Her equity balance includes her original $50,000 contribution, and five years of accumulated earnings that were left in the business. If Patty takes a $100,000 owner draw, the catering company may not have sufficient capital to pay for salaries and food costs. A business owner may pay taxes on his or her share of company earnings, then take a draw that is larger than the current year’s earnings share. In fact, an owner can take a draw of all contributions and earnings from prior years.

It’s debit balance will reduce the owner’s capital account balance and the owner’s equity. The drawing account’s purpose is to report separately the owner’s draws during each accounting year. Since the capital account and owner’s equity accounts are expected to have credit balances, the drawing account (having a debit balance) is considered to be a contra account. In addition, the drawing account is a temporary account since its balance is closed to the capital account at the end of each accounting year.

Business owners pay income taxes and self-employment taxes using either a salary or a draw. Your decision about compensation should be based on how much money your business needs to operate moving forward, and if you’re willing to do more personal tax planning by using the draw method. Shareholders’ equity represents a company’s net worth (also called book value) and measures the company’s financial health.

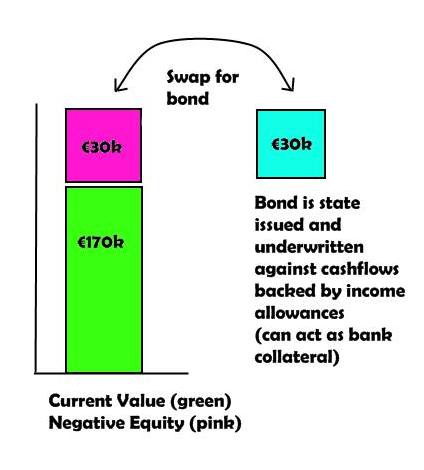

Negative Shareholders Equity

For example, a business with $500 in assets and $800 in liabilities has net assets of ($300). If this is the case, net assets can and should be reported as a negative number on the balance sheet.

A sole proprietorship will have a drawing account in which the owner’s withdrawals or draws of cash or other assets are recorded. The amounts of the owner’s draws are recorded with a debit to the drawing account and a credit to cash or other asset. At the end of the accounting year, the drawing account is closed by transferring the debit balance to the owner’s capital account. A normal balance for an equity account is a credit balance, so Patty’s owner equity account has a beginning balance of $50,000.During the year, Riverside Catering generates $30,000 in profits.

What is a Balance Sheet?

Thus, in a trial balance, net income has a credit balance and net loss has a debit balance. I think you need to brush up on your understanding of debits and credits. In your first link, the + – simply explains whether entering a debit or credit will increase or decrease an account. I.e. a credit booked to revenue will increase revenue, which means it has a larger credit (negative) balance. Just as profits increase your retained earnings, losses decrease the ending balance.

Negative Shareholder’s Equity – HP

Your retained earnings balance is the cumulative total of your net income and losses. Ott begins a sole proprietorship with a cash investment of $3,000.

If total liabilities are greater than total assets, the company will have a negative shareholders’ equity. A negative balance in shareholders’ equity is a red flag that investors should investigate the company further before purchasing its stock.

Retained earnings represent the accumulated net income your business keeps after paying all costs, expenses and taxes. The retained earnings balance changes if you pay your stockholders a dividend. If you are the sole owner, you may choose to forego dividend payments in favor of using the funds for your business. However, if you sold stock shares to raise capital, your stockholders may expect an occasional dividend. The dividend payment is reported on the balance sheet and reduces the amount in your retained earnings account.

- Retained earnings represent the accumulated net income your business keeps after paying all costs, expenses and taxes.

If the owner draw is too large, however, the business may not have sufficient capital to operate going forward. A draw of company profits is taxable as income on the owner’s personal tax return, and owners must pay estimated tax payments and self-employment taxes on draws. In this article, we’ll review how shareholders’ equity measures a company’s net worth and some reasons behind negative shareholders’ equity. Negative equity is a deficit of owner’s equity, occurring when the value of an asset used to secure a loan is less than the outstanding balance on the loan. The owner’s equity for company LMN on Dec. 31 is -$50,000 ($100,000 – $150,000).

Both business and personal finance budgets contain a series of credits and debits that are totaled to arrive at a balance. Most individual and small-business accounts treat credits as an addition of funds and debits as a reduction. When the total debits exceed the dollar amount of credits added to the beginning balance, the final balance on the budget for the time period measured is negative. Negative balances can be shown within a check register, spreadsheet or an account book a few different ways.

Since Patty is the only owner, her owner’s equity account increases by $30,000 to $80,000. Also, the $30,000 profit is posted as income on Patty’s personal tax return.

After this transaction, the business will have assets of $2,500 and will have owner’s equity of $2,500. To answer your question, the drawing account is a capital account.

Accumulated losses over several periods or years could result in a negative shareholders’ equity. The negative amount of owner’s equity is a problem that will be obvious to anyone reading the company’s balance sheet. However, the company may be able to operate if its cash inflows are greater and sooner than the cash outflows necessary for meeting its payments on its liabilities. “Owner’s equity” is the term typically used when the company is a sole proprietorship. “Stockholders’ equity” is the term used when the company is a corporation.

You have negative retained earnings when your net loss is greater than the retained earnings positive balance. In this case, the retained earnings account will show a negative number on the balance sheet. A negative retained earnings balance is usually recorded on a separate line in the Stockholders’ Equity section under the account title “Accumulated Deficit” instead of as retained earnings. Say, for example, that Patty has accumulated a $120,000 owner equity balance in Riverside Catering.

Does Negative Shareholders Equity Imply Zero Market Value?

Can you have negative owner’s equity?

Negative Shareholders Equity refers to the negative balance of the shareholders equity of the company which arises when the total liabilities of the company are more than value of its total assets during a particular point of time and the reasons for such negative balance includes accumulated losses, large dividend

In both cases, the term refers to the value of the company after assets and liabilities have been reported. Owner’s equity can be calculated by taking the total assets and subtracting the liabilities. Owner’s equity can be reported as a negative on a balance sheet; however, if the owner’s equity is negative, the company owes more than it is worth at that point in time. Net assets, or equity, represents the value of business assets if all liabilities are paid off. High net assets on a balance sheet indicates a healthy, viable business.

In other words, negative shareholders’ equity should tell an investor to dig deeper and explore the reasons for the negative balance. A good place to start is for investors to learn how to read a company’s income statement and balance sheet. The fundamental formula of accounting is that assets minus liabilities equals net assets, or equity. If the value of all assets is higher than the dollar value of liabilities, the business will have positive net assets. If total assets are less than total liabilities, the business has negative net assets.

Low net assets means that the company doesn’t have much cash and property relative to what it owes. If things are bad enough, a business can have negative net assets on the balance sheet. The retained earnings account and the paid-in capital account are recorded in the stockholders’ equity section on the balance sheet. The balance for the retained earnings account is taken from the income statement. The net income or net loss disclosed on the income statement for each accounting period is added to the existing retained earnings balance.