In the modern economy, all enterprises exist on the money received from the sale of goods or services. However, the shareholders of a business must also have their share of income from the company’s activities. For these purposes, there is a special bookkeeping account known as Retained earnings.

Retained Earnings

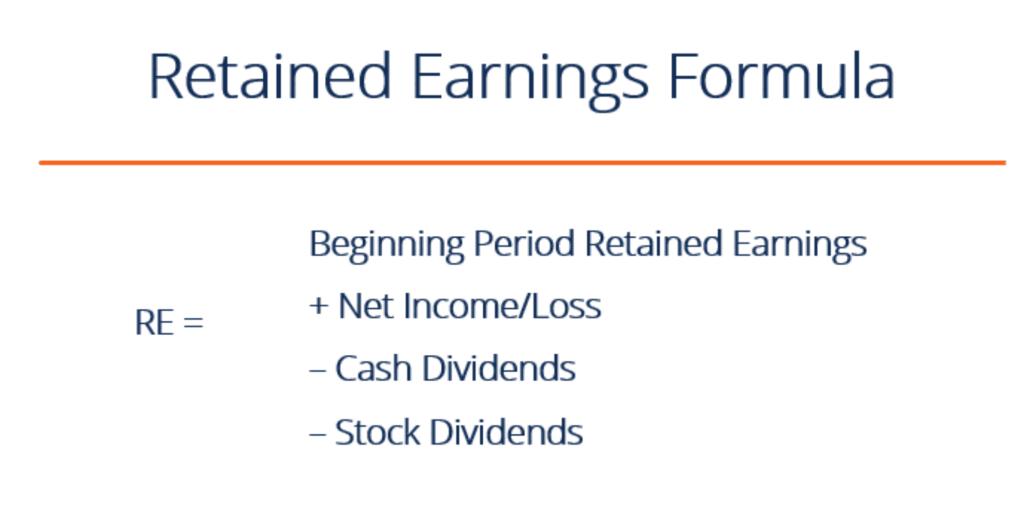

Any company starts its activities to generate income. The company’s shareholders expect to have profits coming in from their investments. Retained earnings that a user will usually see on the Balance sheet are the remaining income after all debts to suppliers, employees, and creditors of the company have been covered.

Business retained earnings are its net profit, which has not yet been divided among the participants (shareholders) of the organization. How this profit will be distributed in the end depends on the decision of the shareholders at the annual meeting. Usually, funds are spent for the following purposes:

- payment of dividends;

- formation or increase of reserve capital;

- fulfillment of the remaining obligations;

- other goals chosen by the owners of the business.

Accumulated earnings, as they are also known, are a liability since it is an unfulfilled obligation to the owners. Ideally, the money should be paid as dividends to the owners and put into the development of the business.

Negative Retained Earnings

If the profit is not spent, then it remains at the enterprise as retained earnings, accumulating over years and increasing the size of the company’s equity capital. The presence of retained earnings improves the financial stability of the enterprise, indicates the availability of a source for further development.

Unfortunately, companies do not always make a profit. There are cases when a business experiences a loss. This loss is also recorded under retained earnings, reducing the balance of this account. The impact of a loss on the retained earnings will depend on how much was accumulated under retained earnings and how big the loss is. In some cases, the company might end up having negative retained earnings.

When would you expect to have negative retained earnings? The loss might be insignificant, but the retained earnings could have been already reinvested or paid out to the shareholders, so there is nothing or too little left in the account.

In other situations, the earnings a business set aside over the years were initially high enough, but the organization might have suffered a very big loss and/or it has been working for a long time at a loss. Although it does not happen frequently, understatement of assets or overstatement of liabilities can also lead to negative retained earnings.

Besides being unable to pay any dividends to shareholders until it recovers, it is likely that a business will not be able to recover at all, which will inevitably lead to bankruptcy. The study of the structure of the balance sheet items allows you to establish one of the possible reasons for the financial instability of the enterprise, which led to negative retained earnings.