin ratio because a simple dollar figure of profit is inadequate to assess the company’s financial health. A larger net margin, especially as compared to industry peers, means a greater margin of financial safety, and also indicates a company is in a better financial position to commit capital to growth and expansion. The balance sheet gets its name from the fact that it follows the basic accounting equation assets equal liabilities plus owners’ equity.

Accounts payable are debts that must be paid off within a given period to avoid default. At the corporate level, AP refers to short-term debt payments due to suppliers. The payable is essentially a short-term IOU from one business to another business or entity. The other party would record the transaction as an increase to its accounts receivable in the same amount. For large corporations, these statements may be complex and may include an extensive set of footnotes to the financial statements and management discussion and analysis.

This equation must always balance, with the same amount on each side of the sheet. The balance sheet is one of a company’s most important financial statements, because it gives investors a snapshot of the company’s financial health at any given moment in time. Essentially, it is a company’s account ledger, containing information about assets the company possesses, liabilities and obligations it needs to address, and owner equity in the company. This guide will teach you to perform financial statement analysis of the income statement, balance sheet, and cash flow statement including margins, ratios, growth, liquiditiy, leverage, rates of return and profitability. You can’t calculate financial ratios without using a company’s financial statements.

The statements must comply with Generally Accepted Accounting Principles and be certified by independent accountants. Accounting information is reported in the form of a financial statement.

The income statement, balance sheet and cash flow statement are the three most common financial statements. Business owners use each statement to analyze various pieces of their company’s financial information. Smaller or home-based businesses using cash basis accounting methods will not have a cash flow statement. Cash flow statements are only used by companies using the accrual accounting method.

Otherwise, you could make a mistake such as buying into a company with too much debt, not enough cash to survive, or low profitability. This guide to financial ratios will explain how to calculate the most important financial ratios, and, more importantly, what they mean. A company’s total accounts payable (AP) balance at a specific point in time will appear on its balance sheetunder the current liabilities section.

Cash basis accounting accurately reports cash for the business owner, making the cash flow statement redundant. A cash flow statement summarizes the cash and cash equivalents that come into and go out of a company’s business operations. The cash flow statement gives investors a view of how financially solid a company is, and it shows creditors how much cash the business has available to pay its debts and fund its operations.

Where asset turnover tells an investor the total sales for each $1 of assets, return on assets, or ROA, tells an investor how much profit a company generated for each $1 in assets. The return on assets figure is also a sure-fire way to gauge the asset intensity of a business. For example, does the company in which you are researching have to spend large sums of money on expensive machinery before it can manufacture and sell a product to generate a return? Before you start investing in individual stocks, it is very useful to learn how to understand, calculate, and interpretfinancial ratios. Even if you usually get financial ratios from your broker or a financial site, you still need to know what they represent and what they can tell you about the business in which you would like to invest.

Cash flows provide more information about cash assets listed on a balance sheet and are related, but not equivalent, to net income shown on the income statement. And information is the investor’s best tool when it comes to investing wisely. A full set of financial statements should also provide some clues to the overall soundness of your bookkeeping. If your profit and loss statements show that you consistently make a profit, yet your balance sheet shows that you’re chronically short on cash, a savvy lender will rightfully have some questions to ask. Similarly, if your income statement shows you losing money year after year, yet you have incurred no debt, lenders and investors will want to know how you’ve covered your losses.

The financial statement is the final outcome of the accounting process and is prepared as per the basic accounting principles, concepts and assumptions. It helps to draw conclusions on the company’s profitability, efficiency, performance, and position. These are furnished in such a way that the users of financial statement can understand them easily and take decisions.

The notes typically describe each item on the balance sheet, income statement and cash flow statement in further detail. Notes to financial statements are considered an integral part of the financial statements.