Net book value is the historical cost of an asset, less any amounts recorded for depreciation, amortization, or depletion. This accumulated depletion amount needs to be subtracted from the original value of the asset to calculate the net book value of the asset. This accumulated depletion amount needs to be subtracted from the original value of the natural resource to calculate the net book value of the natural resource.

- If the market value of the asset falls substantially and the company concludes that the value of the asset has permanently reduced, then the company recognizes an impairment loss for that asset.

- Cube’s API empowers teams to seamlessly connect and transform their data, allowing you to access it easily and efficiently.

- Net book value is one of the most common financial measures and can be used in regards to the value of an asset, liability or equity item.

- Instead, it shows the value of the asset after accumulated depreciation has been deducted.

- It is also an important factor to consider when a company considers buying another, as they can clearly see whether the depreciation is worth the actual cost.

- Impairment is a situation where the market value of an asset is less than its net book value, in which case the accountant writes down the remaining net book value of the asset to its market value.

The significance of NBV lies in its role in accrual accounting, where it ensures that the value of assets reported on financial statements correlates with their economic utility and contribution to revenue generation. By doing so, NBV offers a more accurate depiction of a company’s financial health than simply considering the historical cost of assets. Net Book Value (NBV) is an important concept for investors to understand because it helps us assess a company’s financial strength.

What is the net book value formula?

Our goal is to deliver the most understandable and comprehensive explanations of climate and finance topics. We follow ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. Much of our research comes from leading organizations in the climate space, such as Project Drawdown and the International Energy Agency (IEA).

It is especially true when used to help give value to a company – either for the company’s own accounting records, if the company is considering liquidation, or if another company is considering taking over the business. As we touched on previously, the underlying goal of financial reporting is to provide insight into certain aspects of a business. NBV plays a critical role in this as it helps to give merit to the value of the company by fairly representing the value of PPE.

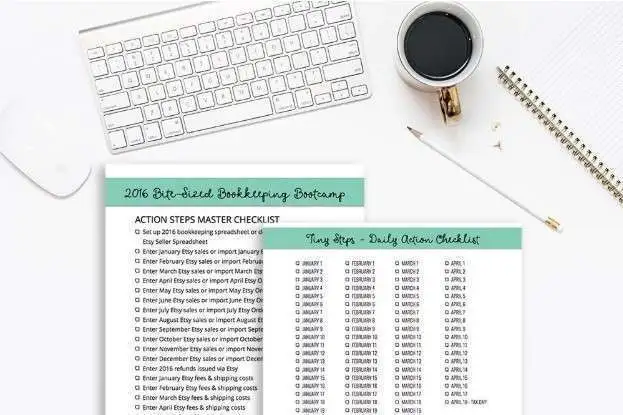

Purchase Cost and Accumulated Depreciation Calculation Example

Consider asset age, condition, and degree of wear-and-tear or obsolescence as you calculate net book value. Knowing an organization’s NBV improves data-informed decision-making, such as where to invest or how much debt is feasible. Sign up for our bi-weekly newsletter from former serial CFO turned CEO of Cube, Christina Ross. Join our exclusive, free Slack community for strategic finance professionals like you.

Integrating cash flow forecasts with real-time data and up-to-date budgets is a powerful tool that makes forecasting cash easier, more efficient, and shifts the focus to cash analytics. This is due, in part, to certain tax strategies that seek to minimize taxable income through the use of depreciation and amortization expense. Because of its relationship to depreciation, it is important to understand that NBV is typically much lower than market value in the first years of an asset’s useful life. Cube offers a powerful FP&A platform that allows your team to make sound financial decisions without moving away from their spreadsheets.

Book Value: Definition, Meaning, Formula, and Examples

Net book value is the amount at which an organization records an asset in its accounting records. Net book value is calculated as the original cost of an asset, minus any accumulated depreciation, accumulated depletion, accumulated amortization, and accumulated impairment. Given these deductions, net book value represents an accounting methodology for the gradual reduction in the recorded cost of a fixed asset. It does not necessarily equal the market price of a fixed asset at any point in time. Nonetheless, it is one of several measures that can be used to derive a valuation for a business. Net book value is the value of an asset as recorded in the books of accounts of a company.

The net book value of an asset is the carrying value of the asset on the balance sheet. Book value gets its name from accounting lingo, where the accounting journal and ledger are known as a company’s “books.” In fact, another name for accounting is bookkeeping. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance.

Sustainable Investing Topics

NBV is a tool a company can use to demonstrate its value and estimate total financial worth. Cube’s API empowers teams to seamlessly connect and transform their data, allowing you to access it easily and efficiently. With regard to the assumptions surrounding the fixed asset, the useful life assumption is 20 years, while the salvage value is assumed to be zero. Market value is another important metric; however, NBV and market value typically aren’t equal. Regardless of the business budgeting approach your organization adopts, it requires big data to ensure accuracy, timely execution, and of course, monitoring.

Is NBV the same as market values?

This method is often used for high wear-and-tear assets that will be most used in earlier years of operation. This method accelerates the depreciation to frontload the expense of depreciation losses in its earlier years of service. Depreciation over the period of service begins with the market value, decreasing consistently until it reaches total depreciation. Accounting principles and tax laws outline the specific requirements for the depreciation of assets.